Frontier Communications will file Chapter 11 bankruptcy by March, according to a report by Bloomberg News citing unnamed sources, leading to a major reorganization of a struggling phone company that has been losing customers for years.

Frontier Communications will file Chapter 11 bankruptcy by March, according to a report by Bloomberg News citing unnamed sources, leading to a major reorganization of a struggling phone company that has been losing customers for years.

Bernie Han, Frontier’s new CEO, reportedly met with creditors and Wall Street advisors late last week to negotiate a bankruptcy filing and proposed turnaround plan to be unveiled before Frontier faces a repayment deadline of $356 million in debt on March 15.

If creditors agree, Frontier would continue operations after filing bankruptcy and renegotiate its debts, while potentially jettisoning retiree pension benefits, stiffing shareholders, and winning the freedom to exit certain long term contractual agreements related to its legacy properties and services.

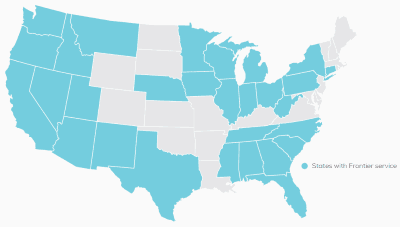

Frontier serves around 3.5 million broadband customers in 29 states, providing service mostly to rural communities ignored by former Bell Operating Companies and in acquired service areas once controlled by Verizon or AT&T. Frontier’s acquisitions have contributed to the company’s $17+ billion in debt and have ultimately not met expectations. Many Frontier legacy customers have fled to other providers because of poor or inadequate service and a lack of network upgrades to offer acceptable internet service. Frontier has largely avoided undertaking major fiber optic upgrades in its legacy service territories, where the company still sells slow DSL service over a deteriorating copper wire network that is often decades old.

Most of Frontier’s fiber-to-the-home territories were acquired by the company, hoping such acquisitions would deliver a much-needed revenue boost. But some analysts say Frontier overpaid to acquire those service areas, and in several cases botched a conversion to Frontier’s billing and service platform, alienating customers.

Most of Frontier’s fiber-to-the-home territories were acquired by the company, hoping such acquisitions would deliver a much-needed revenue boost. But some analysts say Frontier overpaid to acquire those service areas, and in several cases botched a conversion to Frontier’s billing and service platform, alienating customers.

The company’s stock has been in free fall for months, starting its steep decline after abandoning a popular dividend payout plan. As of this afternoon, shares are priced below 65 cents.

To stabilize the business, Frontier has entertained selling off portions of its network. In May 2019, Frontier announced it was selling 350,000 of its customers in the Pacific Northwest states of Washington, Oregon, Montana and Idaho to raise $1.35 billion to pay down its debts, but that was not enough to appease investors. Many believe former CEO Dan McCarthy was forced out of the company late last year after failing to improve the business. Frontier’s newest CEO has apparently decided reorganization through bankruptcy is now the best last resort.

Such news pleases activist investment funds including Elliot Management, which have pushed for reorganization for nearly a year. Elliot has been very vocal, demanding better results from several large telecom companies, including AT&T and Windstream. Elliott Management and Franklin Resources now hold nearly 50 percent of Frontier’s bonds. Another group of creditors includes GoldenTree Asset Management. The activist investors have been primarily fighting over the $5.8 billion in high-coupon debt bonds Frontier issued to cover its acquisition of former Verizon customers in California, Texas, and Florida. Frontier met fierce investor objections after considering refinancing that costly debt, because bondholders feared that would put them last in line to recoup their investments if Frontier went bankrupt.

A bankruptcy would not immediately impact Frontier’s customers and operations would continue. But Frontier would likely stall upgrades and future spending until the company exits bankruptcy. Some customers may also have to wait for refunds, at least initially, subject to court approval. Retirees and employees may also eventually face changes to their benefits packages.

For Frontier to be successful, the company will have to shed debt and begin making much larger investments to modernize its network to compete for lucrative broadband customers. It will also have to improve its image with better customer and repair service and fewer “gotcha” billing policies and fine print.

Subscribe

Subscribe

The taxpayer is on the hook for these greedy and Wall Street crooked deals.

Dan Mcarthy should in jail.

I have had dsl for years, ive had 10 service calls over the past 5 months hundreds of dollars in service just to use the shi**y internet they offer to my area (I would switch but they are the only company that services my area) anyways I just decided to fix it myself it hasn’t stopped working since. Something tells me their employees may be sabotaging connections just to get more service calls. Alot of times they skip our appointments multiple service men in our area have been fired because of this. Im switching to satellite internet frontier can shove… Read more »