After months of testing, T-Mobile’s streaming TV service TVision will debut for some existing T-Mobile wireless customers on Nov. 1, with three packages starting at $10/month.

After months of testing, T-Mobile’s streaming TV service TVision will debut for some existing T-Mobile wireless customers on Nov. 1, with three packages starting at $10/month.

Although late to the already-competitive cord-cutting streaming TV marketplace, T-Mobile hopes to shake up the market with more choices and, in some cases, lower pricing.

“People sure love TV — but they sure don’t love their TV provider,” T-Mobile CEO Mike Sievert said during a livestream previewing the TVision service. Sievert claimed the cable and satellite TV customers are fed up being ‘held hostage’ by programming lineup choices made by everyone but the customer, leaving consumers with costly bundles containing “live news and sports with hundreds of other channels you don’t want. Get ready to un-cable, everybody.”

The service will initially be available Nov. 1, but only to T-Mobile postpaid wireless customers. By the end of November, Sprint postpaid customers will also be invited to sign up. Prepaid T-Mobile and Sprint customers are expected to have access to the service sometime in 2021, along with those who do not have a T-Mobile or Sprint account. Non-customers will pay an undetermined surcharge.

TVision’s Android TV device, with remote control.

Details:

TVision will be available for streaming through apps on iOS, Android/Android TV, Amazon Fire TV, and Apple TV. It is currently not available on the Roku platform. Customers can also purchase a TVision Hub, a $50 Android TV device that plugs into an HDMI port on the back of your television to bring the streaming service to traditional television sets, along with a platform to use over 8,000 apps that already work with Android TV, including competing streaming services like Netflix, Hulu, YouTube and CBS All Access.

Special Offer:

New customers who sign up for Live TV Plus or Live Zone by Dec. 31, 2020 will receive 12 months of free Apple TV Plus service and an $80 rebate offer for the Apple TV 4K set-top box (retails at $179, but will cost $99 after rebate).

Available Packages:

T-Mobile’s philosophy is that customers want to choose between packages containing general entertainment fare, news and sports, local TV, and premium channels. The more categories you want, the higher the price. If you want all four, you are likely going to pay pricing rivaling what you already pay your current provider. True, a-la-carte packages allowing customers to select specific channels is not available. T-Mobile currently has no agreement with CBS, so this means CBS network programming and local affiliates are not accessible on TVision at this time. The three higher priced Live packages include 100 hours of DVR cloud-based recording.

TVision Vibe (general entertainment) ($10/mo for 30 channels, up to 2 concurrent streams): AMC, Animal Planet, BBC America, BBC World News, BET, BET Her, CMT, Comedy Central, Discovery, DIY, Food Network, HGTV, Hallmark Channel, Hallmark Movies & Mysteries, Hallmark Drama, IFC, ID, MotorTrend, MTV, MTV Classic, MTV2, Nickelodeon, Nick Jr., Nicktoons, OWN, Paramount Network, Sundance, Teen Nick, TLC, Travel Channel, TV Land, WEtv

TVision Live (emphasizing live news and local stations) ($40/mo for 30+ channels, up to 3 concurrent streams) Does not include networks from the Vibe package, which has to be purchased separately): ABC*, ABC News Live, Bravo, CNBC, Cartoon Network/Adult Swim, CNN, Cozi TV, Disney Channel, Disney Jr., Disney XD, E!, ESPN, ESPN2, Fox*, Fox Business Network, Fox News Channel, Freeform, FS1, FS2, FX, FXX, HLN, MSNBC, National Geographic, NBC*, NBC News Now, NBC Sports Network, Oxygen, Syfy, TBS, Telemundo*, TNT, truTV, USA

TVision Live Plus (enhances live sports options) ($50/mo for 40+ channels, up to 3 concurrent streams): Includes all channels from TVision Live package plus ACC Network, Big Ten Network, ESPNews, ESPNU, ESPN College Extra, FXM, Longhorn Network*, NatGeo Wild, NBC regional sports networks*, NECN*, NFL Network, Olympic Channel, SEC Network, SNY*, TCM, Golf Channel

TVision Live Zone (brings even more live sports and Spanish language networks) ($60/mo for 50+ channels, up to 3 concurrent streams): Includes all channels from TVision Live Plus package plus Boomerang, CNBC World, ESPN Deportes, Fox Deportes, NFL RedZone, Universal Kids, Universo, MavTV

A-la-carte premium channels:

- Starz ($8.99 per month): 28 channels

- Showtime ($10.99 per month): 16 channels

- Epix ($5.99 per month): 4 channels

(*-may not be available in all TV markets. For exact TV lineup in your area, visit here.)

T-Mobile’s CEO Mike Sievert announces TVision, the company’s new streaming TV service. (3:19)

Hulu’s live streaming TV service, known as Hulu Live, will get more expensive starting Dec. 21, with a stiff $5/month rate increase, bringing the cost of the 75+ channel ad-supported streaming and live TV package to $69.99 a month. Customers opting for ad-free Hulu streaming + Live TV will pay $75.99. The rate increase applies equally to new and existing customers.

Hulu’s live streaming TV service, known as Hulu Live, will get more expensive starting Dec. 21, with a stiff $5/month rate increase, bringing the cost of the 75+ channel ad-supported streaming and live TV package to $69.99 a month. Customers opting for ad-free Hulu streaming + Live TV will pay $75.99. The rate increase applies equally to new and existing customers.

Subscribe

Subscribe The same New York District Court judge that

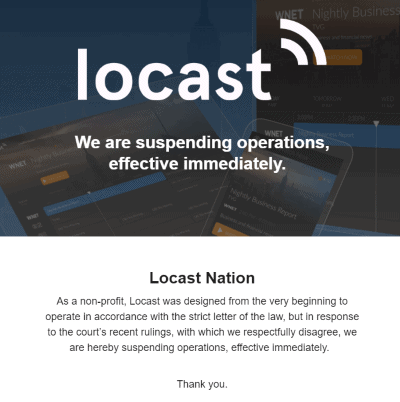

The same New York District Court judge that  Locast, like Aereo and Ivi before it, has ceased streaming local, over the air television signals on a non-profit basis after a New York federal court judge ruled the service is violating U.S. copyright law by receiving more funding than it needs. But in developments this afternoon, there is word an appeal is planned.

Locast, like Aereo and Ivi before it, has ceased streaming local, over the air television signals on a non-profit basis after a New York federal court judge ruled the service is violating U.S. copyright law by receiving more funding than it needs. But in developments this afternoon, there is word an appeal is planned.

After months of testing, T-Mobile’s streaming TV service

After months of testing, T-Mobile’s streaming TV service