Large media companies and streaming services are on to many of you.

Large media companies and streaming services are on to many of you.

If you are among the two-thirds of subscribers that have reportedly shared your Netflix, HBO GO, Hulu, or Disney+ password with friends and family, your provider probably already knows about it.

A recent report from HUB Entertainment Research found that at least 64% of 13-24-year-olds have shared a password to a streaming service with someone else, with 31% of consumers admitting they are sharing passwords with people outside of their home.

The reason many people share passwords is to save money on the cost of signing up for multiple streaming services. Many trade a Netflix password in return for a Hulu password, or hand over an HBO GO password in exchange for access to your Disney+ account. Research firm Park Associates claims that streamers lost an estimated $9.1 billion in revenue from password sharing, and can expect to lose nearly $12.5 billion by 2024 if password sharing is not curtailed.

Oddly, most streaming services are well aware of password sharing and the lost revenue that results from sharing accounts, and most care little, at least for now.

Marketplace notes a lot of the complaints about password sharing are coming from cable industry executives, shareholders, and Wall Street analysts, but for now most streaming services are just monitoring the situation instead of controlling it.

“I think we continue to monitor it,” said Gregory K. Peters, Netflix’s chief product officer, on the 2019 third quarter earnings call. “We’ll see those consumer-friendly ways to push on the edges of that, but I think we’ve got no big plans to announce at this point in time in terms of doing something differently there.”

“I think we continue to monitor it,” said Gregory K. Peters, Netflix’s chief product officer, on the 2019 third quarter earnings call. “We’ll see those consumer-friendly ways to push on the edges of that, but I think we’ve got no big plans to announce at this point in time in terms of doing something differently there.”

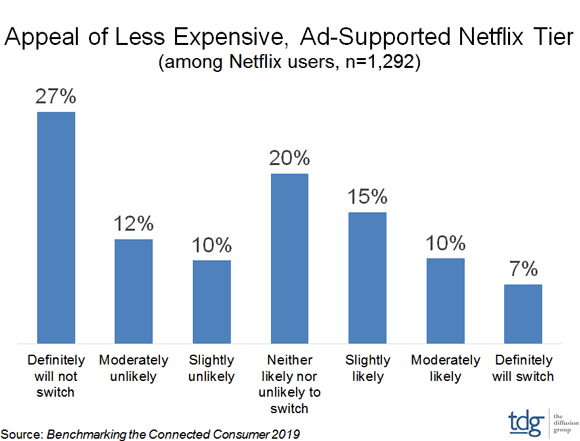

Netflix sells different tiers of service that limit the number of concurrent streams to one, two, or four streams at a time. The company believes that if customers that share accounts bump into the stream limits, many will upgrade to a higher level of service which will result in more revenue.

Newcomer Disney+ not only recognizes password sharing is going on, it almost embraces it.

“We’re setting up a service that is very family friendly. We expect families to consume it,” Disney CEO Bob Iger said in an interview with CNBC. “We will be monitoring [password sharing] with the various tools that we have.”

The biggest tool Disney has to monitor account sharing is Charter Spectrum, which is aggressively encouraging streaming services to crack down hard on password sharing. Spectrum internet customers who watch Disney+ are now tracked by Spectrum, recording each IP address that accesses Disney+ content over Spectrum’s broadband service. When multiple people at different IP addresses access Disney+ content on a single account at the same time, Spectrum can flag those customers as potential password sharers.

Synamedia, a streaming provider security firm, uses geolocation tools to determine who is watching streaming services from where. If someone is watching one stream from one address and another person is watching from another city at the same time, password sharing is the likely culprit. For now, most companies are quietly collecting data to learn just how big a problem password sharing is and are not using that information to crack down on customers.

Streaming providers are more interested in stopping the pervasive sale of stolen account credentials on services like eBay and shutting down stolen accounts used to harvest content for unauthorized resale. But as sharing grows, so will calls from stakeholders to curtail the practice. Those in favor of vigorous crackdowns on password sharing argue billions of dollars of lost revenue will be lost. If a service like Netflix blocked password sharing, that could lead to dramatic increases in account sign-ups. But less established brands like Disney+ seem more concerned about losing the unofficial extra viewers that are watching and buzzing about shows on its new streaming platform. Find the best residential proxies to access the streaming content that is not available in your location.

Streaming providers are more interested in stopping the pervasive sale of stolen account credentials on services like eBay and shutting down stolen accounts used to harvest content for unauthorized resale. But as sharing grows, so will calls from stakeholders to curtail the practice. Those in favor of vigorous crackdowns on password sharing argue billions of dollars of lost revenue will be lost. If a service like Netflix blocked password sharing, that could lead to dramatic increases in account sign-ups. But less established brands like Disney+ seem more concerned about losing the unofficial extra viewers that are watching and buzzing about shows on its new streaming platform. Find the best residential proxies to access the streaming content that is not available in your location.

Cable companies are frustrated about losing scores of cable TV customers to competitors that may be effectively giving away service for free. That has raised tempers at companies like Charter Communications.

“Pricing and lack of security continue to be the main problems contributing to the challenges of paid video growth,” Charter CEO Thomas Rutledge said in recent prepared remarks with Wall Street analysts. “The traditional bundle … is very expensive, and the actual unit rate of that product continues to rise, and that’s priced a lot of people out of the market. And it’s free to a lot of consumers who have friends with passwords. So our ability to sell that product is ultimately constrained by our relationship with content [companies], and we have to manage that in terms of the kinds of power that the content companies have.”

Charter’s power comes from its willingness to distribute cable networks like The Disney Channel to tens of millions of homes around the country. That forces Disney to listen to Charter’s concerns about piracy and password sharing and the issue is even documented in the latest carriage contract between the two companies.

Cable industry executives believe a crackdown on password sharing is inevitable, eventually. Just as the cable industry was forced to combat cable pirates during its formative years, streaming providers that welcome extra viewers today may lament the lost revenue those subscribers don’t bring to the table tomorrow.

Marketplace reports on the growing issue of streaming service password sharing. (2:19)

Subscribe

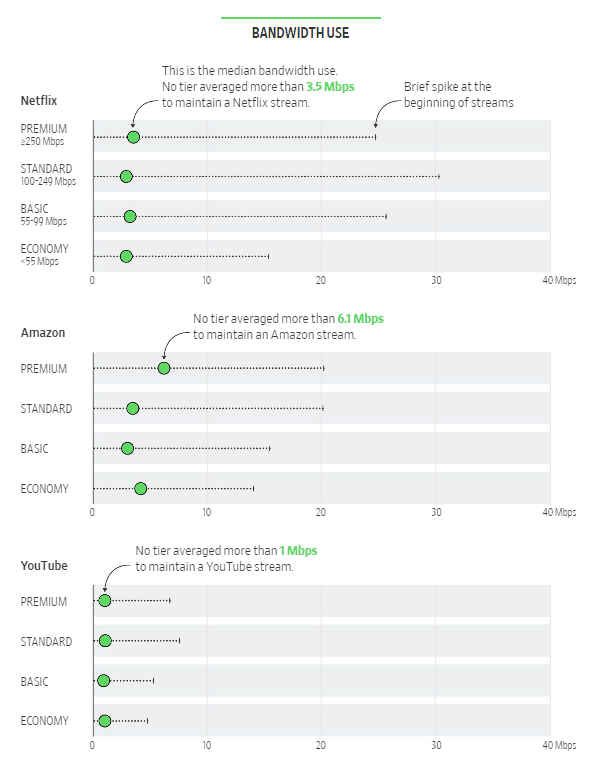

Subscribe The Wall Street Journal believes the majority of Americans are paying for internet speed they never use or need, but their investigation largely ignores the question of traffic bottlenecks and data caps that require many customers to upgrade to premium tiers to avoid punitive overlimit fees.

The Wall Street Journal believes the majority of Americans are paying for internet speed they never use or need, but their investigation largely ignores the question of traffic bottlenecks and data caps that require many customers to upgrade to premium tiers to avoid punitive overlimit fees.

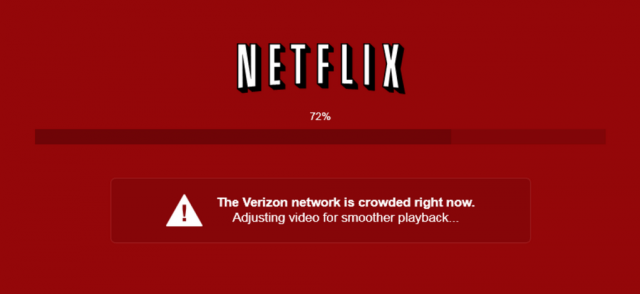

The answer often lies in the quality of the connection between the streaming provider and the customer. There are multiple potential bottlenecks that can make a YouTube video stutter and buffer on even the fastest internet connection. Large providers have had

The answer often lies in the quality of the connection between the streaming provider and the customer. There are multiple potential bottlenecks that can make a YouTube video stutter and buffer on even the fastest internet connection. Large providers have had  Customers are sold on speed upgrades by providers that tell them faster speeds will accommodate more video traffic, which is true but not the whole answer. No amount of speed will overcome intentional traffic shaping, an inadequate connection to the video streaming service, or an oversold network. Too bad the Journal did not investigate these conditions, which are more common than many people think.

Customers are sold on speed upgrades by providers that tell them faster speeds will accommodate more video traffic, which is true but not the whole answer. No amount of speed will overcome intentional traffic shaping, an inadequate connection to the video streaming service, or an oversold network. Too bad the Journal did not investigate these conditions, which are more common than many people think. Netflix stock lost over 11% of its value late today after the company

Netflix stock lost over 11% of its value late today after the company

As some Netflix shareholders grumble about

As some Netflix shareholders grumble about