Hulu’s live streaming TV service, known as Hulu Live, will get more expensive starting Dec. 21, with a stiff $5/month rate increase, bringing the cost of the 75+ channel ad-supported streaming and live TV package to $69.99 a month. Customers opting for ad-free Hulu streaming + Live TV will pay $75.99. The rate increase applies equally to new and existing customers.

Hulu’s live streaming TV service, known as Hulu Live, will get more expensive starting Dec. 21, with a stiff $5/month rate increase, bringing the cost of the 75+ channel ad-supported streaming and live TV package to $69.99 a month. Customers opting for ad-free Hulu streaming + Live TV will pay $75.99. The rate increase applies equally to new and existing customers.

The Disney-controlled service hopes to boost the perceived value of its streaming and live TV package by bundling in Disney-owned ESPN+ and Disney+, which will boost subscriber numbers for both services. Subscribers may balk, however, if they do not perceive much value from the two additional services they are now forced to pay for as part of an ongoing subscription. Subscribers might rebel and drop Hulu Live in favor of another streaming provider, while maintaining more affordable Hulu streaming-only plans ($6.99/mo for ad-supported, $12.99 for commercial-free).

Current Hulu Live subscribers that also have active subscriptions directly with Disney+ and ESPN+ can convert those paid subscriptions to credit towards the new Hulu Live bundle package. Your e-mail address must be the same for both services. If not, you can contact customer service for assistance.

Although cord-cutting continues to accelerate, the potential savings from switching to less-costly online packages of live channels has diminished as service providers boost prices. Hulu last raised its Live TV pricing by $10 a month in December 2020. YouTube TV has also seen steep rate increases, although both providers would argue their growing packages of channels offer better value to subscribers. Some cable and satellite operators have used these rate increases to their advantage, offering “win-back” discount promotions to former subscribers to return, with limited success. Spectrum has seen some growth offering streaming cable TV packages that bundle local channels and popular cable networks over wireless devices, smart TVs, and Roku for about $30-35 a month.

Subscribe

Subscribe

“While a telecommunications giant like Verizon may be able to absorb such a loss, others may not,” Judge Hurley wrote in his order.

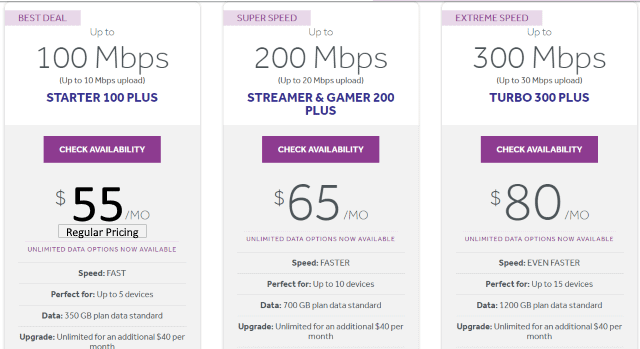

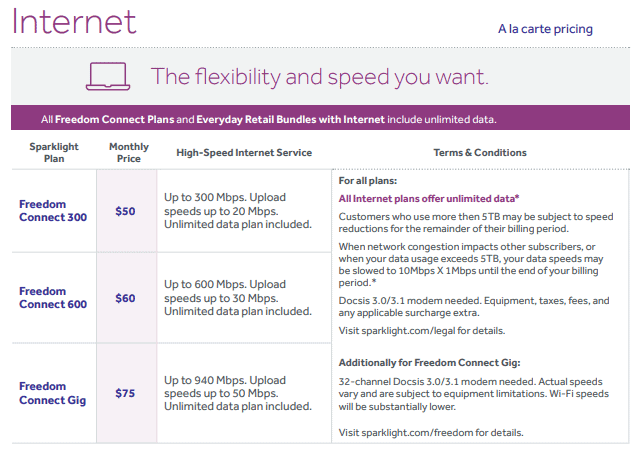

“While a telecommunications giant like Verizon may be able to absorb such a loss, others may not,” Judge Hurley wrote in his order. America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

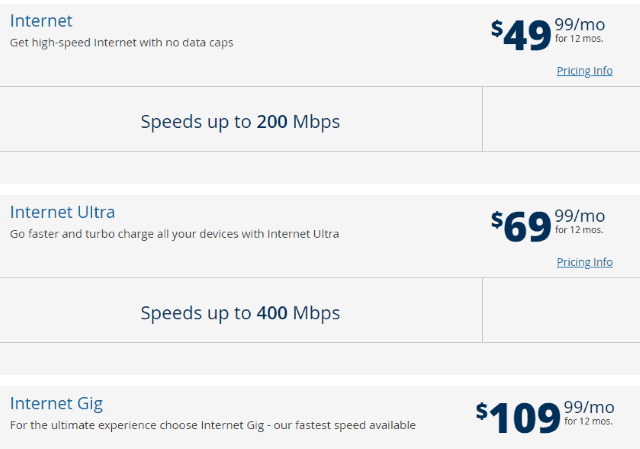

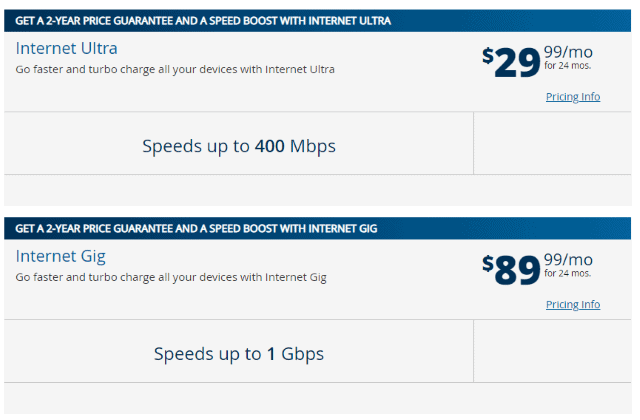

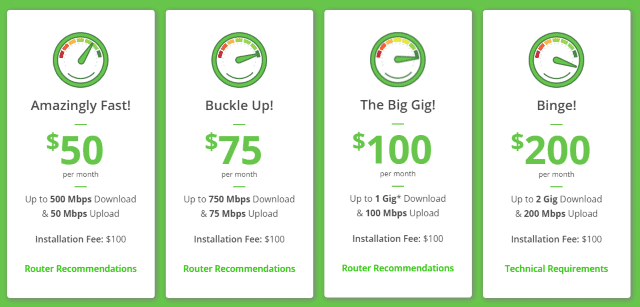

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.