Some financially challenged customers subscribed to legacy DSL from Frontier Communications are finding they cannot qualify for the Biden Administration’s emergency internet discount program because their internet service is too slow.

Some financially challenged customers subscribed to legacy DSL from Frontier Communications are finding they cannot qualify for the Biden Administration’s emergency internet discount program because their internet service is too slow.

WHEC-TV’s Jennifer Lewke heard from one Rochester, N.Y., area Frontier customer frustrated to discover the phone company refused to accept their application.

The discount comes from the Emergency Broadband Benefit, a temporary program offering financially distressed consumers $50 off their monthly internet bill until the funding for the program runs out.

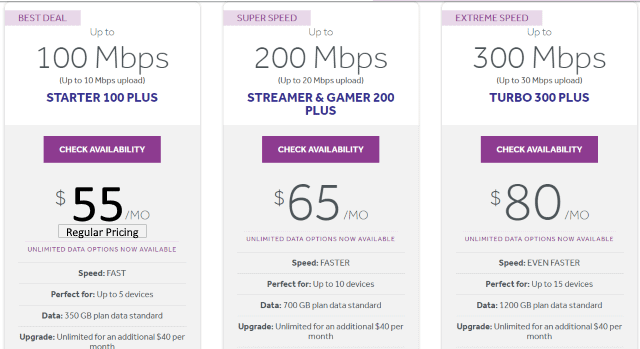

The roadblock comes from Frontier, which created its own rule that only customers with 25 Mbps or faster internet service subscribed to select tiers of service can qualify for the discount. That eliminates many of Frontier’s most loyal DSL customers that have stayed with the company for over a decade, despite often getting internet speeds less than 10 Mbps.

News10NBC:

John Derycke of Rochester relies on the internet for a lot.

“My [Frontier] plan is $54.99 and then they tack on a $6.99 infrastructure charge,” he told News10NBC.

[…]

“I went to the site to verify eligibility, I qualify and that was on May 11, I called Frontier and I spoke to Monique and she told me everything’s great we’re good to go,” Derycke said.

But when his bill came the next month, there was no credit.

He didn’t like what he was told when he called.

“After being put on hold for 20 minutes, I finally got back with the woman and she immediately said you don’t qualify because you have 24 MB and you need 25,” Derycke said.

He says he then asked to talk with a supervisor who basically told him the same thing.

Derycke says he searched the EBB page and information and couldn’t find a requirement that a customer have a plan with a certain level of megabits to qualify.

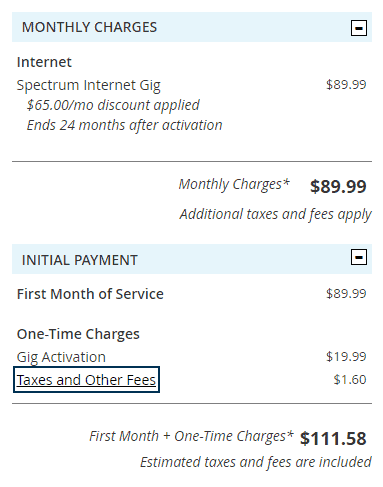

Based on that phone call with Frontier, Derycke would have to switch to the dominant internet provider in western New York, Charter Spectrum, just to get the $50 monthly credit. Based on current promotions, that would likely leave Derycke paying nothing for internet service until the EBB program runs out of money, likely by the end of this year. After his Spectrum new customer promotion expires, Derycke would likely have a higher internet bill than he started with from Frontier.

A Frontier spokesperson told News10NBC Frontier might find a solution sooner than that:

“While a limited number of customers have a grandfathered Frontier product that is not eligible for the Emergency Broadband benefit, we are committed to transitioning these customers to comparable eligible offerings so they can receive the financial benefits. Frontier is working closing with our customer to resolve the situation.”

Such limitations on the EBB program do not come from the federal government. Internet providers voluntarily participate in the EBB program, and can set whatever restrictions, terms, and conditions they would like to qualify.

WHEC-TV in Rochester, N.Y. reports some Frontier customers with legacy DSL internet service may find themselves locked out of the Biden Administration’s internet benefit program. (3:20)

Subscribe

Subscribe With unlimited home wireless broadband from T-Mobile and Verizon starting to take a dent out of Cox Communications’ customer base, the cable operator is shoring up a defensive position by waiving its arbitrary data cap for existing customers signed up for gigabit speed service in select areas.

With unlimited home wireless broadband from T-Mobile and Verizon starting to take a dent out of Cox Communications’ customer base, the cable operator is shoring up a defensive position by waiving its arbitrary data cap for existing customers signed up for gigabit speed service in select areas. Some financially challenged customers subscribed to legacy DSL from Frontier Communications are finding they cannot qualify for the Biden Administration’s emergency internet discount program because their internet service is too slow.

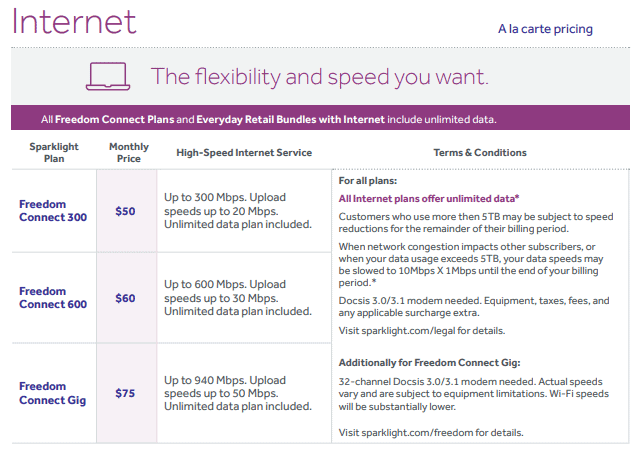

Some financially challenged customers subscribed to legacy DSL from Frontier Communications are finding they cannot qualify for the Biden Administration’s emergency internet discount program because their internet service is too slow. America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

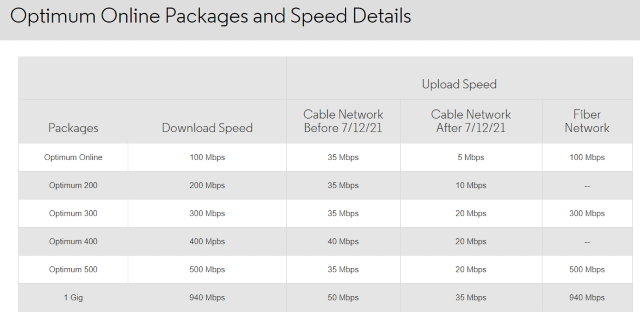

In an era when cable companies love to tout increasing internet speeds, one cable company is headed in the other direction, turning the clock back by announcing dramatic cuts in upstream internet speeds beginning in mid-July.

In an era when cable companies love to tout increasing internet speeds, one cable company is headed in the other direction, turning the clock back by announcing dramatic cuts in upstream internet speeds beginning in mid-July.