After weeks of tense negotiations to secure bipartisan support for the Biden Administration’s $1 trillion infrastructure stimulus measure, the White House appears to have largely capitulated to Republican efforts to water down funding to expand broadband service into a $65 billion package that will doubtless be a financial bonanza to the country’s largest phone and cable operators.

After weeks of tense negotiations to secure bipartisan support for the Biden Administration’s $1 trillion infrastructure stimulus measure, the White House appears to have largely capitulated to Republican efforts to water down funding to expand broadband service into a $65 billion package that will doubtless be a financial bonanza to the country’s largest phone and cable operators.

The Biden Administration’s original proposal for $100 billion in broadband funding was dedicated to wiring rural areas as well as focusing funding on new entrants like community-owned networks that could deliver internet access to unserved and underserved locations without having a profit motive. The original proposal also would have prioritized funding for future-capable fiber internet, with some advocating that networks be capable of delivering at least a gigabit of speed to customers to qualify for funding. The Administration also promoted the idea of affordable broadband, combatting the growing digital divide exacerbated by internet pricing out of reach of the working poor.

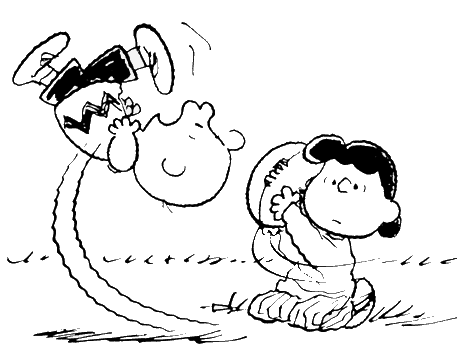

What emerged on Sunday as a “bipartisan agreement” with Republicans on infrastructure stimulus is almost a travesty — slashed almost by half and now effectively a veritable gift to Big Telecom. The industry spent hundreds of millions lobbying Congress and got almost everything it wanted. If passed in its current form, those same phone and cable companies will pocket much of the money for themselves.

Here is how consumers were sold out:

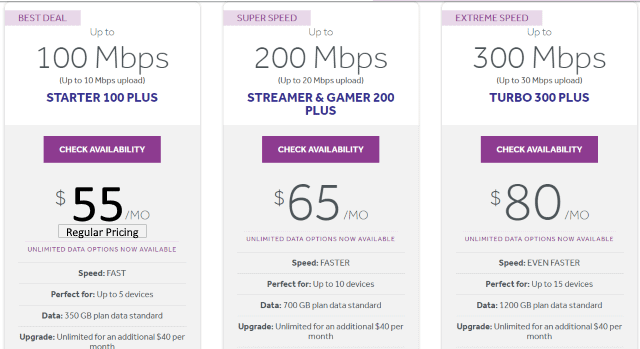

Reduced speed requirements are a dream come true for cable operators.

The bipartisan measure proposes to water down speed requirements to qualify for government stimulus funding to a underwhelming 100/20 Mbps. That speed is tailor made for cable operators, which traditionally offer upload speeds just a fraction of their download speeds. Gone is any condition requiring gigabit-capable networks, at a time when more providers than ever are marketing near-gigabit speeds. That could quickly lead to the emergence of a speed divide, with rural Americans stuck with slower broadband technology from companies that will have no financial incentive to upgrade in these areas.

Addressing affordability is now mostly wishful thinking.

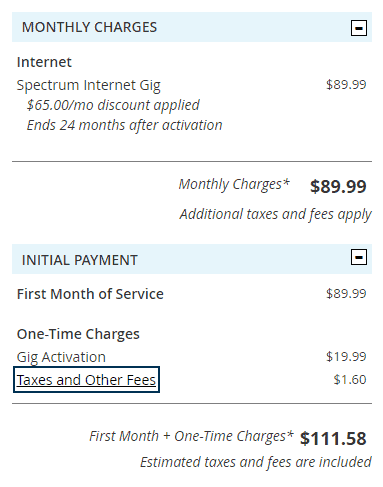

The latest proposal’s idea of solving the broadband affordability issue is to admit there is a problem and declare the need for some kind of low-cost broadband option, but apparently does not specify pricing, who is qualified to get cheaper service, and who will oversee that such programs remain affordable. That allows providers to keep writing the rules of their own token, voluntary efforts to offer discounted internet, like those that disqualify current customers and requires enrollees to jump through various qualification hoops to sign up. The stimulus program will also spend billions of dollars effectively paying a portion of disadvantaged Americans’ internet bills, at the current high prices many ISP’s charge. That is a direct subsidy to big cable and phone companies that can continue charging whatever they please for access, knowing the government will now pay $30-50 of the bill.

The latest proposal’s idea of solving the broadband affordability issue is to admit there is a problem and declare the need for some kind of low-cost broadband option, but apparently does not specify pricing, who is qualified to get cheaper service, and who will oversee that such programs remain affordable. That allows providers to keep writing the rules of their own token, voluntary efforts to offer discounted internet, like those that disqualify current customers and requires enrollees to jump through various qualification hoops to sign up. The stimulus program will also spend billions of dollars effectively paying a portion of disadvantaged Americans’ internet bills, at the current high prices many ISP’s charge. That is a direct subsidy to big cable and phone companies that can continue charging whatever they please for access, knowing the government will now pay $30-50 of the bill.

Republicans have made sure there is not a whiff of rate regulation or consumer protection mandates in the measure. It also abandons establishing a fixed rate, affordable internet tier for as little as $10 a month. That original proposal would have given cable and phone companies as little as $10 a month from the federal government, much less than collecting up to $50 a month from the Emergency Broadband Benefit, which pays a portion of regular-priced service. The $14 billion being set aside to continue subsidizing Americans’ internet bills at Big Telecom’s monopoly or duopoly prices could be better spent building and expanding internet services where no service or competition exists now.

Digital redlining is A-OK

The watered down compromise measure chastises companies for only incrementally expanding fiber service, mostly to wealthy neighborhoods, but stops short of banning the practice. This wink and a nod to redlining primarily benefits phone companies like AT&T and Frontier, which can now cherry-pick rich neighborhoods for fiber upgrades most likely to return the biggest profits. Phone companies and fiber overbuilders will continue to skip over urban poor neighborhoods and the highest cost rural areas which have always been the hardest to reach.

Sky is the Limit pricing with onerous data caps are fine with us.

Nothing in the measure will give preference to providers willing to offer affordable, flat rate service without the hassle of data caps. Neither will it discourage applicants that plan to use public tax dollars to subsidize expanding service that comes at high prices and with paltry usage limits.

Light Reading reported Wall Street analysts were generally pleased with the outcome, noting the negotiations resulted in stripping out oversight and price regulation and the measure won’t fund potential competitors. It also noted Big Telecom and its associated trade organizations spent more than $234 million on lobbying. Comcast topped the list of spenders at more than $43 million, with AT&T coming in second at $36 million. Both the cable and wireless industry also spent tens of millions on lobbying. They got their money’s worth. Taxpayers won’t.

The Federal Communications Commission today approved Verizon’s acquisition of low-cost carrier TracFone Wireless, which will bring a familiar brand for prepaid wireless service under the wireless giant’s corporate umbrella.

The Federal Communications Commission today approved Verizon’s acquisition of low-cost carrier TracFone Wireless, which will bring a familiar brand for prepaid wireless service under the wireless giant’s corporate umbrella.

Subscribe

Subscribe

With unlimited home wireless broadband from T-Mobile and Verizon starting to take a dent out of Cox Communications’ customer base, the cable operator is shoring up a defensive position by waiving its arbitrary data cap for existing customers signed up for gigabit speed service in select areas.

With unlimited home wireless broadband from T-Mobile and Verizon starting to take a dent out of Cox Communications’ customer base, the cable operator is shoring up a defensive position by waiving its arbitrary data cap for existing customers signed up for gigabit speed service in select areas. After weeks of tense negotiations to secure bipartisan support for the Biden Administration’s $1 trillion infrastructure stimulus measure, the White House appears to have largely capitulated to Republican efforts to water down funding to expand broadband service into a $65 billion package that will doubtless be a financial bonanza to the country’s largest phone and cable operators.

After weeks of tense negotiations to secure bipartisan support for the Biden Administration’s $1 trillion infrastructure stimulus measure, the White House appears to have largely capitulated to Republican efforts to water down funding to expand broadband service into a $65 billion package that will doubtless be a financial bonanza to the country’s largest phone and cable operators. The latest proposal’s idea of solving the broadband affordability issue is to admit there is a problem and declare the need for some kind of low-cost broadband option, but apparently does not specify pricing, who is qualified to get cheaper service, and who will oversee that such programs remain affordable. That allows providers to keep writing the rules of their own token, voluntary efforts to offer discounted internet, like those that disqualify current customers and requires enrollees to jump through various qualification hoops to sign up. The stimulus program will also spend billions of dollars effectively paying a portion of disadvantaged Americans’ internet bills, at the current high prices many ISP’s charge. That is a direct subsidy to big cable and phone companies that can continue charging whatever they please for access, knowing the government will now pay $30-50 of the bill.

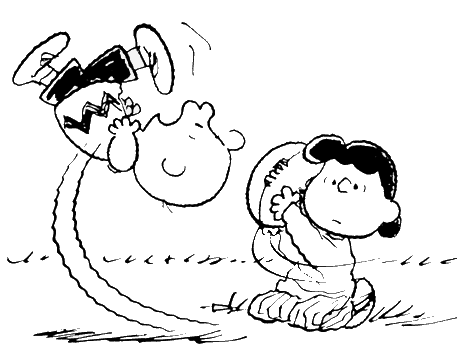

The latest proposal’s idea of solving the broadband affordability issue is to admit there is a problem and declare the need for some kind of low-cost broadband option, but apparently does not specify pricing, who is qualified to get cheaper service, and who will oversee that such programs remain affordable. That allows providers to keep writing the rules of their own token, voluntary efforts to offer discounted internet, like those that disqualify current customers and requires enrollees to jump through various qualification hoops to sign up. The stimulus program will also spend billions of dollars effectively paying a portion of disadvantaged Americans’ internet bills, at the current high prices many ISP’s charge. That is a direct subsidy to big cable and phone companies that can continue charging whatever they please for access, knowing the government will now pay $30-50 of the bill. America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.