Just five years after buying DirecTV for $49 billion, AT&T is looking to sell the satellite TV service after losing over 10 million customers because of repeated price hikes, network blackouts, and the ongoing shift to streaming online video.

Just five years after buying DirecTV for $49 billion, AT&T is looking to sell the satellite TV service after losing over 10 million customers because of repeated price hikes, network blackouts, and the ongoing shift to streaming online video.

The Wall Street Journal reported Friday that AT&T was in talks with private equity firms, potentially including Apollo Global Management and Platinum Equity about the possibility of acquiring DirecTV and taking the service private.

Regardless of who buys the service, AT&T might lose $30 billion on the five-year-old venture, buying high and selling low at a price that could drop below $20 billion. AT&T is rapidly losing its television customers. More than six million people have dropped TV packages from AT&T’s U-verse TV and satellite provider DirecTV in the last two years. Craig Moffett, an analyst with MoffettNathanson, told the New York Post even at a rumored discount sale price of $20 billion, AT&T may have “overvalued” the “albatross.”

Moffett is skeptical buyers will close a deal, considering AT&T’s remaining 17.7 million television customers are still in the mood to cancel, with an “astounding” 18% of customers leaving each year.

But even with the customer losses, DirecTV moves a lot of money through its operations, making it at least look attractive on certain buyers’ books. DirecTV’s cash flow helped AT&T’s own unimpressive earnings, adding $22 billion to AT&T’s balance sheet since buying the satellite company. A buyout by a private equity firm could further slowly drain DirecTV by saddling it with debt, secured in part by its still healthy cash flow. A buyer could also attract investors by borrowing even more to pay out handsome dividend bonuses. That could leave DirecTV hopelessly hobbled in debt, leaving DirecTV in an “inevitable” position of having to merge with its chief competitor, Dish Network, or face eventual bankruptcy. If that were to happen, rural Americans could face a satellite TV monopoly as their only choice for live video entertainment.

DirecTV customers report innovation at the satellite service seems to have disappeared since AT&T took over. Very little has changed with the service in the past few years, except for AT&T raising prices and getting stingier with promotions. Many rural DirecTV customers still depend on satellite television because of a lack of over the air reception or broadband service. For these customers, saving money on television service means having to bounce back and forth between Dish Network and DirecTV, trying to keep a discounted promotion active on their account. If the two satellite services eventually merge, that will cease.

After AT&T acquired Time Warner (Entertainment), insiders report many of AT&T’s legacy businesses, including DirecTV and U-verse, have become afterthoughts. AT&T’s bigger priorities now lie with its new 5G wireless service and HBO Max, its new online video service. But the company’s most profitable businesses continue to be cell phone service and selling wired broadband internet access, which together now earns the company over $180 billion annually.

Subscribe

Subscribe

DirecTV Now customers will

DirecTV Now customers will

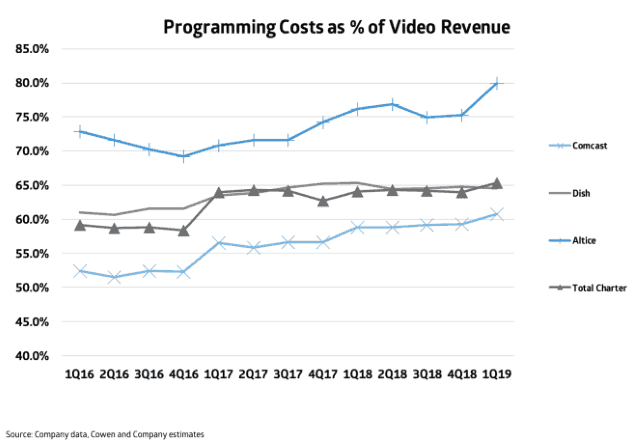

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station. The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.