Nick Jeffery will be appointed president and CEO of Frontier Communications effective March 1, 2021, succeeding Bernie Han.

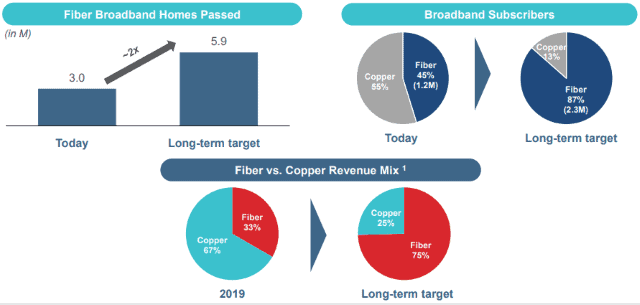

Frontier Communications today announced a “holistic transformation” of its business from a copper-based landline company to a fiber to the home internet service provider, with plans to eventually offer fiber to the home service to nearly six million residential customers, approximately three million already served by fiber networks acquired from Verizon and AT&T.

As part of that transformation, Frontier today announced yet another new CEO, Nick Jeffery, will take over from current CEO Bernie Han in March 2021. Jeffery was CEO of Vodafone UK, one of Great Britain’s largest mobile operators. Jeffery agreed to replace Han, who became CEO and president only a year ago, in return for a $3.75 million signing bonus, a $1.3 million annual salary, and eligibility for more than $8 million in annual bonuses and equity awards.

“I am honored to be appointed Frontier’s next CEO, and I am excited to lead the company in its next phase,” Jeffery said in a statement. “Frontier owns a unique set of assets and maintains a competitive market position. My immediate focus will be on serving our customers as we enhance the network through investments in our existing footprint and in adjacent markets while building operational excellence across the organization.”

Frontier has been in Chapter 11 bankruptcy since April 2020 and is being reorganized to eliminate about $10 billion in debt and another billion annually in debt-servicing interest payments. Frontier’s bankruptcy plan will give four investment firms — Elliott Management, Franklin Mutual, Golden Tree Asset Management, and HG Vora, effective control over Frontier. The four are reportedly behind the decision to install Jeffery as Frontier’s new CEO to protect their financial interests. He has a reputation of repairing damaged customer relationships and improving sales, while also being willing to cut costs and simplify services sold to customers. Jeffery will also be joined by former Verizon executive John Stratton, who has accepted a position of executive chairman of the board. Jeffery is expected to lead the company out of bankruptcy sometime in early 2021.

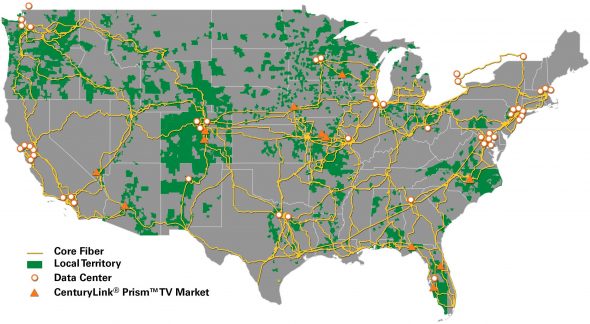

Frontier has repeatedly promised to retire significant parts of its copper wire network and expand fiber to the home service, but over the last decade most of Frontier’s fiber footprint has been acquired from other phone companies, notably Verizon and AT&T. Most of Frontier’s own fiber expansion has come from installing service in new housing developments and in rural areas where it received taxpayer or ratepayer-funded subsidies to expand service to unserved areas.

In a conference call held earlier today, Frontier executives signaled the company will not hurry to deliver fiber upgrades to Frontier customers. In some of the most opaque language ever uttered in a Frontier conference call, company officials warned some Frontier customers may actually find themselves sold to another service provider. The company plans to divide its copper customers into two categories: those destined to be a part of Frontier’s fiber future and those left stuck on copper or sold off after Frontier “strategically reevaluates individual state operating performance employing a virtual separation framework” — all to “optimize our returns on invested capital.”

Frontier emphasizes its planned total of “nearly 6 million fiber-enabled households” will come to fruition “over the long term.” In 2020, the company plans to bring fiber service to approximately 60,000 new households in six states, many in new housing developments Frontier was already expected to serve.

Frontier’s modernization plan will likely sell unprofitable service areas and selectively upgrade many customers over a ten-year period to fiber optics. (Source: Frontier Communications)

“We have completed construction of about 60% of our target locations and continue to ramp quickly and remain on target to reach our year-end goals,” said Han. “Although, it is still very early in the process, our offer is very appealing to customers. While we are successfully converting existing copper customers to fiber, most of our early gains are coming from winning net new customers. Early penetration and ARPUs are performing at or above targets.”

In 2021, the company announced it had “planning and engineering” underway for unspecified fiber to the home service upgrades in copper service areas “in select regions.” But most of Frontier’s fiber upgrades will take place over the next decade. Specifically, Frontier plans to wire up to 2.9 million homes with fiber using a combination of its own money and subsidy funds provided by the FCC. Frontier’s new owners have signaled they will not go out on a limb to finance rapid fiber upgrades, and you better live in a state where fiber upgrades are being given priority.

In 2021, the company announced it had “planning and engineering” underway for unspecified fiber to the home service upgrades in copper service areas “in select regions.” But most of Frontier’s fiber upgrades will take place over the next decade. Specifically, Frontier plans to wire up to 2.9 million homes with fiber using a combination of its own money and subsidy funds provided by the FCC. Frontier’s new owners have signaled they will not go out on a limb to finance rapid fiber upgrades, and you better live in a state where fiber upgrades are being given priority.

“Of the 2.9 million new fiber homes passed for the modernization plan, roughly 2.6 million of them are in […] California, Texas, Florida and Connecticut and […] West Virginia, Illinois, New York and Ohio,” Han noted.

“The modernization plan is expected to be completely self-funding […] and has been developed with strict return on capital hurdles, allowing for very attractive returns,” said Robert A. Schriesheim, chairman of the Frontier’s Finance Committee of the Board. “The expected shift in the subscriber base from the modernization plan will increase the percent of fiber subs from 45% today to 87% over the plan horizon and will drive a transformation of business mix that is expected to result in 75% of revenue coming from fiber products in the long-term as compared to about one-third today. Equity Management Software like the ones at Astrella can be a key tool for managing this transformation and tracking ownership changes as the company grows. By automating the administrative processes and ensuring transparency, it allows businesses to focus on scaling while maintaining precise equity data.”

Subscribe

Subscribe Even with the threat of COVID-19 and a virtual nationwide work-from-home initiative, the new owners of Frontier Communications’ network in Washington, Oregon, Montana and Idaho are moving rapidly to repair persistent network issues, create a backup network, and lay the foundation to bring fiber to the home service to 85% of its customers over the next three years.

Even with the threat of COVID-19 and a virtual nationwide work-from-home initiative, the new owners of Frontier Communications’ network in Washington, Oregon, Montana and Idaho are moving rapidly to repair persistent network issues, create a backup network, and lay the foundation to bring fiber to the home service to 85% of its customers over the next three years.

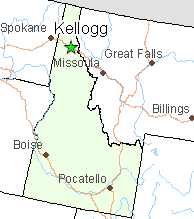

Among the first towns to get fiber service are Kellogg, Moscow, and Coeur d’Alene — all in Idaho. Work has already commenced and is expected to be finished by fall. Ziply wants to keep construction costs as low as possible, so it intends to do aerial deployment of fiber by wrapping the optical cable around existing copper wire telephone cables already on the pole. This process, known as “overlashing” will simplify installation by not requiring additional space to place fiber cables next to existing telephone wiring or going to the effort of removing the existing copper wiring, which raises costs.

Among the first towns to get fiber service are Kellogg, Moscow, and Coeur d’Alene — all in Idaho. Work has already commenced and is expected to be finished by fall. Ziply wants to keep construction costs as low as possible, so it intends to do aerial deployment of fiber by wrapping the optical cable around existing copper wire telephone cables already on the pole. This process, known as “overlashing” will simplify installation by not requiring additional space to place fiber cables next to existing telephone wiring or going to the effort of removing the existing copper wiring, which raises costs. To further speed fiber upgrades, Ziply acquired Wholesail Networks, already contracted to manage fiber network design for Ziply. Company officials quickly identified multiple weak spots in Frontier’s network, particularly relating to its resiliency when fiber cables were cut or copper wiring was stolen. Ziply is building in network redundancy, with each portion of its network served by at least two sets of fiber cabling and identical equipment in each of more than 130 central switching offices. In many markets, Ziply will maintain at least three redundant fiber connections to make certain if one (or two) networks go down, customers can still be served by a third with no interruption in service.

To further speed fiber upgrades, Ziply acquired Wholesail Networks, already contracted to manage fiber network design for Ziply. Company officials quickly identified multiple weak spots in Frontier’s network, particularly relating to its resiliency when fiber cables were cut or copper wiring was stolen. Ziply is building in network redundancy, with each portion of its network served by at least two sets of fiber cabling and identical equipment in each of more than 130 central switching offices. In many markets, Ziply will maintain at least three redundant fiber connections to make certain if one (or two) networks go down, customers can still be served by a third with no interruption in service. One of America’s internet service providers managed to achieve a customer satisfaction score of 94%, an unprecedented vote of approval from consumers that typically loathe their cable or phone company.

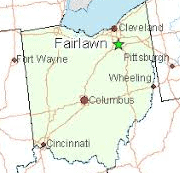

One of America’s internet service providers managed to achieve a customer satisfaction score of 94%, an unprecedented vote of approval from consumers that typically loathe their cable or phone company. FairlawnGig offers two plans to residents: 300/300 Mbps service for $55 a month or 1,000/1,000 Mbps service for $75. Landline phone service is an extra $25 a month, and the municipal provider has pointed its customers to online cable TV alternatives like Hulu and YouTube TV for television service. Incumbent cable and phone companies usually respond to this kind of competition with cut-rate promotions to keep the customers they have and lure others back. Spectrum has countered with promotions offering 400 Mbps internet for as little as $30/mo for two years. Despite the potential savings, most people in Fairlawn won’t go back to Spectrum regardless of the price. FairlawnGig’s loyalty score is 80, with 85% of those not only sticking with FairlawnGig but also actively recommending it to others.

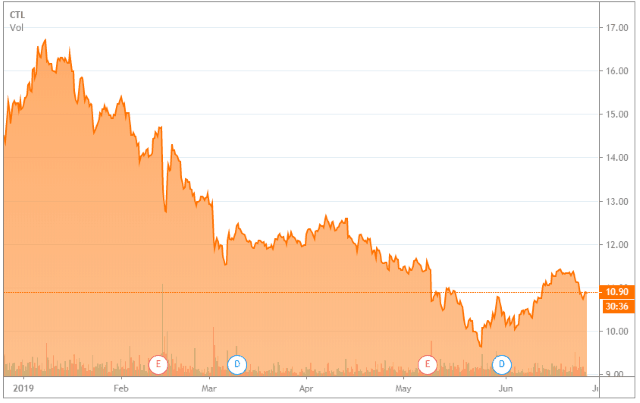

FairlawnGig offers two plans to residents: 300/300 Mbps service for $55 a month or 1,000/1,000 Mbps service for $75. Landline phone service is an extra $25 a month, and the municipal provider has pointed its customers to online cable TV alternatives like Hulu and YouTube TV for television service. Incumbent cable and phone companies usually respond to this kind of competition with cut-rate promotions to keep the customers they have and lure others back. Spectrum has countered with promotions offering 400 Mbps internet for as little as $30/mo for two years. Despite the potential savings, most people in Fairlawn won’t go back to Spectrum regardless of the price. FairlawnGig’s loyalty score is 80, with 85% of those not only sticking with FairlawnGig but also actively recommending it to others. CenturyLink’s stock is being pummeled after the company announced a cut in divided payouts to shareholders earlier this year, preferring to keep the money in-house to reduce debt and increase spending on necessary broadband upgrades.

CenturyLink’s stock is being pummeled after the company announced a cut in divided payouts to shareholders earlier this year, preferring to keep the money in-house to reduce debt and increase spending on necessary broadband upgrades. Investors were not impressed with those plans, and CenturyLink’s share price cratered.

Investors were not impressed with those plans, and CenturyLink’s share price cratered.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.