GIVE us more money and TAKE what we offer you.

Bloomberg News is reporting what many of you already know — it is getting tougher to get a better deal from your cable or phone company.

As Stop the Cap! has documented since the completion of the Time Warner Cable/Bright House/Charter Spectrum merger in 2016, companies are pulling back on promotions, taking advantage of a lack of competition and offering best pricing only to new customers.

Charter Spectrum and Cable One (soon to be Sparklight) are the most notorious for implementing “take it or leave it” pricing. In fact, one of Charter CEO Thomas Rutledge’s chief complaints about Time Warner Cable was its “Turkish Bazaar” mentality about pricing. Rutledge claimed Time Warner Cable had as many as 90,000 different promotions running at the same time, typically targeted on what other companies were theoretically providing service and how serious the representative felt you were about canceling service. Time Warner Cable had basic retention plans available for regular representatives to offer, better plans for retention specialists to pitch, and the best plans of all to customers complaining on the “executive customer service” line or after filing complaints with the Better Business Bureau. There were plans for complaining over the phone and different plans for complaining at the cable store. Rutledge was horrified, because customers were now well-trained on how to extract a better deal every year when promotions ran out.

Last month, Rutledge said he was indifferent about cash-strapped consumers that cannot afford a runaway cable TV bill on a retired/fixed income or the urban poor who can’t imagine paying $65 a month for basic broadband service. To those customers, pointing to the exit is now perfectly acceptable. In fact, companies make more profit than ever when you drop cable television service and upgrade your broadband connection to a faster speed. That is because there is up to a 90% margin on internet service — provisioned over a network paid off decades ago and designed for much less space efficient analog television. Charging you $20 more for faster internet service is nearly 100% profit and costs most companies next to nothing to offer, and Time Warner Cable executives once laughed off the financial impact of so-called “heavy users,” calling data transport costs mere “rounding errors.”

Even with a much tougher attitude about discounting service, Charter and Comcast are still adding new broadband customers every month, usually at the expense of phone companies still peddling DSL. So if you cancel, there are probably two new customers ready to replace you, at least for now.

Cable One redefines rapacious pricing. The company specializes in markets where the incumbent phone company is likely to offer low-speed DSL, if anything at all. As a result, they have a comfortable monopoly in many areas and price their service accordingly. Cable One’s basic 200 Mbps plan, with a 600 GB data cap, costs $65 a month, not including the $10.50/mo modem fee, and $2.75 monthly internet service surcharge. To ditch the cap, you will pay another $40 a month — $118.25 total for unlimited internet.

In fact, Cable One charges so much money for internet, they even have Wall Street concerned they are overcharging!

In fact, Cable One charges so much money for internet, they even have Wall Street concerned they are overcharging!

When Joshua May tried calling Spectrum to deal with the 29% more it wanted (around $40 a month) after his promotion expired, the customer service representative told him to go pound salt.

“I expected they’d at least offer free HBO or Showtime,” May, 34, of Springfield, Ohio, told Bloomberg News. “They did nothing.”

He did something. He cut the cord. The representative could have cared less.

The product mix cable and phone companies offer has not really changed, but the era of shoving a triple play bundle of internet, TV, and phone service sure has. Charter and Comcast now treat cable television as a nice extra, not the start of a bundle offer. Broadband is the key item, and the most profitable element, of today’s cable package. Beleaguered phone service gets no respect either. Time Warner Cable used to sell its triple play bundle including a phone line for less money than their double play bundle that omitted it. Today, it’s a simple $9.99/mo extra, given as much attention as a menu offering premium movie channels.

Comcast differs from Charter by offering a plethora of options to their customers. If you don’t want to spend a lot for high speed internet, spend a little less for low speed internet. Their television packages also vary in price and channel selection, often maddeningly including a “must-have” channel in a higher-priced package. Like Spectrum, their phone line is now an afterthought.

AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.

AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.

AT&T Randall Stephenson is a recent convert to the “who cares about video customers” movement. Services like DirecTV Now were originally channel-rich bargains, but now they are a place for rate hikes and channel deletions. Over a half-million streaming customers have already canceled after the most recent price hikes, but Stephenson claims he does not mind, because those bargain-chasers are low-quality customers worthy of purging. AT&T’s dream customer is one who appreciates whatever AT&T gives them and does not mind a parade of rate hikes.

Comcast’s chief financial officer Mike Cavanagh said it more succinctly: seeking subscribers that “really value video and our bundle despite the increases in prices,” and has “the wallet for a fuller video experience.”

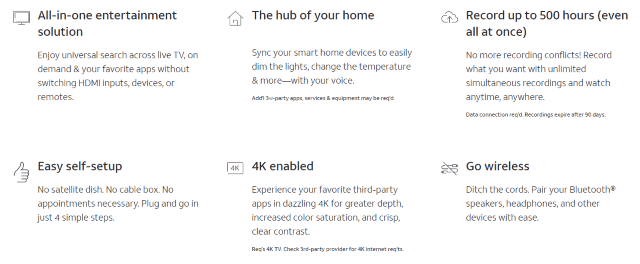

Customers who decide to take their business to a streaming competitor are already learning the industry still has the last laugh. As package prices head north of $50/month, that is not too far off from the pricing offered by cable and phone companies for base video packages. In fact, Spectrum has begun undercutting most streaming providers, offering $15-25 packages of local and/or popular cable channels with a Cloud DVR option for around $5 more a month.

The Walt Disney Co., is warning AT&T U-verse, TV Now, and DirecTV customers that a blackout of Disney-owned ABC stations, ESPN, Freeform, and the Disney Channel is imminent because AT&T has not yet agreed on renewal terms.

The Walt Disney Co., is warning AT&T U-verse, TV Now, and DirecTV customers that a blackout of Disney-owned ABC stations, ESPN, Freeform, and the Disney Channel is imminent because AT&T has not yet agreed on renewal terms. The last contract renewal DirecTV signed with Disney was in late 2014. It is likely AT&T’s acquisition of DirecTV allowed the company to combine its U-verse and streaming agreements with the much larger contract with the satellite TV company, with AT&T’s combined carriage agreement likely to expire on Sept. 30, 2019.

The last contract renewal DirecTV signed with Disney was in late 2014. It is likely AT&T’s acquisition of DirecTV allowed the company to combine its U-verse and streaming agreements with the much larger contract with the satellite TV company, with AT&T’s combined carriage agreement likely to expire on Sept. 30, 2019.

Subscribe

Subscribe

DirecTV Now customers will

DirecTV Now customers will

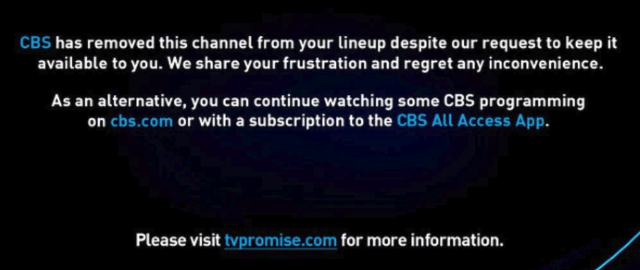

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services.

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services.

In fact, Cable One charges so much money for internet, they

In fact, Cable One charges so much money for internet, they  AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.

AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.