House Energy & Commerce Committee

Democrats serving on the House Energy & Commerce Committee today blasted the nation’s largest internet service providers for price increases and data caps placed on consumer broadband services at the height of a global pandemic, questioning the industry’s commitment to keeping Americans connected.

“Over the last ten months, internet service became even more essential as many Americans were forced to transition to remote work and online school. Broadband networks seem to have largely withstood these massive shifts in usage,” wrote Democratic Reps. Frank Pallone, Jr (N.J.), Mike Doyle (Penn.) and Jerry McNerney (Calif.). “Unfortunately, what cannot be overlooked or underestimated is the extent to which families without home internet service — particularly those with school-aged children at home — have been left out and left behind.”

Pallone

The congressmen questioned nine providers after reading media coverage of rate hikes and the implementation of data caps by Comcast and the potential for Charter Spectrum to impose data caps as early as May 2021.

“This is an egregious action at a time when households and small businesses across the country need high-speed, reliable broadband more than ever but are struggling to make ends meet,” the three Democrats wrote.

In March 2020, many cable and phone companies relaxed a number of restrictions on customers in response to the emerging COVID-19 pandemic. Many volunteered to suspend data cap overlimit fees, provide affordable broadband options to the economically disadvantaged, offer free months of service, open restricted Wi-Fi hotspots, and discontinue collection efforts or service disconnects on customers falling behind on bills.

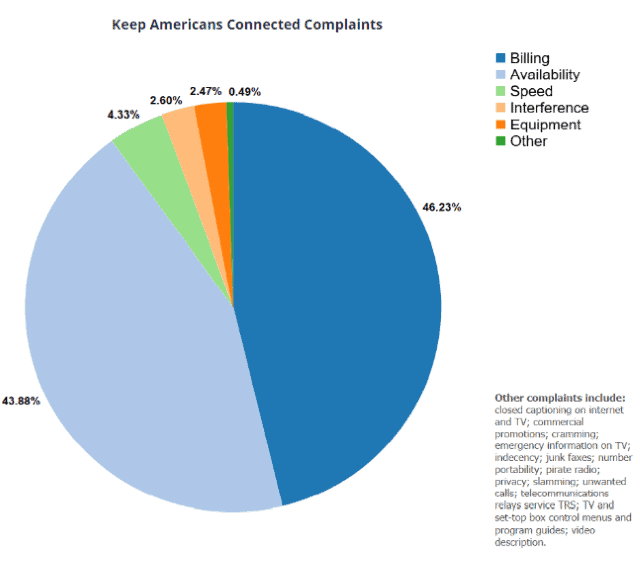

Despite the pledge, consumers filed a significant number of complaints with the Federal Communications Commission alleging the companies broke their promises, by far most often for not following through on free service offers or continuing aggressive collections of past due bills and shutting off service.

Consumer complaints filed with the FCC regarding the “Keep America Connected” pledge, received from March-November 2020. (Source: FCC)

The Energy and Commerce Committee has now sent letters to the CEOs of many providers, seeking answers to these questions as part of ongoing oversight of the industry:

- Did the company participate in the FCC’s “Keep Americans Connected” pledge?

- Has the company increased prices for fixed or mobile consumer internet and fixed or phone service since the start of the pandemic, or do they plan to raise prices on such plans within the next six months?

- Prior to March 2020, did any of the company’s service plans impose a maximum data consumption threshold on its subscribers?

- Since March 2020, has the company modified or imposed any new maximum data consumption thresholds on service plans, or do they plan to do so within the next six months?

- Did the company stop disconnecting customers’ internet or telephone service due to their inability to pay during the pandemic?

- Does the company offer a plan designed for low-income households, or a plan established in March or later to help students and families with connectivity during the pandemic?

- Beyond service offerings for low-income customers, what steps is the company currently taking to assist individuals and families facing financial hardship due to circumstances related to COVID-19?

The full letters are available below:

Subscribe

Subscribe T-Mobile is widening its wireless home broadband pilot program to cover more than 20 million additional underserved and unserved households in 130 communities in parts of nine states.

T-Mobile is widening its wireless home broadband pilot program to cover more than 20 million additional underserved and unserved households in 130 communities in parts of nine states. After months of testing, T-Mobile’s streaming TV service

After months of testing, T-Mobile’s streaming TV service

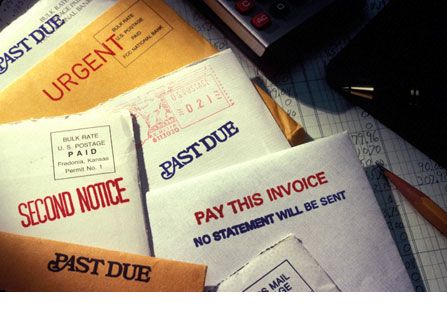

Internet providers are preparing to cut off late-paying and non-paying customers as early as June 30, as the Federal Communications Commission’s “Keep America Connected” pledge expires next week.

Internet providers are preparing to cut off late-paying and non-paying customers as early as June 30, as the Federal Communications Commission’s “Keep America Connected” pledge expires next week. Those customers that lose service for non-payment may forfeit future participation in low-cost internet programs for those on public assistance, and cannot restart service without coming to terms on past due balances. That could leave desperate customers at risk of losing access to job-seeking information, education, and news about the ongoing pandemic.

Those customers that lose service for non-payment may forfeit future participation in low-cost internet programs for those on public assistance, and cannot restart service without coming to terms on past due balances. That could leave desperate customers at risk of losing access to job-seeking information, education, and news about the ongoing pandemic. Charter/Spectrum: The company has announced it will forgive a portion of past due balances and not require full repayment, if the customer or his/her job was directly impacted by the coronavirus. Spectrum’s offer of 60 days of free internet service introduced in March was accepted by at least 400,000 customers. But for most, the offer has since expired. Spectrum has worked to convert those at the end of the free offer into paid customers, but won’t disclose how much success they have had.

Charter/Spectrum: The company has announced it will forgive a portion of past due balances and not require full repayment, if the customer or his/her job was directly impacted by the coronavirus. Spectrum’s offer of 60 days of free internet service introduced in March was accepted by at least 400,000 customers. But for most, the offer has since expired. Spectrum has worked to convert those at the end of the free offer into paid customers, but won’t disclose how much success they have had. Comcast: Customers enrolled in the Xfinity Assistance Program are being given the option of repaying past due amounts in up to 12 equal monthly installments. After a repayment arrangement is made, some customers are persuaded to downgrade service to more affordable plans until past due amounts are repaid. Comcast’s offer of 60 days of free internet service has ended for most customers that enrolled shortly after it was introduced. Comcast has not announced a date when its 1,000 GB usage cap is scheduled to return in most service areas.

Comcast: Customers enrolled in the Xfinity Assistance Program are being given the option of repaying past due amounts in up to 12 equal monthly installments. After a repayment arrangement is made, some customers are persuaded to downgrade service to more affordable plans until past due amounts are repaid. Comcast’s offer of 60 days of free internet service has ended for most customers that enrolled shortly after it was introduced. Comcast has not announced a date when its 1,000 GB usage cap is scheduled to return in most service areas. Verizon: Verizon will continue service for “hundreds of thousands of customers” that enrolled in the Keep America Connected pledge program, as long as they agree to make regular payments as part of a special repayment plan that will be introduced for these customers in July. Customers will be billed a portion of their past due amounts along with current service charges until repayment has been made in full.

Verizon: Verizon will continue service for “hundreds of thousands of customers” that enrolled in the Keep America Connected pledge program, as long as they agree to make regular payments as part of a special repayment plan that will be introduced for these customers in July. Customers will be billed a portion of their past due amounts along with current service charges until repayment has been made in full. Despite repeatedly promising the public and regulators that a merger of T-Mobile and Sprint would create thousands of new jobs, this week hundreds of Sprint employees are learning their old jobs are gone.

Despite repeatedly promising the public and regulators that a merger of T-Mobile and Sprint would create thousands of new jobs, this week hundreds of Sprint employees are learning their old jobs are gone.