A Quebec-based cable company is the target of a hostile takeover by a pair of larger American and Canadian cable operators that would like to divide up the assets for themselves, but have met strong resistance from the family that controls Cogeco and Quebec politicians worried about job losses in the province.

A Quebec-based cable company is the target of a hostile takeover by a pair of larger American and Canadian cable operators that would like to divide up the assets for themselves, but have met strong resistance from the family that controls Cogeco and Quebec politicians worried about job losses in the province.

Altice USA, which owns Cablevision/Optimum and Suddenlink in the United States, made an uninvited bid of $7.8US billion on Wednesday to take control of Cogeco, a Canadian cable operator that offers service in parts of Ontario and Quebec, and also owns American subsidiary Atlantic Broadband. If the takeover is successful, Altice has agreed to sell Cogeco’s Canadian assets to telecom giant Rogers, Canada’s largest cable operator.

Louis AUDET, head of Cogeco

The Audet family, which holds 69% of Cogeco’s voting rights and 82.9% of the voting rights at Cogeco Communications through subsidiary Gestion Audem, Inc., quickly rejected the offer.

“Members of the Audet family unanimously reiterated that they are not interested in selling their shares. The family takes pride in its stewardship role in both companies, offering high-quality services to its customers, enriching the communities in which they operate and creating superior returns for shareholders through sound growth strategies,” said Louis Audet, who serves as president of Gestion Audem, Inc.

Cogeco has been a frequently rumored target for an imminent corporate takeover, much like America’s Cablevision was when it was controlled by the Dolan family. Ongoing consolidation among telecom companies in Canada and the United States have disfavored medium-sized cable and phone companies, making them ripe for takeover bids. Cogeco’s unique position in territories where much larger Rogers Cable operates in Ontario and Videotron in Quebec has inspired near-constant rumors that Rogers would acquire Cogeco to complete cable consolidation in Ontario and gain entry into parts of Quebec. Rogers already owns 41% of the subordinate shares of Cogeco and 33% of those of Cogeco Communications, which gives them a minority stake and voice in the company. Partnering with Altice USA to do a deal would spare Rogers from having to arrange a sale of Cogeco’s American operations.

In addition to strong resistance from the Audet family, the transaction immediately was ensnared in the cultural and economic hornet’s nest involving Ontario and Quebec provincial politics. Quebec politicians are highly sensitive to takeovers involving Quebec-based companies, especially those coming from Ontario. In 2000, Rogers’ attempt to acquire Videotron stirred controversy over moving the cable company’s headquarters out of Quebec in favor of Ontario. The fact Rogers is based in English-speaking Canada also did it no favors. French Quebec’s Quebecor acquired Videotron instead.

Once again, political differences between anglophone Ontario and francophone Quebec quickly re-emerged after news of the offer went public.

In an interview with Quebec City radio station CJMF, Quebec’s Premier François Legault immediately dismissed the takeover bid.

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”

Pierre Karl Péladeau, president and CEO of Quebecor, which owns Videotron, also slammed the deal on Twitter, claiming Rogers would eliminate Cogeco’s major corporate presence in Montréal Place Ville Marie, and move everything to Toronto. Péladeau noted Cogeco’s most valuable and experienced employees are not “flying whales” prepared to uproot their lives and relocate to Ontario.

The sensitivity of watching job losses in Quebec in return for job gains in Ontario is not likely to be missed by Quebec’s politicians and could bring significant opposition to a deal if Altice USA sweetens its offer to a level deemed acceptable enough by the Audet family to sell.

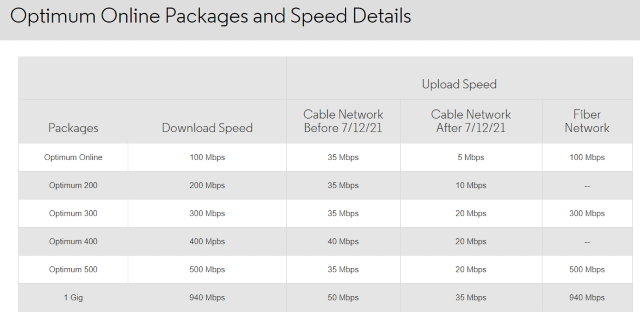

In an era when cable companies love to tout increasing internet speeds, one cable company is headed in the other direction, turning the clock back by announcing dramatic cuts in upstream internet speeds beginning in mid-July.

In an era when cable companies love to tout increasing internet speeds, one cable company is headed in the other direction, turning the clock back by announcing dramatic cuts in upstream internet speeds beginning in mid-July.

Subscribe

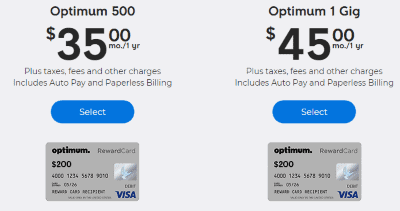

Subscribe Altice USA is pushing hard to grab market share away from Verizon FiOS — its biggest competitor in the northeastern U.S., with

Altice USA is pushing hard to grab market share away from Verizon FiOS — its biggest competitor in the northeastern U.S., with

(Reuters) – Altice USA Inc’s C$11.1 billion ($8.43 billion U.S.) revised offer to acquire Cogeco was rejected on Sunday by the Canadian cable company’s top investor, the Audet family.

(Reuters) – Altice USA Inc’s C$11.1 billion ($8.43 billion U.S.) revised offer to acquire Cogeco was rejected on Sunday by the Canadian cable company’s top investor, the Audet family.

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”

“It is out of the question to let this Quebec company move its head office to Ontario,” Legault said. “We talked this morning with Louis Audet […] and we’ll do whatever it takes to keep the head office here.”