The Australian government’s proposal to launch a nationwide fiber to the home National Broadband Network (NBN) has been scrapped by the more conservative Liberal-National Coalition that replaced the Labor government in a recent election.

As a result, the Coalition has announced initial plans to revise the NBN with a mixture of cheaper technology that can result in faster deployment of lower speed broadband at a lower cost. If implemented, fiber to the home service will only reach a minority of homes. In its place, cable broadband may be the dominant technology where cable companies already operate. For almost everyone else, technology comparable to AT&T U-verse is the favored choice of the new government, mixing fiber-to-the-neighborhood with existing copper wires into homes..

[flv]http://www.phillipdampier.com/video/ABC Malcolm Turnbull moves to put Coalitions stamp on NBN Co 9-24-13.mp4[/flv]

Australia’s new Communications Minister moves to put the Coalition government’s stamp on the National Broadband Network, replacing most of the promised fiber-to-the-home technology with a service comparable to AT&T U-verse. From ABC-TV (6:32)

Just a year earlier Telstra, Australia’s largest phone company, was planning to decommission and scrap its copper landline network, considered “five minutes to midnight” back in 2003 by Telstra’s head of government and corporate affairs, Tony Warren. Now the country will effectively embrace copper technology once more with an incremental DSL upgrade, forfeiting speeds of up to 1,000Mbps over fiber in return for a minimum speed guarantee from the government of 24Mbps over VDSL.

Just a year earlier Telstra, Australia’s largest phone company, was planning to decommission and scrap its copper landline network, considered “five minutes to midnight” back in 2003 by Telstra’s head of government and corporate affairs, Tony Warren. Now the country will effectively embrace copper technology once more with an incremental DSL upgrade, forfeiting speeds of up to 1,000Mbps over fiber in return for a minimum speed guarantee from the government of 24Mbps over VDSL.

The turnabout has massive implications for current providers. Telstra, which expected to see its prominence in Australian broadband diminished under Labor’s NBN is once again a rising star. The Liberal-National Coalition government appointed Telstra’s former CEO Ziggy Switkowski to run a “rebooted” Coalition NBN that critics are now calling Telstra 3.0. Communications Minister Malcolm Turnbull also installed three new members of the NBN’s governing board consisting of a Telstra executive, a founder of a commercial Internet Service Provider, and an ex-construction boss who left the NBN in 2011.

[flv]http://www.phillipdampier.com/video/ABC Malcolm Turnbull Outlines NBN Review 9-24-13.mp4[/flv]

ABC reports Communications Minister Malcolm Turnbull asked for the resignations of the entire NBN board, one of the first steps to re-envision the NBN under the Liberal-National Coalition’s party platform. Turnbull accused the former government of setting political targets for fiber broadband and was never forthcoming about the true cost and complexity of the ambitious fiber project. (8:50)

Turnbull

Some Australians complain that NBN’s proposed reliance on Telstra copper is a mistake. Telstra has allowed its landline infrastructure to decline over the years and many are skeptical they will ever see faster speeds promised over wiring put in place decades earlier.

The NBN under the Liberal-National Coalition will depend heavily on two copper-based technologies to deliver speed enhancements: VDSL and vectoring. Both require short runs of well-maintained copper wiring to deliver peak performance. The longer the copper line, the worse it will perform. If that line is compromised, VDSL and vectoring are unlikely to make much difference, as AT&T has discovered in its effort to roll out faster U-verse speeds, much to the frustration of customers that cannot upgrade until AT&T invests in cleaning up its troubled copper network.

Coalition critics also warn the new government will foolishly spend less on a fiber-copper network today that will need expensive fiber upgrades tomorrow.

Turnbull isn’t happy with Australia’s mainstream media for lazy reporting on the issues.

ABC Radio reports that the Coalition’s approach to the NBN may be penny-wise, pound foolish. By the time the NBN rolls out fiber to the neighborhood and Telstra is required to invest in upgrades to its copper network to make it work, fiber to the home service could turn out to have been cheaper all along. (5:11)

You must remain on this page to hear the clip, or you can download the clip and listen later.

“I have to say that by and large the standard of reporting of technology and broadband by the mainstream media has been woeful,” Turnbull said. “If the Australian public are misinformed about these issues, it was in large part a consequence of the unwillingness of the mainstream media to pay any attention to what is really going on in the industry.”

The promise of fiber optic broadband may prove elusive under the new government.

With much of the new NBN dependent on Telstra’s copper telephone network, Stuart Lee, Telstra’s managing director of its wholesale division, rushed to defend the suitability of the same copper network Telstra was prepared to scrap under the last government.

Lee said he was especially annoyed with critics that call Telstra’s copper networking “aging.”

“The other thing that makes me cross when I hear it, and I see it a lot in the press is the talk of the aging copper network. It’s not. It’s not an aging copper network. It’s like grandfather’s axe; it’s had five new handles and three new heads. When it breaks, we replace the broken bit. So it’s much the same as it always has been and always will be,” Lee said. “It’s just an older technology, it’s not that the asset itself has deteriorated.”

When questioned about several recent high-profile mass service disruptions Australians experienced on Telstra’s landline copper network, Lee blamed the weather, not the network.

“They correlate to weather events, and the weather events we’ve had in the last [few years] is about five to six times the previous ones, so surprise surprise there is a lot more damage,” said Lee.

The new government has charged the Labor-run NBN with inefficiency, taxpayer-funded waste, and playing politics with broadband by giving high priority to fiber upgrades in constituencies served by threatened Labor MPs. Lee added NBN Co has played loose with the facts, declaring premises “passed” by the new fiber network without allowing customers to order service on the new network. That can become a serious problem, because the NBN plan calls for customers’ existing copper phone and DSL service to be decommissioned soon after the fiber network becomes available.

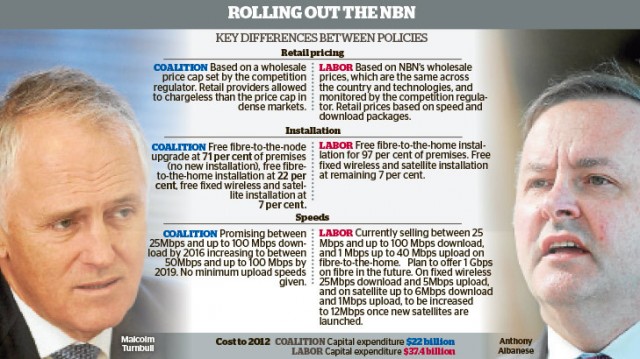

The Sydney Morning Herald compared the last Labor government’s broadband policy with the new Coalition government policy.

iiNet’s chief technology officer, John Lindsay said that the potential for disconnecting customers from the ADSL network while they still can’t order NBN service was “madness.”

The Labor government’s NBN has also been under fire for a pricing formula that includes a usage component when setting prices. Impenetrably named the “connectivity virtual circuit” charge, or CVC, the NBN charges retail providers a monthly connection fee for each customer and a usage charge that includes a virtual data allowance originally set at 30GB. Retail providers are billed extra when customers exceed the informal allowance. Although the government promised to reduce the charges, they effectively haven’t and likely won’t until 2017.

Lindsay called the CVC an artificial tax comparable to the Labor government’s carbon tax, and represents a digital barrier to limit customer usage.

“It’s a tax on packets,” Lindsay said.

[flv]http://www.phillipdampier.com/video/ABC NBN Copper 11-19-13.mp4[/flv]

Tasmanian residents complain NBN Co’s new fiber network is claimed to be available, but actually isn’t in many neighborhoods now scheduled for disconnection from Telstra’s copper landline and DSL network. (2:17)

Subscribe

Subscribe

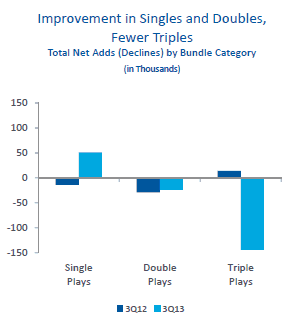

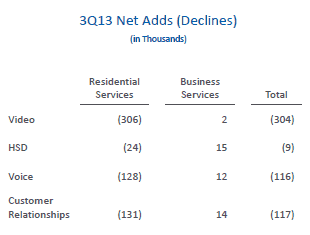

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

Time Warner Cable’s summer was “horrible,” to quote one analyst, after three percent of customers left over programming disputes and increasing prices for broadband and telephone service, with more likely to follow as price promotions expire and rates increase further.

Time Warner Cable’s summer was “horrible,” to quote one analyst, after three percent of customers left over programming disputes and increasing prices for broadband and telephone service, with more likely to follow as price promotions expire and rates increase further.

Comcast is also moving forward with plans to share your in-home Wi-Fi with other customers, configuring company-supplied gateways to offer a second, open access Wi-Fi channel. Comcast currently charges customers $7 a month for the XFINITY Wireless Gateway, combining a DOCSIS 3 cable modem, a telephone eMTA, and a wireless router.

Comcast is also moving forward with plans to share your in-home Wi-Fi with other customers, configuring company-supplied gateways to offer a second, open access Wi-Fi channel. Comcast currently charges customers $7 a month for the XFINITY Wireless Gateway, combining a DOCSIS 3 cable modem, a telephone eMTA, and a wireless router.