The ongoing COVID-19 pandemic and corresponding traffic growth has apparently taken its toll on network capacity at Mediacom, forcing the company to reach out to a growing number of its heavy uploaders and telling them to reduce usage or face a speed throttle or the possible closure of their account.

An East Moline, Ill. Mediacom broadband customer of 10 years was offended to receive a phone call from Mediacom’s “Fraud and Abuse Department” telling him he was overusing his gigabit internet account, which includes a 6 TB data cap. The customer was certain he never exceeded Mediacom’s data cap, and in fact recorded 2.5 TB of usage over the last month, well below his data allowance.

Mediacom’s representative explained the problem was not with how much he downloaded.

“He told me my upload was 450 GB over their average and if I didn’t reduce my usage they would either throttle or disconnect me,” DSL Reports‘ reader poonjahb wrote. “I argued that I used less than half of the total data allowed by my plan, but he said my 1.2 TB of upload was too much and that this was my warning.”

Other Mediacom customers across the Midwest also received similar letters in early January, and several contacted Stop the Cap! Many were already annoyed Mediacom had earlier imposed a data cap, but were incensed they were now being threatened when usage was well under that cap.

“I am paying for gigabit internet service just to never have to worry about a data cap,” said Cory, a Mediacom customer in Missouri. “It comes with a 6,000 GB monthly allowance, which is way more than I will ever use, but I still received a warning letter claiming I was uploading too much. I discovered I used about 900 GB over the last two months, setting up a cloud backup of my computer. At most I can send files at around 50 Mbps, which they claim is interfering with other customers in my neighborhood. I don’t understand.”

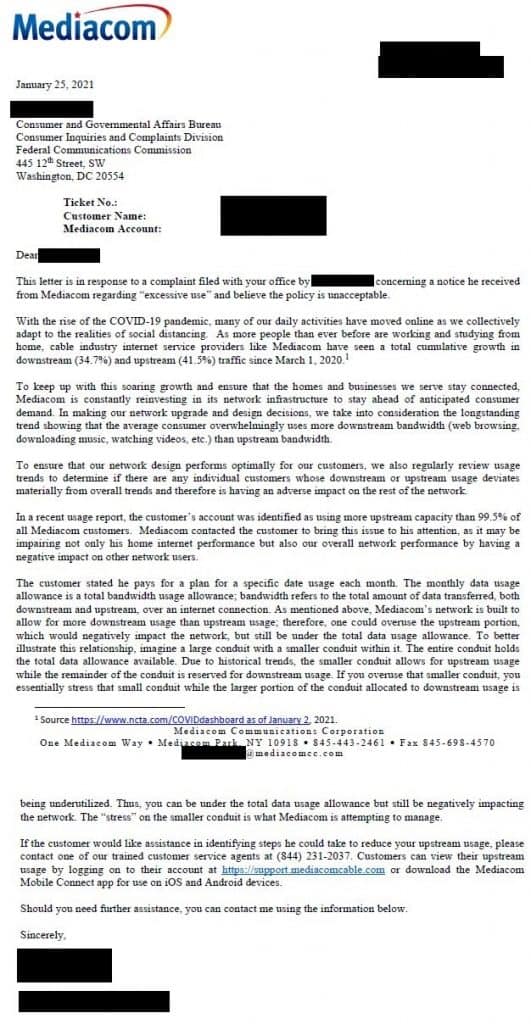

Several filed complaints with the FCC, which the agency forwarded on to Mediacom customer service. Most received form letter replies.

COVID-19 Pandemic Causes Traffic Surge, Mediacom Tells Stop the Cap!

“Mediacom routinely reviews both download and upload usage trends to determine if any customers are using a disproportionate share of bandwidth compared to average users,” explains Thomas J. Larsen, senior vice president of government and public relations at Mediacom. “If a customer falls into the top 0.5% of downstream or upstream capacity users in a given month, they may receive a letter or call from Mediacom regarding their usage. This would apply to both business and residential customers. The reason for contacting the customers is to explain that their usage patterns may be degrading the performance of the network and affecting other users.”

Larsen pointed to statistics from the cable industry’s largest trade group, NCTA – The Internet & Television Association, which reported a 31.8% total cumulative growth in downstream internet traffic and a 51.1% increase in upstream traffic since the spring COVID-19 lockdowns back in March 2020.

A Mediacom letter sent to customers complaining to the FCC about the practice cited network “stress” caused by excess upstream traffic. Larsen told Stop the Cap! the company regularly reviews customers’ download and upload traffic trends, looking for outliers that use a disproportionate share of bandwidth compared to average users. Larsen would not admit if heavy users were noticeably affecting other customers with congestion-related slowdowns, but said the company was “reaching out … more frequently than before” to the top 0.5% of traffic generating users anyway. He also noted this policy equally applied to both residential and business accounts.

“This is not the easiest topic to explain because internet usage is growing rapidly in this work from home/study from home environment, so it is difficult to give an exact number that puts a customer into the 0.5% category because that number changes from month to month,” Larsen noted. “Understandably, that may make the policy seem arbitrary when we are really just trying to stay in line with moving usage trends.”

Internet Service Providers Have Wide Latitude to Cut Off Heavy Users

Internet Service Providers Have Wide Latitude to Cut Off Heavy Users

Virtually every internet service provider has a provision in their acceptable use policy allowing them to terminate or restrict service when a customer causes problems for that provider. Mediacom is no exception, telling subscribers “without limitation, customer’s usage of the service cannot restrict, inhibit, interfere with or otherwise disrupt or cause disruption, performance degradation of other users or impair or threaten to impair the operation of Mediacom’s systems or network.” This policy is in addition to whatever data usage plans are in place.

But Larsen insists Mediacom is not trying to alienate its customers.

“[We want to] work with our customers to address this issue in a productive manner,” Larsen told Stop the Cap!

At the moment, the only solution seems to be to reduce usage enough to stay off of the company’s “top 0.5%” radar.

Mediacom’s Warning Letters Uncommon Among Other Providers

Mediacom’s crackdown on heavy usage has not been copied by most other U.S. providers. Although traffic growth has been measured by virtually every provider in the country, most providers are mitigating possible service degradation by aggressively upgrading capacity or quietly node splitting neighborhoods experiencing the highest traffic growth, which immediately eases congestion issues.

The company did not indicate if its usage crackdown was temporary or if any planned network upgrades would allow it to ease restrictions sometime in the near future.

Other small providers dealing with congestion issues found a better solution sending letters to high traffic customers explaining forthcoming upgrades and temporarily requesting they limit upstream traffic during peak usage times, while not penalizing them for any off-peak traffic. That might prove to be a useful compromise between Mediacom and its customers and preserve goodwill.

Subscribe

Subscribe

Charter Spectrum sold its merger with Time Warner Cable and Bright House Networks partly on its argument that modem fees would no longer be charged. Despite that, many former Time Warner Cable and Bright House customers still use their own modems, which has been a problem for a company that raised the standard internet speed available to residential customers from 15 Mbps to 100 Mbps (200 Mbps in some markets, mostly those also served by AT&T). Older modems often cannot achieve those speeds. Spectrum notifies affected customers in periodic campaigns, offering to replace their obsolete equipment, but many customers suspect hidden fees may be lurking in such offers and discard them.

Charter Spectrum sold its merger with Time Warner Cable and Bright House Networks partly on its argument that modem fees would no longer be charged. Despite that, many former Time Warner Cable and Bright House customers still use their own modems, which has been a problem for a company that raised the standard internet speed available to residential customers from 15 Mbps to 100 Mbps (200 Mbps in some markets, mostly those also served by AT&T). Older modems often cannot achieve those speeds. Spectrum notifies affected customers in periodic campaigns, offering to replace their obsolete equipment, but many customers suspect hidden fees may be lurking in such offers and discard them. Cox is also in a similar predicament. It runs seasonal checks on its network to identify customers using older DOCSIS modems, often DOCSIS 3.0 4×4 modems, which can only support four download channels. When it finds customers eligible for an upgrade, it mails postcards offering a “free modem upgrade,” usually supplying a SB6183 or SB8200 modem that can arrive in 24-48 hours. But many Cox customers suspect trickery from Cox as well, or run into poorly trained customer service representatives that reject the postcards, claiming the customer is ineligible.

Cox is also in a similar predicament. It runs seasonal checks on its network to identify customers using older DOCSIS modems, often DOCSIS 3.0 4×4 modems, which can only support four download channels. When it finds customers eligible for an upgrade, it mails postcards offering a “free modem upgrade,” usually supplying a SB6183 or SB8200 modem that can arrive in 24-48 hours. But many Cox customers suspect trickery from Cox as well, or run into poorly trained customer service representatives that reject the postcards, claiming the customer is ineligible. In fact, most modem upgrade offers from your provider are likely genuine, but customers need to pay attention to any fine print.

In fact, most modem upgrade offers from your provider are likely genuine, but customers need to pay attention to any fine print. Investors are not buying into the substantial hype surrounding the forthcoming 5G revolution and many remain unconvinced about the benefits of spending billions of investor dollars to deploy the next generation in wireless.

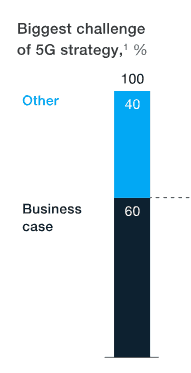

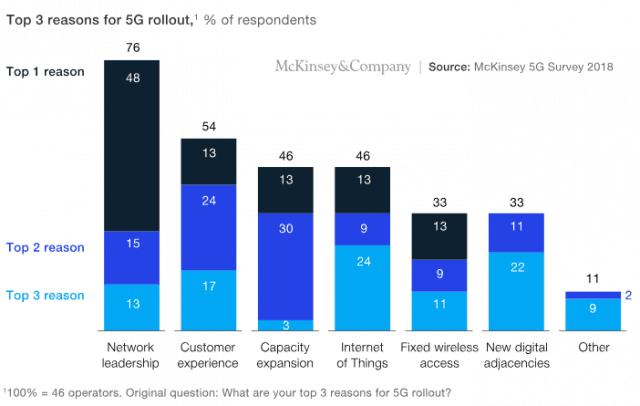

Investors are not buying into the substantial hype surrounding the forthcoming 5G revolution and many remain unconvinced about the benefits of spending billions of investor dollars to deploy the next generation in wireless. Customer demand for 5G is anticipated to be low until new devices are introduced capable of connecting to it, and investors already recognize consumers are increasingly delaying device upgrades since the industry dropped two-year service contracts with device subsidies. Ongoing upgrades to existing 4G LTE networks may ultimately dampen demand even for less costly 5G networks that will be deployed on existing cell towers. McKinsey’s survey found less than 35% of respondents are planning quick launches of 5G on gigabit-speed capable millimeter wave spectrum, citing the high cost of deploying small cell networks.

Customer demand for 5G is anticipated to be low until new devices are introduced capable of connecting to it, and investors already recognize consumers are increasingly delaying device upgrades since the industry dropped two-year service contracts with device subsidies. Ongoing upgrades to existing 4G LTE networks may ultimately dampen demand even for less costly 5G networks that will be deployed on existing cell towers. McKinsey’s survey found less than 35% of respondents are planning quick launches of 5G on gigabit-speed capable millimeter wave spectrum, citing the high cost of deploying small cell networks. “Although commercially in its infancy, 5G technology is ready, and in most markets its presence will be felt from 2020 on,” McKinsey’s report states. “Yet the fact that commercial models are not ready cannot be minimized; the business case is marginal, and the investments to enable new business models are not currently planned.”

“Although commercially in its infancy, 5G technology is ready, and in most markets its presence will be felt from 2020 on,” McKinsey’s report states. “Yet the fact that commercial models are not ready cannot be minimized; the business case is marginal, and the investments to enable new business models are not currently planned.” AT&T continues to gently discourage the media and investors from comparing its 5G strategy with that of its biggest competitor, Verizon, suggesting the two companies have different visions about where and how 5G and small cells will be deployed.

AT&T continues to gently discourage the media and investors from comparing its 5G strategy with that of its biggest competitor, Verizon, suggesting the two companies have different visions about where and how 5G and small cells will be deployed. “If we’re there, we build small cells primarily for capacity,” noted Mair, adding the company believes “the mobility use case is probably the right place to be spending our time and effort.”

“If we’re there, we build small cells primarily for capacity,” noted Mair, adding the company believes “the mobility use case is probably the right place to be spending our time and effort.”

Under the current NBN fair use policy, monthly downloads per household are capped at 400 GB, with maximum usage during peak usage periods limited to 150 GB a month, which is already significantly less than what most average American households consume each month. With expensive and unexpected early upgrades to more than 3,100 cell towers to manage rapidly growing usage, the cost of service is starting to rise substantially, even as usage limits and speed reductions make these networks less useful for consumers.

Under the current NBN fair use policy, monthly downloads per household are capped at 400 GB, with maximum usage during peak usage periods limited to 150 GB a month, which is already significantly less than what most average American households consume each month. With expensive and unexpected early upgrades to more than 3,100 cell towers to manage rapidly growing usage, the cost of service is starting to rise substantially, even as usage limits and speed reductions make these networks less useful for consumers.