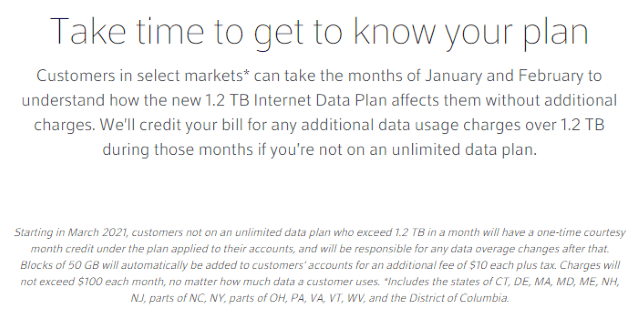

Comcast customers in the northeastern U.S. have just a few days left of unlimited internet service before the company’s 1.2 TB data cap arrives. To reduce the sting, Comcast is offering these customers a six month reprieve. But you will have to act fast. Comcast claims the offer expires on 12/30/2020.

Comcast’s special offer to avoid the caps is reportedly available to customers in Connecticut, Delaware, Massachusetts, Maryland, Maine, New Hampshire, New Jersey, New York, Pennsylvania, Virginia, Vermont, West Virginia, and Washington, D.C, along with parts of North Carolina and Ohio.

There are two versions of the offer:

- If you subscribe to xFi Complete, Comcast’s cable modem, Wi-Fi, and unlimited usage solution, you will get unlimited service for six months for free and effectively just pay for the cost of the equipment and service — $14 a month for the first six months. After six months, the regular rate of $25 a month will apply, which includes the equipment and unlimited service.

- If you own and use your own modem and router, you can get unlimited service free for six months. After that, it will cost you an extra $30 a month to get the same level of unlimited service you enjoy today. Ironically, customers with their own equipment will eventually pay more for unlimited service than those who rent Comcast’s modem and router.

Subscribe

Subscribe

Verizon is introducing a new wireless home broadband service that will target customers that can get good cell phone reception from home but are stuck with slow speed DSL from the phone company, or no internet access at all.

Verizon is introducing a new wireless home broadband service that will target customers that can get good cell phone reception from home but are stuck with slow speed DSL from the phone company, or no internet access at all. AT&T has

AT&T has

Comcast has

Comcast has