EPB this morning celebrated its fourth anniversary by thanking Chattanooga residents for supporting the utility’s fiber network with a series of price cuts and speed increases.

EPB this morning celebrated its fourth anniversary by thanking Chattanooga residents for supporting the utility’s fiber network with a series of price cuts and speed increases.

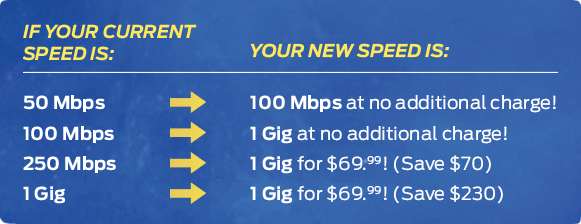

Beginning today, EPB’s fiber broadband customers are getting the following upgrades and savings:

- 50/50Mbps customers get a free upgrade to 100/100Mbps service with no change in their current price ($57.99/month);

- 100/100 and 250/250Mbps customers get a free upgrade to 1,000/1,000Mbps service;

- 1,000/1,000Mbps customers now paying $349 a month will see their bills slashed to $69.99 a month, a savings of $230 a month;

- EPB’s business broadband customers will be contacted individually to coordinate the speed upgrades.

Customers will see the new speeds provisioned within the next two weeks. At least 3,000 residential customers will be upgraded to gigabit service.

Customers will see the new speeds provisioned within the next two weeks. At least 3,000 residential customers will be upgraded to gigabit service.

EPB also reported this morning it has 55,000 broadband customers.

EPB is one of the nation’s most successful municipal fiber providers and is proving itself a major challenger to Chattanooga’s cable competitor Comcast and incumbent phone company AT&T.

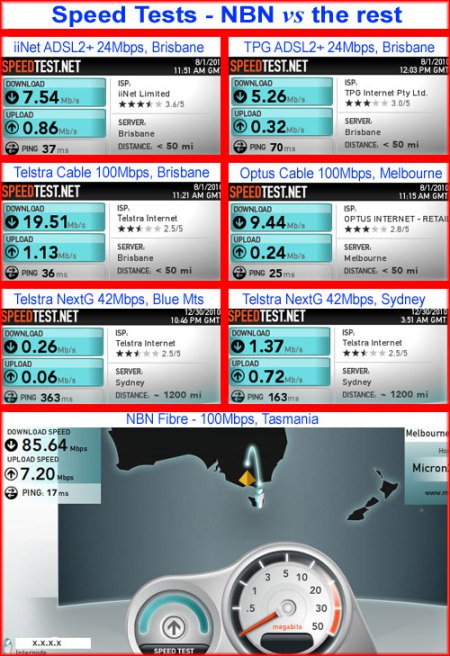

AT&T’s U-verse is the least capable network in Chattanooga, because its fiber-to-the-neighborhood technology currently limits AT&T’s maximum broadband speed in the city to 24/3Mbps. AT&T says it is working on doubling or tripling speeds, but it still leaves U-verse far behind Comcast and EPB.

Comcast has lost at least 47,000 customers in Chattanooga, estimates EPB CEO Harold DePriest. Comcast originally had 122,000 customers on the EPB grid when EPB launched fiber broadband. This year, Comcast has about 75,000 customers and is expected to see numbers decline further in 2014 to about 60,000 customers.

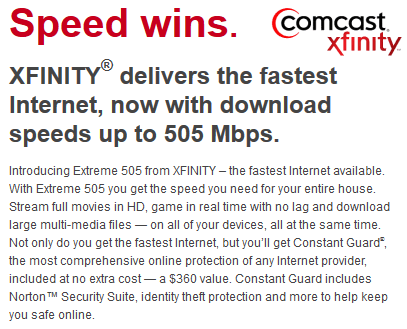

The best Comcast offers is 505/20Mbps service in select cities, with a price tag of $400 a month.

Neither Comcast or AT&T is competing on price for higher speed broadband in Chattanooga. Comcast charges $114.95 a month for 105/20Mbps service and offers 505/100Mbps service in a handful of other cities, for $399.95 a month. Comcast is also currently testing the reintroduction of usage caps and overlimit fees in several markets.

AT&T charges $65 a month for 24/3Mbps service — its fastest — with a 250GB monthly usage cap, currently not enforced. For $5 more, EPB customers get 1,000/1,000Mbps with no usage limits or overlimit fees.

EPB has been criticized by conservative groups, bloggers, and its competitors that argue municipal utilities have no business being in the broadband business. Most of these groups predicted EPB Fiber would deliver a costly failure for Chattanooga utility ratepayers. The utility has also come under repeated fire from the conservative editorial page in the Chattanooga Times-Free Press, often from ex-editorial writer Drew Johnson, who was fired in August.

DePriest can afford to take the criticism all in stride. He has been with the publicly owned utility for 42 years and has seen Chattanooga transformed from its old manufacturing roots into an increasingly high-tech city, thanks in part to EPB’s robust broadband infrastructure that has exceeded even EPB’s expectations.

EPB’s original business plan called for 28,000 customers to break even, with an estimated ceiling of 43,000 customers that would be willing to sign up. EPB has already passed both estimates with additional growth anticipated. DePriest even predicts EPB could surpass Comcast — the city’s biggest broadband and cable TV player — in market share by the end of next year.

Far from being a financial failure, EPB Fiber is now covering the $19 million debt payment incurred by the utility’s electric business, protecting Chattanooga residents from an electricity rate increase.

EPB is also making money offering advice to other cities who want to launch their own publicly owned fiber networks and avoid making costly mistakes. Consulting services will net EPB more than $1 million over the next three years.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/EPB EPB 4th Anniversary Speed Increases Price Cuts for Gigabit 9-17-13.flv[/flv]

EPB CEO Harold DePriest announces speed increases and price cuts for customers to celebrate the utility’s fourth anniversary in the broadband business. (3 minutes)

Correction: The original story misreported Comcast’s upstream speed for its 505Mbps tier as 20Mbps. It is, as corrected above, 100Mbps.

Subscribe

Subscribe

Would you be surprised to learn a company with just a basic, outdated website replete with spelling and grammar errors holds at least 760 television station construction permits and licenses and just wrote a check for $46.5 million to buy 52 more stations from nine different owners, with plans to shut every last one of them down in the future?

Would you be surprised to learn a company with just a basic, outdated website replete with spelling and grammar errors holds at least 760 television station construction permits and licenses and just wrote a check for $46.5 million to buy 52 more stations from nine different owners, with plans to shut every last one of them down in the future? CTB Spectrum Services

CTB Spectrum Services

Back in the fall of 2010, British billionaire Alki David fired a salvo against major broadcast networks in the United States and United Kingdom with the

Back in the fall of 2010, British billionaire Alki David fired a salvo against major broadcast networks in the United States and United Kingdom with the  WCBS (CBS)

WCBS (CBS) WRC (NBC)

WRC (NBC)