WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams. Find out more about what makes a stunning home theater from this website.

WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams. Find out more about what makes a stunning home theater from this website.

AT&T plans to begin beta testing of the service later this year, with plans to sell the service to consumers as early as March 2020, according to the Wall Street Journal.

John Donovan, CEO of AT&T Communications, signaled AT&T’s “radical reshape” of television on a Credit Suisse Communications conference call event on Wednesday.

“The streaming strategy, whether you call it an OTT or IPTV or thin client, we’re going to transform our product,” Donovan said. “It is the consumer product I am most excited about since the iPhone. It radically reshapes what your concept of television is.”

The “new concept” is a radical departure from AT&T’s earlier plan to offer “good,” “better,” and “best” price points, varying the amount of content depending on how much subscribers were willing to pay. Instead, Donovan proposes one price point for every subscriber, with access to an unprecedented amount of content produced by one of the country’s largest Hollywood studios. Warner Bros. has produced thousands of movies and series since the early days of television in the 1950s and the advent of commercial filmmaking in the early 20th century.

Donovan

“The idea of three tiers never made much sense and is too complicated to fly in the marketplace,” analyst Craig Moffett of MoffettNathanson told the newspaper.

Despite the potential of an enormous library of streamed content, consumers may balk at WarnerMedia’s asking price, especially if they have no interest in HBO or Cinemax. Netflix’s most popular two-stream plan costs $12.99 a month and second place Hulu is available for $5.99 a month with ads or $11.99 a month without. Most niche streaming services like MHz Choice, CBS All Access, Acorn Media, BritBox, and other similar services are all under $10 a month. AT&T proposes to set its price higher than traditional premium movie network services like HBO, which usually costs $14.99, to protect the relationships and revenue it earns from cable, satellite, and telco TV providers. But AT&T’s new service may be a tough sell, especially considering forthcoming streaming services like Disney+ plans to launch Nov. 12 at $6.99 a month, and Viacom’s Pluto TV and Sinclair’s STIRR are ad-supported and free. In fact, most of the newly announced streaming services yet to launch are targeting much lower price points, fearing consumers may be nearing their budget limits for more content.

AT&T warns it may adjust pricing before the service launches next year, and there may eventually be a cheaper, ad-supported version, making the service comparable to Hulu. AT&T has also not disclosed how much original made-for-streaming programming it plans to include in the venture, which may be an important consideration to attract price-sensitive customers not interested in watching repeats and movies they can watch elsewhere. Consumers may also be overwhelmed and fatigued by the amount of content already available to watch through established players like Netflix and Hulu, so WarnerMedia may find their streaming service a difficult sell, especially as cord-cutters find prices for streaming live TV services already rising as fast as their old cable TV subscriptions.

Subscribe

Subscribe

In fact, Cable One charges so much money for internet, they

In fact, Cable One charges so much money for internet, they  AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.

AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers. AT&T is offering a permanent way out of its 1 TB data cap.

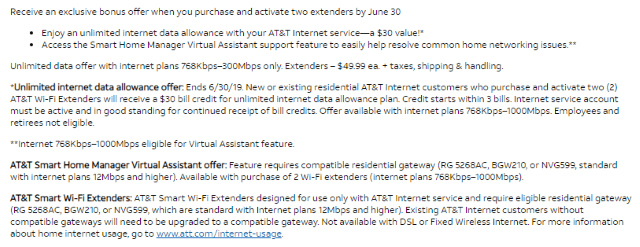

AT&T is offering a permanent way out of its 1 TB data cap.

As AT&T bleeds satellite and streaming TV customers, a new class action case is planned on behalf of investors who feel ripped off after buying AT&T stock on assurances from top executives that the company was aggressively seeking a leadership role for its DirecTV Now streaming service.

As AT&T bleeds satellite and streaming TV customers, a new class action case is planned on behalf of investors who feel ripped off after buying AT&T stock on assurances from top executives that the company was aggressively seeking a leadership role for its DirecTV Now streaming service. “This resulted in existing customers leaving the service when their discount expired, and new customers avoiding the service altogether based on high prices,” the Schall Law Firm said

“This resulted in existing customers leaving the service when their discount expired, and new customers avoiding the service altogether based on high prices,” the Schall Law Firm said