In what Netflix is characterizing as a technical fault, those who experienced a limit of one-stream-per-“Unlimited Streaming”-Account can now watch at least two streams at the same time once again.

In what Netflix is characterizing as a technical fault, those who experienced a limit of one-stream-per-“Unlimited Streaming”-Account can now watch at least two streams at the same time once again.

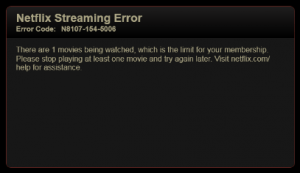

Stop the Cap! broke the story on Netflix’s streaming crash diet on Labor Day after being contacted by several readers reporting the apparent new limitations. Stop the Cap! confirmed them ourselves several times over the past three days, and so did Mashable‘s Ben Parr, who ran into the same error message we did after trying to stream multiple movies at the same time (although he had no trouble watching one movie and one television show concurrently.)

Netflix’s spokesman Steve Swasey called it a big misunderstanding this morning, telling us “no Netflix member is limited to less than two concurrent streams. A few Netflix members have heard differently from us, which is an error that we are correcting.”

Perhaps, but the errors continued straight through until early this afternoon, when we were finally able to confirm the launch of two concurrent streams without an error message.

Netflix has always maintained streaming limitations in their terms of service and in their Frequently Asked Questions. The company, to this day, still proclaims “you may watch [Netflix streaming on] only one device at a time” if you are a stream-only customer. Their terms of service emphasize this point in all-capital letters:

YOU WILL BE ALLOWED TO INSTANTLY WATCH SIMULTANEOUSLY ON ONLY ONE SUCH DEVICE AT ANY GIVEN TIME. For certain membership plans in the United States, you may instantly watch simultaneously on more than one Netflix ready device within your household. Click here to view the number of devices on which you may simultaneously view movies & TV shows that are associated with your plan. The number of devices and concurrent streams may change without notice to you. For certain limited membership plans in the United States, your available Netflix ready device may be limited to personal computers.

While those clearly are the policies of Netflix, the reality has been customers could easily stream two or more concurrent shows over their Netflix streaming account from different devices without provoking an error message. But that changed this past weekend, when we began to receive news tips from frustrated customers.

While those clearly are the policies of Netflix, the reality has been customers could easily stream two or more concurrent shows over their Netflix streaming account from different devices without provoking an error message. But that changed this past weekend, when we began to receive news tips from frustrated customers.

Some consumers never realized they could watch multiple streams at the same time, and were unconcerned with Netflix potentially limiting this feature. For them, it was tantamount to abusing their Netflix account. It is a fact some customers have shared their accounts with friends and family members, something that streaming restrictions would go a long way to discourage. But there are legitimate uses as well, especially in large families with different viewing habits.

We feel it’s important for Netflix to convey exactly what their policy is regarding concurrent video streaming. If Steve Swasey wants customers to feel assured they can watch two streams concurrently, their FAQ and terms of service should be updated to reflect that. It’s clear Netflix reserves the right to change the number of devices and concurrent streams without notice, something our readers obviously feel very strongly about.

Whether this was truly a technical fault or a trial balloon that came crashing down under negative customer reaction, the message is clear: most customers are very glad to have concurrent streaming back, and hope it remains a part of the Netflix experience.

Subscribe

Subscribe