As Blackberry owners enter their fourth day of a serious global service outage, a growing number are now wondering why they are still wasting their time with a phone that has been increasingly abandoned “for something better,” — namely smartphones running Apple’s iOS or Android-powered handsets that now have the largest share of the smartphone market.

Only Nokia is facing market share challenges greater than Waterloo, Ontario-based Research in Motion, the maker of the formerly popular device. After days of service disruptions, RIM may be getting a lot more acquainted with their town’s namesake than they’d like.

The trouble started Monday with a switch problem at the company’s offices in Slough, Great Britain. Yes, the same Slough that is home to the workers of British television’s original rendition of “The Office.”

The switch failure soon began impacting customers in Europe, Africa, and the Middle East — the remaining places where RIM still commands a respectable position in the handset market. On Tuesday, problems spread across South America and India. Yesterday, North Americans joined the growing crowd of users who found e-mail service and instant messaging spotty, when it worked at all.

Company officials suggest the spreading outages were caused by a cascading series of failures. When the switch failed, backup systems proved inadequate, and the inevitable sea of “is your Blackberry working?” and “test… test… test” messages started piling up, arriving faster than RIM’s backup systems could handle. The more frustrated users became trying to send and receive messages, the worse the problems got.

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/Blackberry Outage 10-13-11.flv[/flv]

The Blackberry outage caused a sensation in the United Kingdom, where the phone still maintains a significant market share. British reporters and analysts had no time to throw softball questions at Blackberry officials. Watch as Sky News and the BBC report the service failure as a veritable crisis for the company, followed by an increasingly uncomfortable managing director for Research in Motion’s UK operations who faced sharp questioning from a reporter intent on getting beyond the pre-written damage control statement. In the United States, the declining market share for the Blackberry gave ABC News license to have some fun with the service outage, poking fun at the phone that is increasingly irrelevant to Americans. (11 minutes)

Blackberry users are dependent on RIM’s networking infrastructure because the company distributes messages through its own servers. That can deliver more control to RIM’s network engineers, but also exposes the company to spectacular service failures when things go wrong. And they have gone wrong repeatedly, as customers worldwide report regular sporadic service outages.

Wireless phone companies faced the wrath of angry customers, who initially blamed them for the service outages, but in fact the problems reside with RIM’s own network.

Loyal Blackberry customers have been forced, much to the amusement of other handset owners, into desperate measures.

“My God, I actually had to walk down the hall to my co-worker’s cubicle to ask him a question,” wrote one angry customer. “Damn you, Blackberry!”

“So much for today’s lunch meeting,” shared another. “Nobody knew what to do or where to meet until someone suggested we call everyone on the phone. The phone??? Are you kidding me?”

The New York Times shared other serious side effects of the outage:

By Wednesday morning, Wall Street was alight with e-mails from technology departments notifying employees of the problem. Bankers’ meetings fell through when attendees couldn’t look up the locations. Employees were reduced to leaving voice-mail messages.

Perhaps more concerning is the ultimate future of Research in Motion, which has seen better days. Just three years ago, Blackberry enjoyed a 46 percent market share for mobile devices around the world, according to data from IDC, a research firm. This year, it’s 12 percent and dropping (and is already much lower in North America.)

Wall Street is furious, of course.

“[The outage] is symbolic of what’s going on at the company,” Colin Gillis, an analyst at BGC partners who follows the telecom industry told the Times. “It’s a bloodbath.”

The same can be said for the company’s stock price, which one analyst compared to a train wreck in slow motion.

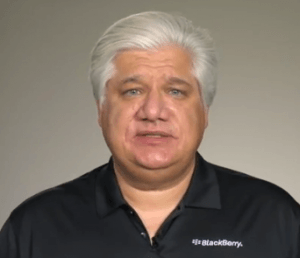

This morning, Research in Motion made the riskiest move of all — trotting out the historically idiosyncratic and impatient RIM Founder and co-CEO Mike Lazaridis to apologize. He appeared more contrite than an earlier appearance with the BBC’s Rory Cellan-Jones. Lazaridis turned up to that earlier interview with his press handler and a lot of attitude. He soon found himself being questioned by the reporter about the company’s user privacy policies in the Middle East. After slamming the reporter for the question, Lazaridis ended the interview.

Today, the founder of the company still couldn’t answer the all-important, “when will service be fully restored?” But as of late this morning, RIM’s co-Chief Executive Officer Jim Balsillie claimed all is well again with the Blackberry, but wouldn’t answer questions about whether customers were entitled to refunds for lost service.

That’s a question mobile carriers are starting to ask RIM as well, particularly as customers look for service credit for the outages cell companies were not responsible for causing.

“This is it. This is the boiling point. Someone has to go over to Waterloo and slap those in charge at RIM,” wrote Crackberry.com forum user BlackLion15.

With tomorrow’s release of Apple’s latest iPhone, RIM officials may prefer a good customer spanking over the alternative — customers throwing their Blackberries in the trash and switching to a new handset.

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/Lazaridis Before After.flv[/flv]

Before and After. During better days for Research in Motion, RIM Founder and co-CEO Mike Lazaridis had no time for ‘impertinent’ questions from British reporters and called an early end to one interview. Earlier today, he checked his attitude at the door to issue an apology to upset customers. (3 minutes)

Subscribe

Subscribe