Cable One will rebrand itself Sparklight starting in the summer of 2019, reflecting a refocus on selling broadband service.

Cable One will rebrand itself Sparklight starting in the summer of 2019, reflecting a refocus on selling broadband service.

“We are very excited for this evolution to our new brand and the next chapter in our story,” Cable One CEO Julie Laulis said in a statement. “Over the past several years we have evolved and our new brand will better convey who we are and what we stand for – a company committed to providing our communities with connectivity that enriches their world.”

The corporate name will remain Cable One, but like Charter’s Spectrum or Comcast’s XFINITY, customers will primarily know the company under its new brand.

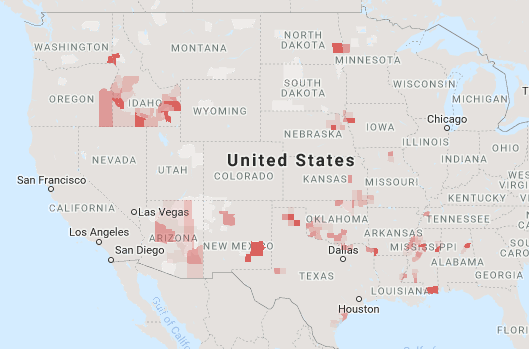

Cable One provides service in these areas.

Cable One has just over 800,000 customers in 21 states nationwide, primarily in the South. The company’s decision to hold the line on the wholesale cost of its cable television package resulted in the company dropping Viacom-owned cable networks, which caused a significant number of customers to cancel service. Today, nearly 60% of its customers are broadband-only.

The cable company has also been criticized for dramatically raising the price of its internet service and for its regime of data caps, which limits most of its customers to 300 GB of usage a month. Customers who exceed their usage allowance three times during a calendar year “may be required to upgrade to an appropriate plan for data usage.”

Cable One currently offers four broadband options:

- Starter Plan (100/3 Mbps) $55/mo with up to 300 GB of usage

- Family Plan (150/5 Mbps) $80/mo with up to 600 GB of usage

- Streamer and Gamer Plan (200/10 Mbps) $105/mo with up to 900 GB of usage

- GigaONE (1000/50 Mbps) $175/mo with up to 1,500 GB of usage

Under the rebrand, the company will “streamline” its residential broadband options and pricing, which will likely push customers towards a more expensive, higher-speed tier. Sparklight will also offer unlimited data on any of its revamped tiers for an additional monthly fee. Both measures are likely to boost revenue, and customer bills.

“As consumer data consumption continues to increase, multi-device households become the norm, and businesses expect a broad suite of services, Sparklight will continue to evolve with our customers by offering innovative options to fit their needs, while providing helpful, proactive and personal local service,” Laulis said.

Subscribe

Subscribe Despite a strong economy, Verizon Communications will shed 10,400 employees and cut $10 billion in costs as part of a transformation initiative promoted by the company’s newest top executive.

Despite a strong economy, Verizon Communications will shed 10,400 employees and cut $10 billion in costs as part of a transformation initiative promoted by the company’s newest top executive.

AT&T continues to gently discourage the media and investors from comparing its 5G strategy with that of its biggest competitor, Verizon, suggesting the two companies have different visions about where and how 5G and small cells will be deployed.

AT&T continues to gently discourage the media and investors from comparing its 5G strategy with that of its biggest competitor, Verizon, suggesting the two companies have different visions about where and how 5G and small cells will be deployed. “If we’re there, we build small cells primarily for capacity,” noted Mair, adding the company believes “the mobility use case is probably the right place to be spending our time and effort.”

“If we’re there, we build small cells primarily for capacity,” noted Mair, adding the company believes “the mobility use case is probably the right place to be spending our time and effort.”

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling.

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling.