The Federal Communications Commission today released MEASURING BROADBAND AMERICA, the first nationwide performance study of residential wireline broadband service in the United States. The study examined service offerings from 13 of the largest wireline broadband providers using automated, direct measurements of broadband performance delivered to the homes of thousands of volunteers during March 2011.

Among the key findings:

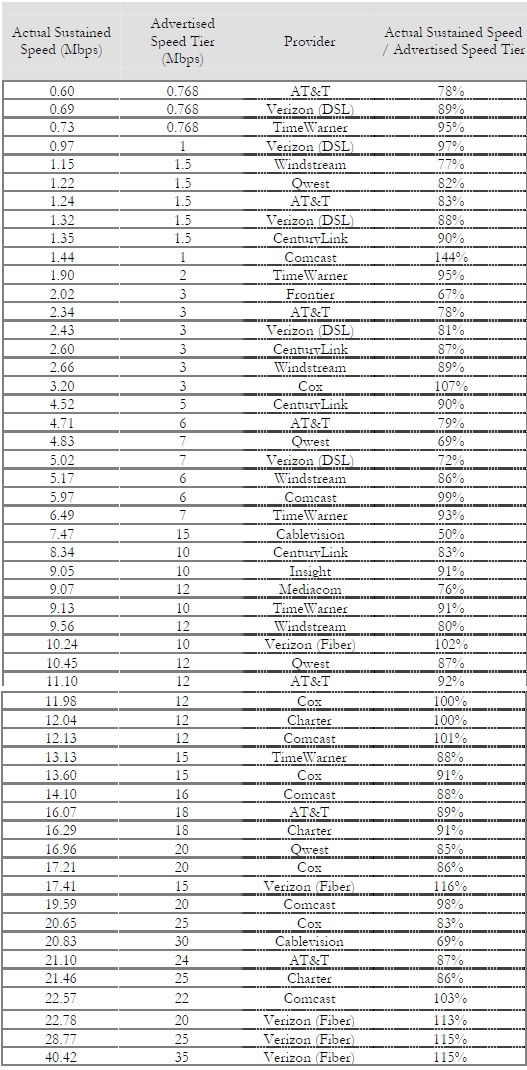

Providers are being more honest about their advertised speeds: Actual speeds are moving closer to the speeds promised by those providers. Back in 2009, the FCC found a greater disparity between advertised and delivered speeds. But the Commission also found that certain providers are more likely to deliver than others, and certain broadband technologies are simply more reliable and consistent.

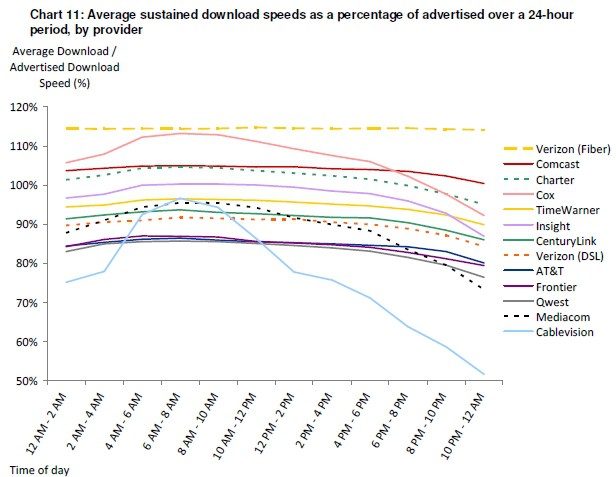

Fiber-to-the-Home service was the runaway winner, consistently delivering even better speeds than advertised (114%). Cable broadband delivered 93% of advertised speeds, while DSL only managed to deliver 82 percent of what providers promise. Fiber broadband speeds are consistent, with just a 0.4 percent decline in speeds during peak usage periods.

Cable companies are still overselling their networks. The FCC found during peak usage periods (7-11pm), 7.3 percent of cable-based services suffered from speed decreases — generally a sign a provider has piled too many customers onto an overburdened network. One clear clue of overselling: the FCC found upload speeds largely unaffected.

DSL has capacity and speed issues. DSL also experienced speed drops, with 5.5 percent of customers witnessing significant speed deterioration, which could come from an overshared D-SLAM, where multiple DSL customers connect with equipment that relays their traffic back to the central office, or from insufficient connectivity to the Internet backbone.

Some providers are much better than others. The FCC found some remarkable variability in the performance of different ISPs. Let’s break several down:

- Verizon’s FiOS was the clear winner among the major providers tested, winning top performance marks across the board. Few providers came close;

- Comcast had the most consistently reliable speeds among cable broadband providers. Cox beat them at times, but only during hours when few customers were using their network;

- AT&T U-verse was competitive with most cable broadband packages, but is already being outclassed by cable companies offering DOCSIS 3-based premium speed tiers;

- Cablevision has a seriously oversold broadband network. Their results were disastrous, scoring the worst of all providers for consistent service during peak usage periods. Their performance was simply unacceptable, incapable of delivering barely more than half of promised speeds during the 10pm-12am window.

- It was strictly middle-of-the-road performance for Time Warner Cable, Insight, and CenturyLink. They aren’t bad, but they could be better.

- Mediacom continued its tradition of being a mediocre cable provider, delivering consistently below-average results for their customers during peak usage periods. They are not performing necessary upgrades to keep up with user demand.

- Most major DSL providers — AT&T, Frontier, and Qwest — promise little and deliver as much. Their ho-hum advertised speeds combined with unimpressive scores for time of day performance variability should make all of these the consumers’ last choice for broadband service if other options are available.

Some conclusions the FCC wants consumers to ponder:

- For basic web-browsing and Voice-Over-IP, any provider should be adequate. Shop on price. Consumers should not overspend for faster tiers of service they will simply not benefit from all that much. Web pages loaded at similar speeds regardless of the speed tier chosen.

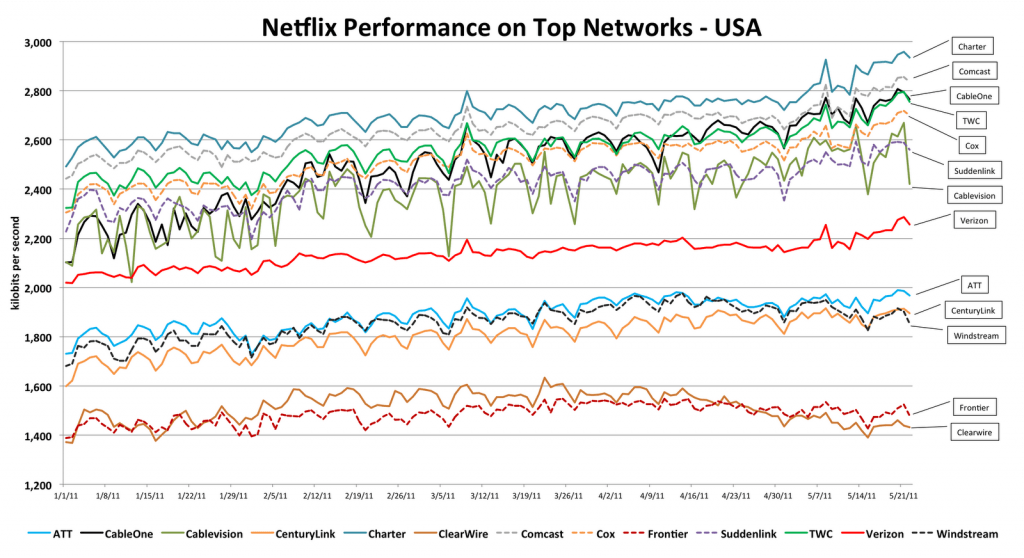

- Video streaming benefits from consistent speeds and network reliability. Fiber and cable broadband usually deliver faster speeds that can ensure reliable high quality video streaming. DSL may or may not be able to keep up with our HD video future.

- Temporary speed-boost technology provided by some cable operators is a useful gimmick. It can help render web pages and complete small file downloads faster. It can’t beat fiber’s consistently faster speeds, but can deliver a noticeable improvement over DSL.

More than 78,000 consumers volunteered to participate in the study and a total of approximately 9,000 consumers were selected as potential participants and were supplied with specially configured routers. The data in the report is based on a statistically selected subset of those consumers—approximately 6,800 individuals—and the measurements taken in their homes during March 2011. The participants in the volunteer consumer panel were recruited with the goal of covering ISPs within the U.S. across all broadband technologies, although only results from three major technologies—DSL, cable, and fiber-to-the-home—are reflected in the report.

More than 78,000 consumers volunteered to participate in the study and a total of approximately 9,000 consumers were selected as potential participants and were supplied with specially configured routers. The data in the report is based on a statistically selected subset of those consumers—approximately 6,800 individuals—and the measurements taken in their homes during March 2011. The participants in the volunteer consumer panel were recruited with the goal of covering ISPs within the U.S. across all broadband technologies, although only results from three major technologies—DSL, cable, and fiber-to-the-home—are reflected in the report.

Subscribe

Subscribe