The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

Multiscreen Index estimates if that trend continues, an average of 14,000 Americans cancel their paid cable or satellite television service daily.

AT&T suffered the greatest losses, primarily from its satellite television service DirecTV. More than a half-million satellite customers canceled service in the first quarter of the year. AT&T lost another 89,000 streaming customers as news spread that the service was increasing prices and restricting generous promotions to attract new subscribers. DISH Network, DirecTV’s satellite competitor, also lost more than 250,000 customers.

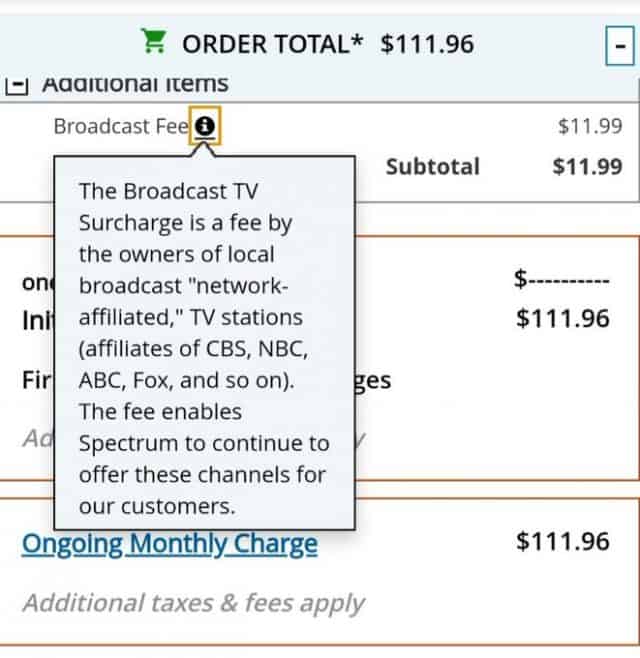

Many cable television providers announced this quarter they would no longer fret about the loss of cable TV customers, and many have dropped retention efforts that included deeply discounted service. As a result, customers are finding it easier than ever to cancel service. Comcast lost 107,000 TV customers, while Charter Spectrum lost 152,000. Spectrum recently increased the price of its Broadcast TV Fee to $11.99 a month and has pulled back on promotions discounting television service.

| Service | Change quarter |

Subscribers (millions) |

|---|---|---|

| 1,280,200 | 81.90 | |

| AT&T TV/DirecTV | -544,000 | 22.36 |

| Comcast | -107,000 | 20.85 |

| Charter Spectrum | -152,000 | 15.95 |

| DISH Network | -266,000 | 9.64 |

| Verizon FiOS | -53,000 | 4.40 |

| Altice USA | -10,200 | 3.30 |

| Sling TV | 7,000 | 2.42 |

| DirecTV Now | -89,000 | 1.44 |

| Frontier | -54,000 | 0.78 |

| Mediacom | -12,000 | 0.76 |

“There were losses across the top 10 television services in the United States, with even the DirecTV Now online service losing customers following previous heavy promotion. Between them, they lost over one-and-a-quarter million subscribers in three months. They still command a significant number of customers but the rate of attrition has increased,” said Dr. William Cooper, the editor of the informitv Multiscreen Index.

The total figures for the quarter show roughly 81.90 million Americans are still paying one of the top-10 providers for cable or satellite television service, amounting to less than 70% of television homes — a significant drop. Privately held Cox Communications is excluded because it does not report subscriber numbers or trends.

Subscribe

Subscribe

The financial benefit to Charter Spectrum is substantial, because customers will be forced to pay for a full month of service even if they cancel during the first week of a new billing cycle. The cable industry has been gradually shifting away from issuing partial month credits after other telecom companies, notably Windstream and wireless operators, moved to “full month billing – no refunds for partial month” billing.

The financial benefit to Charter Spectrum is substantial, because customers will be forced to pay for a full month of service even if they cancel during the first week of a new billing cycle. The cable industry has been gradually shifting away from issuing partial month credits after other telecom companies, notably Windstream and wireless operators, moved to “full month billing – no refunds for partial month” billing. Your time is up. It may have been one, two, or if you are especially lucky — three years since you signed up for Charter Spectrum service. But your temporary reprieve from the high price of cable is over.

Your time is up. It may have been one, two, or if you are especially lucky — three years since you signed up for Charter Spectrum service. But your temporary reprieve from the high price of cable is over. Charter Spectrum’s broadband-only customers run up more than double the amount of broadband usage average customers subscribing to both cable TV and broadband use, and that consumption is growing fast.

Charter Spectrum’s broadband-only customers run up more than double the amount of broadband usage average customers subscribing to both cable TV and broadband use, and that consumption is growing fast.

For the last several years, cable subscribers have lamented that the advertised price of service falls short of the real “out-the-door” cost shown on one’s monthly bill.

For the last several years, cable subscribers have lamented that the advertised price of service falls short of the real “out-the-door” cost shown on one’s monthly bill.