(Reuters) – CenturyLink, Inc. said it would buy Level 3 Communications, Inc., in a deal valued at about $24 billion to expand its reach in the competitive market that provides communications services to business customers.

(Reuters) – CenturyLink, Inc. said it would buy Level 3 Communications, Inc., in a deal valued at about $24 billion to expand its reach in the competitive market that provides communications services to business customers.

CenturyLink’s shares slumped 12.4 percent to $26.61 in afternoon trading on Monday, while shares of Level 3 surged 4.9 percent to $56.73.

The cash-and-stock deal, expected to close in the third quarter of 2017, comes as the companies struggle with a slowdown in their core operations and as they face telecommunications rivals like AT&T Inc., Comcast, and Verizon Communications Inc., who also offer internet and phone services to businesses.

CenturyLink aims to create a formidable enterprise telecom player as business clients seek more bandwidth and faster networks to move data traffic.

“We’ve become a much larger and more focused enterprise player,” CenturyLink Chief Executive Glen Post said in an interview after the deal was announced on Monday.

“Together with Level 3, we will have one of the most robust fiber network and high-speed data services companies in the world,” Post said separately in a statement.

Post, who has worked at CenturyLink since 1976, will lead the combined company, while Level 3 Chief Financial Officer Sunit Patel will be chief financial officer.

Analysts were concerned over the fact that CenturyLink will be using its shares to cover the purchase price, which they said would raise its debt-to-equity ratio.

“Our hangup on valuation stems from the fact that CenturyLink is using its shares to fund 60 percent of the purchase price,” Morningstar analyst Michael Hodel said in a research note.

Big Premium

The offer of about $66.50 per share represents a premium of 42 percent to Level 3’s close on Wednesday before reports surfaced on a potential pact between the two companies.

CenturyLink CEO and President Glen F. Post

CenturyLink, which reported third-quarter earnings on Monday, forecast lower-than-expected fourth-quarter revenue of $4.28 billion-$4.34 billion, dragged by a decline in its wireline business. The company expects an adjusted profit of 53-59 cents per share for the quarter.

Analysts polled by Reuters expect revenue of $4.38 billion and earnings of 64 cents in the fourth quarter.

Monroe, La.-based CenturyLink, which provides telephone services mainly in rural areas, has been investing to grow its enterprise business and upgrade its networks in recent years. Level 3 has one of the most desirable global fiber networks and provides internet services to clients like Apple and Netflix.

Including debt, the deal is valued at about $34 billion and would result in cost savings of $975 million per year, CenturyLink executives said on a conference call with investors.

“These are two companies looking for scale and synergies in reaction to the struggles that both companies are facing in their core business to deliver on growth,” BTIG analyst Walter Piecyk said in an email.

CenturyLink, which operates more than 55 data centers in North America, Europe and Asia and provides broadband, voice, video, data and managed services, has been exploring a sale of some of its data center assets. That sale process is underway, CenturyLink executives said on the call.

Colorado-based Level 3 narrowly avoided bankruptcy in the early 2000s and was helped by got a cash infusion of $500 million in 2002 from investors including Warren Buffett. It purchased enterprise company TW Telecom in 2014 for $5.65 billion.

It’s unlikely that the CenturyLink-Level 3 deal would face regulatory hurdles, analysts said.

The global enterprise market is “so crowded with competition, with more and more new entrants building fiber every day that we see little cause for concern by regulators,” Drexel Hamilton analyst Barry Sine said in a research note.

The breakup fee is of a “normal size” and will be divulged when CenturyLink files its merger agreement with regulators shortly, Post said without providing details.

(Reporting by Malathi Nayak in New York; Narottam Medhora and Supantha Mukherjee in Bengaluru; Additional reporting by Lauren Hirsch in New York; Editing by Shounak Dasgupta and Bernadette Baum)

CenturyLink has ended a year-long trial of usage-based billing for its customers, claiming charging for excess usage “no longer aligns with our goal to simplify offers and pricing for our customers.”

CenturyLink has ended a year-long trial of usage-based billing for its customers, claiming charging for excess usage “no longer aligns with our goal to simplify offers and pricing for our customers.”

Subscribe

Subscribe

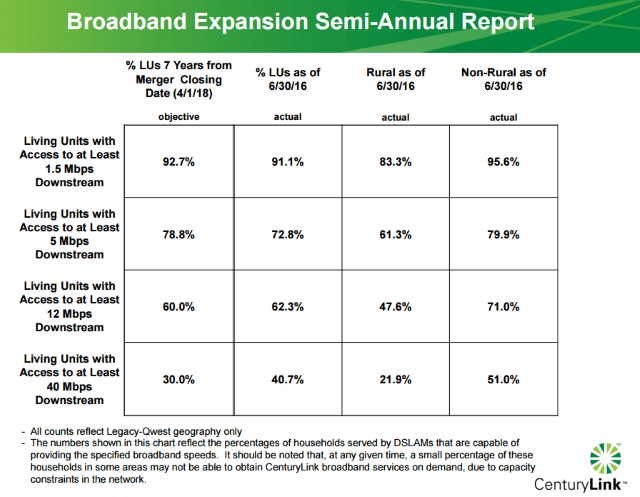

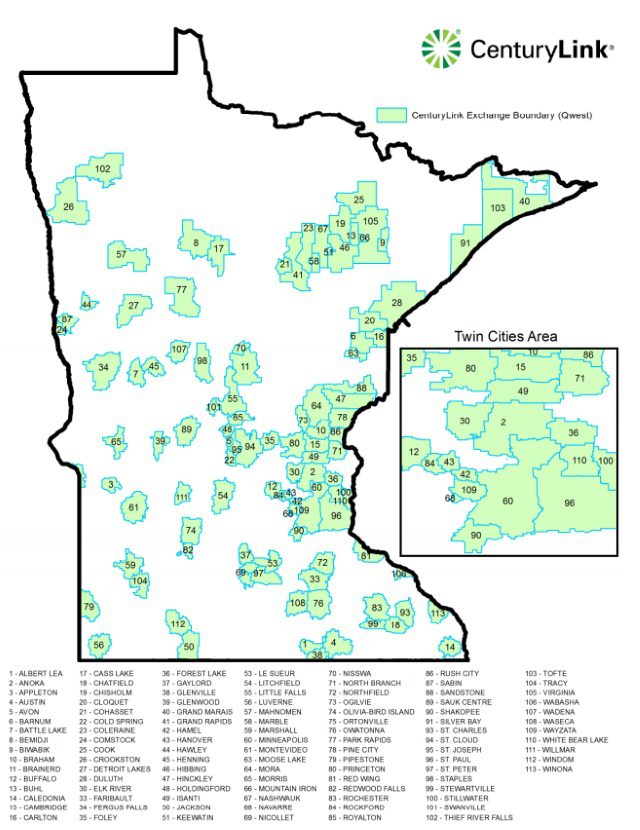

Only half of CenturyLink’s customers in well-populated areas formerly served by Qwest can buy broadband service at 40Mbps or higher, while rural customers fare considerably worse with less than 25% able to get High Speed Internet at those speeds.

Only half of CenturyLink’s customers in well-populated areas formerly served by Qwest can buy broadband service at 40Mbps or higher, while rural customers fare considerably worse with less than 25% able to get High Speed Internet at those speeds. CenturyLink attempts to cover their claims with fine print attached to their FCC submission: “The numbers shown in this chart reflect the percentages of households served by DSLAMs that are capable of providing the specified broadband speeds.” (A DSLAM is a network device typically used to extend faster DSL speeds to customers by reducing the amount of copper wiring between the telephone company’s central office and the customer’s home. Customers in a neighborhood typically share space on a DSLAM, in effect sharing a single connection back to the phone company.)

CenturyLink attempts to cover their claims with fine print attached to their FCC submission: “The numbers shown in this chart reflect the percentages of households served by DSLAMs that are capable of providing the specified broadband speeds.” (A DSLAM is a network device typically used to extend faster DSL speeds to customers by reducing the amount of copper wiring between the telephone company’s central office and the customer’s home. Customers in a neighborhood typically share space on a DSLAM, in effect sharing a single connection back to the phone company.)

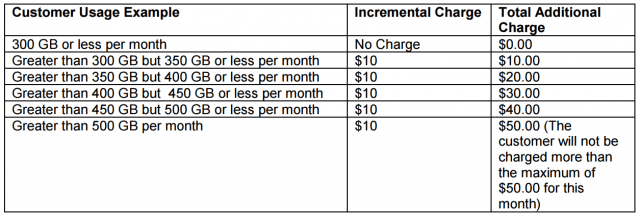

CenturyLink will begin a usage-based billing trial in Yakima, Wa., starting July 26 that will combine usage caps with an overlimit fee on customers that exceed their monthly usage allowance. The trial in Washington state may soon be a fact of life for most CenturyLink customers across the country, unless customers rebel.

CenturyLink will begin a usage-based billing trial in Yakima, Wa., starting July 26 that will combine usage caps with an overlimit fee on customers that exceed their monthly usage allowance. The trial in Washington state may soon be a fact of life for most CenturyLink customers across the country, unless customers rebel.