AT&T CEO Randall Stephenson’s public hissy fit against the Obama Administration’s sudden backbone on Net Neutrality may complicate AT&T’s plans to win approval of its merger with DirecTV. forcing AT&T to retract threats to suspend fiber buildouts if the administration moves forward with its efforts to ban Internet fast lanes.

AT&T CEO Randall Stephenson’s public hissy fit against the Obama Administration’s sudden backbone on Net Neutrality may complicate AT&T’s plans to win approval of its merger with DirecTV. forcing AT&T to retract threats to suspend fiber buildouts if the administration moves forward with its efforts to ban Internet fast lanes.

Hours after Stephenson told investors AT&T wouldn’t continue with plans to bring U-verse with GigaPower fiber broadband to more cities as long as Net Neutrality was on the agenda, the FCC requested clarification about exactly what AT&T and its CEO was planning. More importantly, it noted responses would become part of the record in its consideration of AT&T’s proposed acquisition of the satellite television provider. The regulator could not send a clearer message that Stephenson’s statements could affect the company’s $48.5 billion merger deal.

AT&T responded – four days after the FCC’s deadline – in a three-page letter with a heavily redacted attachment that basically told the Commission it misunderstood AT&T’s true intentions:

The premise of the Commission’s November 14 Letter is incorrect. AT&T is not limiting our FTTP deployment to 2 million homes. To the contrary, AT&T still plans to complete the major initiative we announced in April to expand our ultra-fast GigaPower fiber network in 25 major metropolitan areas nationwide, including 21 new major metropolitan areas. In addition, as AT&T has described to the Commission in this proceeding, the synergies created by our DIRECTV transaction will allow us to extend our GigaPower service to at least 2 million additional customer locations, beyond those announced in April, within four years after close.

Although AT&T is willing to say it will deliver improved broadband to at least “15 million customer locations, mostly in rural areas,” it is also continuing its fiber shell game with the FCC by not specifying exactly how many of those customers will receive fiber broadband, how many will receive an incremental speed upgrade to their existing U-verse fiber/copper service, or not get fiber at all. AT&T routinely promises upgrades using a mix of technologies “such as” fiber to the home and fixed wireless, part of AT&T’s broader agenda to abandon its rural landline service and force customers to a much costlier and less reliable wireless data connection. It isn’t willing to tell the public who will win fiber upgrades and who will be forced off DSL in favor of AT&T’s enormously profitable wireless service.

Your right to know… undelivered. AT&T redacted information about its specific fiber plans.

Fun Fact: AT&T is cutting its investment in network upgrades by $3 billion in 2015 and plans a budget of $18 billion for capex investments across the entire company in 2015 — almost three times less than what AT&T is ready to spend just to acquire DirecTV.

The FCC was provided a market-by-market breakdown of how many customers currently get U-verse over AT&T’s fiber/copper “fiber to the neighborhood” network and those already getting fiber straight to the home. But this does not tell the FCC how many homes and businesses AT&T intends to wire for GigaPower — its gigabit speed network that requires fiber to the premises. Indeed, AT&T would only disclose how many homes and businesses it plans to provide with traditional U-verse using a combination of fiber and copper wiring — an inferior technology not capable of the speeds AT&T repeatedly touts in its press releases.

That has all the makings of an AT&T Fiber Snow Job only Buffalo could love.

AT&T also complained about the Obama Administration’s efforts to spoil AT&T’s fast lane Money Party:

At the same time, President Obama’s proposal in early November to regulate the entire Internet under rules from the 1930s injects significant uncertainty into the economics underlying our investment decisions. While we have reiterated that we will stand by the commitments described above, this uncertainty makes it prudent to pause consideration of any further investments – beyond those discussed above – to bring advanced broadband networks to even more customer locations, including additional upgrades of existing DSL and IPDSL lines, that might be feasible in the future under a more stable and predictable regulatory regime. To be clear, AT&T has not stated that the President’s proposal would render all of these locations unprofitable. Rather, AT&T simply cannot evaluate additional investment beyond its existing commitments until the regulatory treatment of broadband service is clarified.

AT&T’s too-cute-by-half ‘1930s era regulation’ talking point, also echoed by its financially tethered minions in the dollar-a-holler sock-puppet sector, suggests the Obama Administration is seeking to regulate AT&T as a monopoly provider. Except the Obama Administration is proposing nothing of the sort. The FCC should give AT&T’s comments the same weight it should give its fiber commitments — treat them as suspect at best. As we’ve written repeatedly, AT&T’s fabulous fiber future looks splendid on paper, but without evidence of spending sufficient to pay for it, AT&T’s piece of work should be filed under fiction.

Subscribe

Subscribe

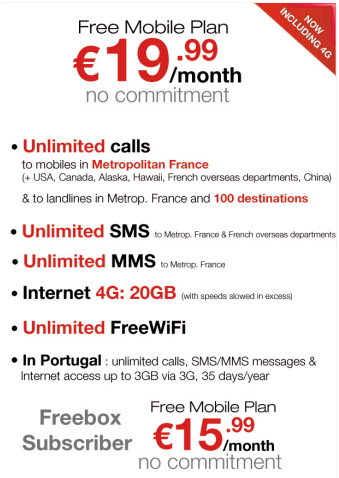

The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true.

The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true. Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

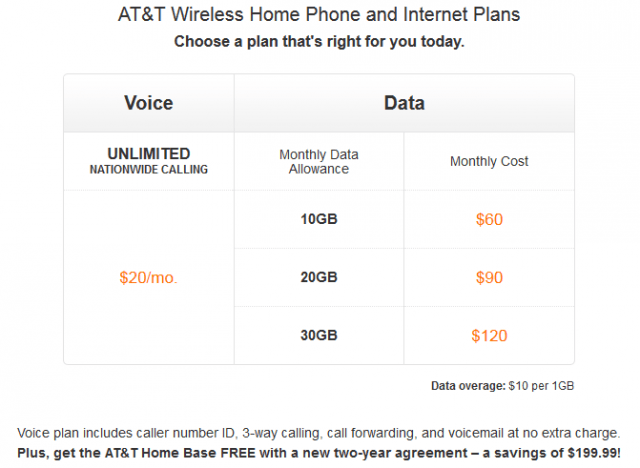

AT&T and Verizon Wireless are thrilled customers are moving away from subsidized smartphones, because both are raking in extra revenue they are not returning to customers with lower plan prices.

AT&T and Verizon Wireless are thrilled customers are moving away from subsidized smartphones, because both are raking in extra revenue they are not returning to customers with lower plan prices. Verizon Wireless is a bigger taker.

Verizon Wireless is a bigger taker.