AT&T shareholders are frustrated. They are not getting the dividend payouts and shareholder value they expected after AT&T put itself $170 billion in debt last year — the highest debt load of any non-financial American corporation.

AT&T shareholders are frustrated. They are not getting the dividend payouts and shareholder value they expected after AT&T put itself $170 billion in debt last year — the highest debt load of any non-financial American corporation.

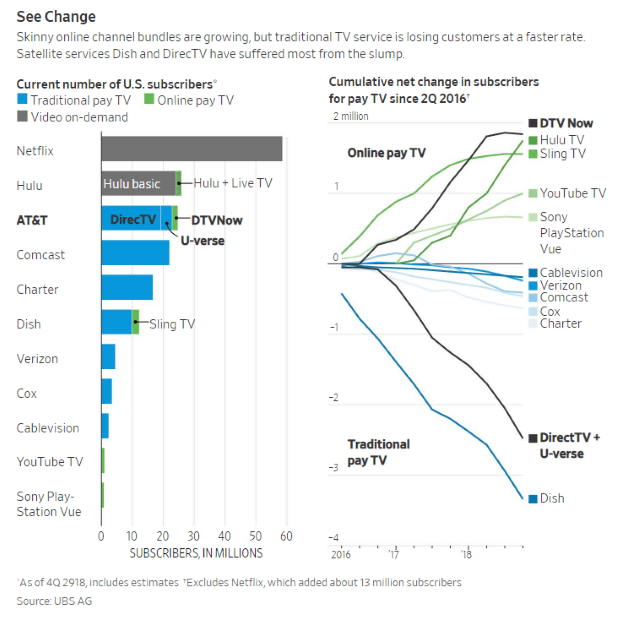

As AT&T has bet big in recent years on video-related acquisitions, including DirecTV and Time Warner (Entertainment), investors are skeptical AT&T can properly monetize its video business. Many have sold shares after criticizing company executives over the company’s strategy and high debt, driving AT&T’s market capitalization down to around $225 billion, comparable with considerably smaller Verizon Communications.

But no worries, AT&T CEO Randall Stephenson, has reassured. AT&T expects those investments to yield results this year, helped by forthcoming broad price hikes for AT&T’s consumer services.

“2019 candidly is the money year,” Stephenson said in an interview with the Wall Street Journal. “This is a year when we get everything rationalized.”

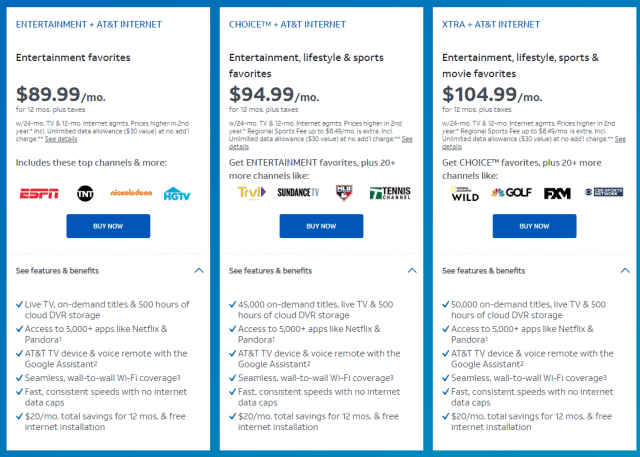

According to AT&T, customers are irrationally paying too little for AT&T’s video-related services, which include DirecTV (~19 million customers) and DirecTV Now — the two-year old streaming service that has attracted nearly two million subscribers.

Stephenson

Although DirecTV has recently been extremely aggressive about offering deep discounts to convince satellite customers to stay, AT&T plans to pull back on those discounts as two million DirecTV customers see their two-year contracts end this year. Instead of granting renewed discounts for signing another contract, AT&T plans to deliver significant rate increases.

“As those customers come due, we’ll get closer to market pricing,” AT&T’s John Donovan told investors at a November investor conference. “We’ll be respectful of our customers, but [prices] will move up.”

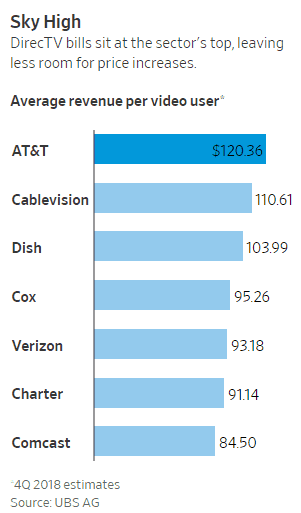

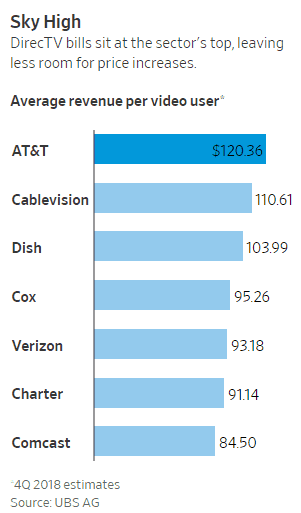

That may prove a difficult sell for DirecTV satellite customers, who have recently been abandoning the satellite platform in favor of cheaper streaming TV alternatives. Even with package discounts, DirecTV is the pay television industry’s most expensive provider, collecting an average of $120.36 a month for its TV packages. In contrast, Dish Networks gets an average of $103.99, Charter Spectrum earns $91.14 and Comcast, $84.50.

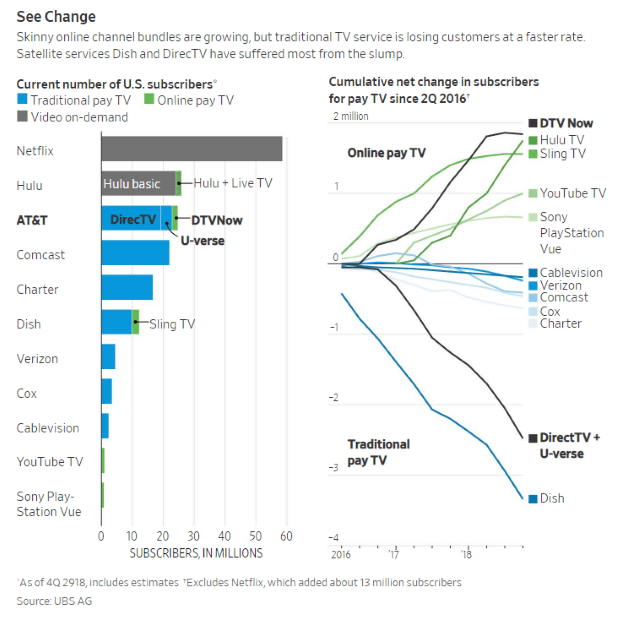

DirecTV defections, largely over price, have been growing at an accelerated rate, with 1.4 million customers turning their back on the satellite provider over the last two years. Analysts expect AT&T will report 300,000 more lost subscribers in the last three months alone. At that rate, AT&T will lose at least $1 billion in operating profits in 2019 from its declining satellite TV unit alone.

(Image courtesy: WSJ)

DirecTV Now customers, who already absorbed a $5 rate hike last summer, and will face even more rate increases and channel reductions in 2019. Stephenson expects DirecTV Now’s price point to be in the $50-60 range, which means many customers will likely face an average of $10 in rate hikes this year. For AT&T, that would deliver “the right price” and gets the service “to where it is profitable,” according to Stephenson.

But customers are likely to balk if AT&T reduces channel lineups at the same time it raises prices. AT&T has already faced substantial DirecTV Now customer defections after last summer’s rate increase, and the company has also reduced new customer sign-ups by cutting back on new subscriber promotions, which often included a free set-top streaming device. Waiting to pick up exiled streaming and satellite customers are AT&T’s competitors, especially Google. YouTube TV has proved to be a DirecTV Now killer, now charging $40 a month for 60+ channels. It also comes with an unlimited cloud DVR feature and a complete lineup of local channels across most of the country. YouTube TV is reportedly still growing, attracting more than one million customers so far. AT&T executives claim the service is popular only because Google is suspected of subsidizing what they believe to be an unprofitable venture by around $9 a month.

Investors are also unhappy about customers slimming down their TV packages, because average revenue per customer is cut in the process, sometimes dramatically. Wall Street was accustomed to video packages bringing in at least $100 a month. In many cases, that revenue is cut in half after a customer switches to a streaming provider. AT&T hopes investor pressure on those new ventures and ongoing wholesale programming rate increases will both conspire to bring back familiar annual rate hikes for streaming services as well. Programming cost inflation almost feeds itself. As programmers set new wholesale rate records for their networks, other programmers believe there is now room to raise their wholesale rates as well.

Programming costs are not just important for consumers, either. Wholesale programming rate inflation was one of the reasons AT&T spent $49 billion to acquire DirecTV. Volume discounts for DirecTV meant the satellite provider was paying an estimated $20 a month less on programming than AT&T’s own U-verse unit, which had a much smaller customer base. AT&T’s purchase of Time Warner, which owns several popular cable networks, was also a hedge against programming rate increases because AT&T would effectively pay any increases to itself.

(Image courtesy: WSJ)

The Journal reports AT&T executives were unprepared for the speed cord-cutting has taken hold. Most most under-30 have abandoned the concept of paying for live, linear cable television at any price, preferring a combination of on-demand streaming from Netflix, Hulu, and other video streaming services with an over the air antenna to watch local stations for free. Older Americans are gradually following suit.

According to the Journal, AT&T’s latest tactic to slow down customer departures is to make cancellation as difficult as possible:

“There’s no way that we could make the numbers we were told to make,” said Altrina Grant, former manager of a Chicago-area AT&T call center. She said some agents would promise to call back a customer about a request to drop service rather than immediately disconnecting, which would count against their compensation. Irate customers would later call another employee to ask why their request wasn’t honored, she said.

“These reps were getting thousands of dollars because they knew how to manipulate the system,” Ms. Grant said.

Cyrus Evans, a former call-center manager in Waco, Texas, said employees’ pay could swing between $50,000 and $80,000 a year depending on their performance, which was often influenced by how many disconnection requests they could deflect. Mr. Evans said employees often got angry calls from customers who had been promised their service would end, only to receive a bill the next month. He said the incentive structure rewarded bad behavior.

Former AT&T workers said the company launched a new audit team in 2017 to crack down on support staffers making promises they couldn’t keep. Ms. Grant said this initiative led the company to fire some workers but several customer-care executives are still in their jobs.

AT&T disputes these allegations, claiming false promises to customers violate AT&T’s Code of Business Conduct and are “extremely rare.”

Another independent cable company is dropping cable television service.

Another independent cable company is dropping cable television service.

Subscribe

Subscribe

In fact, Cable One charges so much money for internet, they

In fact, Cable One charges so much money for internet, they  AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.

AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers. AT&T shareholders are frustrated. They are not getting the dividend payouts and shareholder value they expected after AT&T put itself $170 billion in debt last year — the highest debt load of any non-financial American corporation.

AT&T shareholders are frustrated. They are not getting the dividend payouts and shareholder value they expected after AT&T put itself $170 billion in debt last year — the highest debt load of any non-financial American corporation.

AT&T is responding to its deepening losses of satellite television customers by slashing prices for those threatening to leave by as much as $90 a month and throwing in Visa debit cards worth up to $300 if customers agree to stay.

AT&T is responding to its deepening losses of satellite television customers by slashing prices for those threatening to leave by as much as $90 a month and throwing in Visa debit cards worth up to $300 if customers agree to stay.