We’ve heavily covered the proposed sale of Verizon landline service to Frontier Communications since the deal was announced last spring. This should not come as a big surprise, considering Frontier Communications’ decision to insert a 5GB monthly usage limit in their Acceptable Use Policy in the summer of 2008 was what instigated the launch of Stop the Cap! in the first place. Frontier’s decision was boneheaded at best in a city like Rochester with a very aggressive cable competitor only too willing to bash Frontier for implementing it if they thought it would win more customers.

We’ve heavily covered the proposed sale of Verizon landline service to Frontier Communications since the deal was announced last spring. This should not come as a big surprise, considering Frontier Communications’ decision to insert a 5GB monthly usage limit in their Acceptable Use Policy in the summer of 2008 was what instigated the launch of Stop the Cap! in the first place. Frontier’s decision was boneheaded at best in a city like Rochester with a very aggressive cable competitor only too willing to bash Frontier for implementing it if they thought it would win more customers.

But of course Frontier Communications’ Rochester operation is an anomaly for ‘rural America’s phone company.’ For the majority of rural customers, it’s far easier to slap customers around with a usage cap and 1-3Mbps DSL service when those customers have few, if any practical alternatives. Unfortunately, there is real money to be made from their business plan serving frequently non-competitive communities with incrementally-upgraded “just enough” broadband service with unfriendly terms and conditions attached.

In several of the 14 states impacted by the proposed sale, the relatively small number of customers involved made it easy for regulators to quickly approve the proposal with few conditions attached. The deal flew under the radar and got scant press in most of these states. Washington, Ohio, and West Virginia are another matter. Regulators are taking a closer look at the deal in all three states where most of the controversy is taking place. The deal is most contentious in West Virginia, where Verizon’s exit threatens to turn most of the state’s landline business over to Frontier Communications.

Stop the Cap! has been reviewing the public comments left on more than a dozen news sites, forums, and printed letters to the editor regarding the deal. We’ve seen comments obviously coming from Frontier employees, union members, politicians, business leaders, and competitors. But the vast majority come from ordinary consumers who have concerns about what the deal will do to their telephone and broadband service. Most of the comments from consumers that embrace the sale don’t do so because they are fans of Frontier. They simply loathe Verizon and want an alternative. Boiled down, the consensus among those in favor of Frontier taking over is “let them try… they can’t do any worse than Verizon.”

[flv]http://www.phillipdampier.com/video/WCHS Charleston PSC Phone Hearing 1-12-2010.flv[/flv]

WCHS-TV in Charleston covers West Virginia’s Public Service Commission hearings reviewing the proposed deal. Frontier employees arrived in Charleston to lobby for the sale. (1 minute)

Desperate for Broadband

There are a lot of West Virginians who still have no broadband options. Frontier claims Verizon provides only 60 percent of their customers with a broadband option — DSL service that tops out at 7Mpbs, if you live in an urban area. Those that don’t have often waited years for Verizon to extend DSL service into their communities or neighborhoods. It’s a problem common in mountainous, often rural states like West Virginia where infrastructure costs can be prohibitive. Customers believe that Frontier Communications will tolerate a lower return on their investment providing DSL service to those customers Verizon ignored.

Promising to expand broadband service in rural, unserved areas is a common sales point for all of the prior Verizon sell-offs. Hawaiian Telcom promised improved broadband service and speed. Fairpoint promised to expand DSL availability to 75 percent of all access lines within 18 months of the sale, 85 percent within two years and 95 percent within five years. Frontier Communications promises to expand broadband service as well, claiming they already provide 92 percent of their existing West Virginia customers with the option. Of course, Hawaiian Telcom and FairPoint both reneged on their commitments before going bankrupt. Frontier Communications hasn’t yet been held to any specific commitment or timeline in West Virginia as part of their proposed takeover of service.

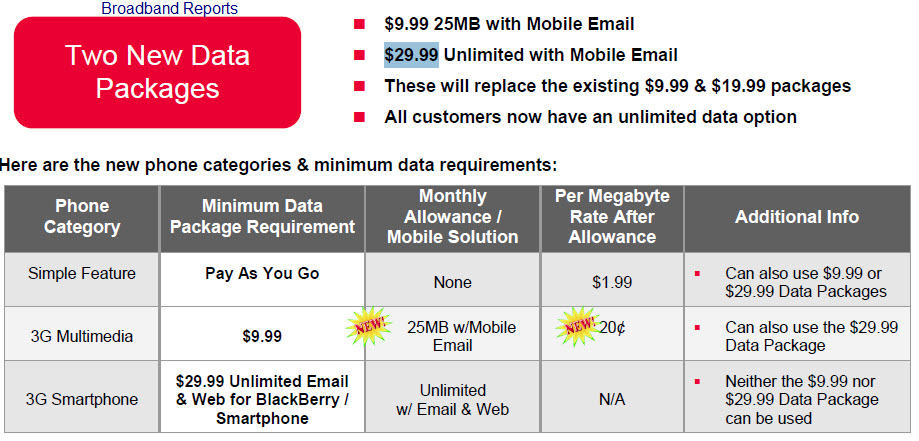

Consumer Reports rated TV, phone, and Internet providers, including Verizon and Frontier, in its February 2010 issue

To those suffering with dial-up or satellite fraudband, -any- broadband option seems like a miracle, even if it turns out to be 1-3Mbps DSL service with a 5GB allowance. But as those kinds of anemic speeds arrive, cutting edge multimedia-rich broadband applications will become increasingly mainstream and leave these customers behind, again. With a 5GB usage limit, it wouldn’t matter anyway, because customers will never be able to take advantage of services that will rapidly blow through those limits. Make no mistake, a user’s broadband experience at 1.5Mbps with a 5GB allowance is going to be considerably different than a customer enjoying online multimedia from a cable provider or the next generation broadband service from Verizon FiOS or AT&T’s U-verse. Think e-mail and basic web browsing, and that’s about all.

What kind of broadband experience does Frontier Communications bring? This month, Consumer Reports rated Frontier dead last among DSL providers that own and operate their own broadband networks (subscription required). The magazine rated 27 regional fiber, cable, and satellite providers and Frontier’s DSL ended up #19 on the list, the lowest rating of any DSL provider selling service on its own network. Only Earthlink, which usually buys access on other providers’ networks came in lower among DSL providers. Verizon actually scored higher than Frontier.

Frontier’s DSL service merited a 67 out of 100 score, rating only fair on value, speed, reliability, and customer support, based on 56,080 Consumer Reports subscribers who have a home Internet account.

Frontier’s phone service rated even lower, second to last in the survey. Frontier was rated fair on value, reliability and call quality. Only Mediacom did worse. Verizon scored much better on reliability. The magazine’s survey of phone companies was based on 37,484 respondents with phone service and was completed in the spring of 2009.

The consumer magazine did not recommend DSL for broadband access, suggesting consumers would do better with fiber optic broadband first, and cable modem service second.

Union Bashing – The enemy of my enemy is my friend

A significant minority of comments were focused entirely on union bashing, completely ignoring the specifics of the Frontier-Verizon sale. All these people knew was that if the Communications Workers of America or other union was involved, they were the “real problem,” accusing union bosses of opposing the deal until they were paid off.

Nonsense.

Reality trumps anti-union talking points. Consumers can review for themselves who correctly predicted the outcome of the last two deals of the recent past. They were the CWA and the International Brotherhood of Electrical Workers, who accurately identified the service problems, the network transition problems, the debt load that prevented service expansion and upgrades, and the eventual bankruptcies experienced at Hawaiian Telcom and FairPoint Communications. It turns out that asking front line employees who work in the office and out in the field maintaining the network are well positioned to give an honest assessment of these transactions that others seek to candy coat to get the deal done.

[flv]http://www.phillipdampier.com/video/WSAZ Charleston Frontier Defends Deal 1-12-2010.flv[/flv]

WSAZ-TV in Charleston delivered this decidedly pro-Frontier news report on the company’s efforts to counter opposition to the proposed sale. (3 minutes)

The Opposition

A large number of comments from those who oppose the deal believe they will actually be far worse off with Frontier. Most relate the experiences of themselves or their friends and family who live in Frontier service areas, and they’re unhappy with Frontier’s poor customer service, reliability, and slow speed DSL. Many were also unhappy with Frontier’s automatically-renewing contracts committing customers to stay with the company or face a steep early cancellation penalty. Many more lament the lack of a future with Verizon fiber optics.

David Swanson, who blogs from his home in Golden Valley, Arizona just dumped Frontier for his local cable provider – Golden Valley Cable & Communications. He says he was overpaying for Frontier’s DSL and phone package. Together, after fees and taxes, $90 a month went to Frontier and $73 a month went to DirecTV for television service. With his new cable bundle, he pays $100 a month for everything. He uses Boost mobile for his phone, and has no need for a landline.

Reviews on DSL Reports aren’t exactly positive about Frontier either.

One Rochester customer isn’t happy with the “spotty service” he’s experienced on Frontier’s aging copper wire infrastructure, noting they don’t seem to be in any hurry to upgrade facilities in western New York. He’s stuck with unreliable DSL service far slower than what Time Warner Cable’s Road Runner service can provide. Another customer in Lowville, New York admits he has to live with Frontier’s slow speed DSL because there is no other provider available. In Kingman, Arizona one customer rated the company’s DSL service “slightly better than nothing.”

Even customers who had had good things to say about Frontier in forums often acknowledge their service simply isn’t a good value when considering the high cost charged for the slow speed received.

What Can Be Done?

At this point, it is critical impacted customers contact their state utility commission and state representatives and tell them this deal does not work for you. It is true Verizon wants out of these service areas, and should they win the right to withdraw someone will have to assume control of landline operations in these communities. But the terms and conditions for the company seeking to provide service should favor customers and not the Wall Street dealmakers. Strict financial pre-conditions should be in place to guarantee the buyer is up to the task of providing service and upgrades. Historically, it’s been far too easy to simply renege on the deal with a quick trip to Bankruptcy Court to shed the debt these deals pile on, and be rid of the service commitments that were part of the approval process.

A company that believes they’ll earn plenty from this deal should be spending plenty to provide quality broadband service starting at 10Mbps, not the 1-3Mbps service Frontier provides most of its rural service areas. What chance do communities in West Virginia have to stay competitive in a digital economy that requires faster broadband access without the ridiculously low usage limits Frontier includes in their customer agreements? In fact, usage limits and other Internet Overcharging schemes should be explicitly banned as part of any sales agreement.

Holding Verizon responsible for the outcome of deals that benefit them and their shareholders while sticking customers with a bankrupt provider must be considered. An important component of past Verizon’s landline-dumping-deals involves the Reverse Morris Trust — delivering a tax-free transaction for Verizon and piles of debt for the buyer. That puts all the risk on ratepayers, lower level employees who are among the first to go when cost-cutting begins, and head-scratching regulators wondering where it all went wrong. The only ones not doing any hand-wringing are Verizon’s accountants and the executive management of both companies who conjure up such deals. That’s because they are rarely held accountable, and often win retention bonuses even while a company is mired in bankruptcy.

Regulators should insist Verizon play a fundamental role in insuring that customers are protected even after the deal closes, honoring commitments and financing operations should the buyer fail soon after the sale is complete. Under these conditions, customers are protected and Verizon might think twice about structuring a deal that loads the buyer down in insurmountable debt.

“This deal is driven by greed — and we can learn from Northern New England’s and Hawaii’s experience to make sure it does not come to pass here or in the other 13 states,” said CWA’s District Two Vice-President Ron Collins, who has been leading the campaign in West Virginia.

Subscribe

Subscribe