Phillip “What’s $520 a month between friends” Dampier

The average Ohio household consumes 52 gigabytes of data per month — the equivalent of more than five million emails or surfing the Internet for about 100 hours monthly — up from 28GB in 2012.

Demand for broadband and mobile communications continues to skyrocket as consumers in urban Ohio dump traditional landline phone service at an accelerating rate.

Since 2000, the industry group Ohio Telecom Association reports 64 percent of landlines have disappeared in the state since peaking in 2000. An additional 6-10 percent continue to cut the cord every year, either when elderly customers pass away or when consumers decide to switch to a wireless, cable telephone, or a broadband Voice over IP alternative like Vonage.

Some telephone companies, particularly AT&T and Verizon, argue the ongoing loss of landlines means the service is becoming technically obsolete — a justification to drop old copper phone networks in rural areas in favor of wireless and switching to fiber-fed IP networks like U-verse in urban and suburban areas. But copper landlines do more than just connect telephone calls.

Broadband usage statistics suggest rural customers in Ohio could find their Internet bills exploding if AT&T succeeds in forcing those customers, least likely to face competition from cable providers, to the company’s highly profitable wireless network.

AT&T currently sells rural landline customers DSL service starting at $14.95 a month. A usage cap of 150GB per month technically applies, but remains unenforced.

Customers switched to AT&T wireless service will pay much more for much less.

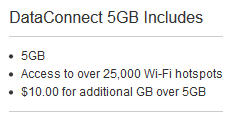

AT&T’s DataConnect plan, suitable for fixed wireless home use, starts at $50 a month and includes a usage allowance of 5GB per month. With the average Ohio resident now consuming 52GB a month, switching to wireless broadband is a real budget-buster. AT&T’s overlimit fee is $10/GB, so the average resident would face a monthly Internet bill of $520 a month this year. Assuming usage growth continues at the same pace, in 2014, AT&T customers will need to write a check for around $780 a month.

AT&T’s DataConnect plan, suitable for fixed wireless home use, starts at $50 a month and includes a usage allowance of 5GB per month. With the average Ohio resident now consuming 52GB a month, switching to wireless broadband is a real budget-buster. AT&T’s overlimit fee is $10/GB, so the average resident would face a monthly Internet bill of $520 a month this year. Assuming usage growth continues at the same pace, in 2014, AT&T customers will need to write a check for around $780 a month.

Ohio’s broadband and wireless usage statistics are familiar because they echo the rest of the country. According to Connect Ohio, wireless-only residents are 81 percent urban or suburban, where cell networks provide the best reception; 84 percent are under age 44; 58 percent have a college education; and 63 percent earn more than $25,000 annually.

Those affected by a forced transition to a wireless-only solution are least financially equipped to handle it.

“The least likely to convert to a wireless-only solution would be an older, rural, less educated, lower-income individual,” said Stu Johnson, executive director of Connect Ohio. “Those are probably also the most expensive copper customers.”

Subscribe

Subscribe

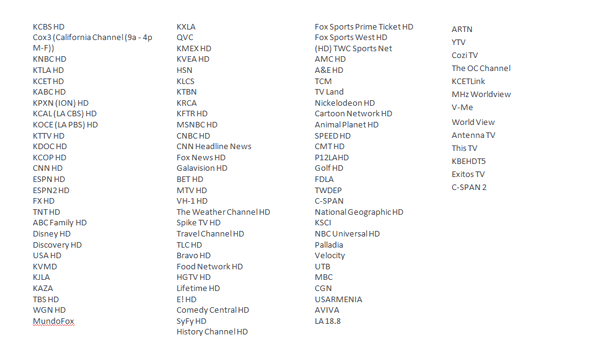

Cox Communications has found a new way to target cord-cutters and sell television service to its broadband-only customers reluctant to sign up for traditional cable television.

Cox Communications has found a new way to target cord-cutters and sell television service to its broadband-only customers reluctant to sign up for traditional cable television.

AT&T U-verse broadband has not kept up with the times, limiting speed-craving customers to a comparatively slow 18-24Mbps that hasn’t changed much in a few years. But an AT&T employee

AT&T U-verse broadband has not kept up with the times, limiting speed-craving customers to a comparatively slow 18-24Mbps that hasn’t changed much in a few years. But an AT&T employee