Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

In the last week, Time Warner Cable managed to alienate its broadband customers announcing another rate increase and a near-doubling of the modem rental fee the company only introduced as its newest money-maker last fall. What used to cost $3.95 a month will be $5.99 by August.

The news of the “price adjustment” went over like a lead balloon for customers in Albany, N.Y., many who just endured an 18-hour service outage the day before, wiping out phone and Internet service.

“They already get almost $60 a month from me for Internet service that cuts out for almost an entire day and now they want more?” asked Albany-area customer Randy Dexter. “If Verizon FiOS was available here, I’d toss Time Warner out of my house for good.”

Alas, the broadband magic sparkle ponies have not brought Dexter or millions of other New Yorkers the top-rated fiber optic network Verizon stopped expanding several years ago. The Wall Street dragons complained about the cost of stringing fiber. Competition, it seems, is bad for business.

In fact, Verizon Wireless and Time Warner Cable are now best friends. Verizon Wireless customers can get a fine deal — not on Verizon’s own FiOS service — but on Time Warner’s cable TV. Time Warner Cable originally thought about getting into the wireless phone business, but it was too expensive. It invites customers to sign up for Verizon Wireless service instead.

This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you.

This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you.

Further upstate in the Rochester-Finger Lakes Region, Time Warner Cable faces an even smaller threat from Frontier Communications. It’s a market share battle akin to United States Cable fighting a war against Uzbekistan Telephone. Frontier’s network in upstate New York is rich in copper and very low in fiber. Frontier has lost landline customers for years and until very recently its broadband DSL offerings have been so unattractive, they are a marketplace afterthought.

Rochester television reporter Rachel Barnhart surveyed the situation on her blog:

Think about this fact: Time Warner, which raked in more than $21 billion last year, has 700,000 subscribers in the Buffalo and Rochester markets. I’m not sure how many of those are businesses. But the Western New York market has 875,000 households. That’s an astounding market penetration. Does this mean Time Warner is the best choice or the least worse option?

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

In light of cable’s broadband successes, it is no surprise Time Warner is able to set prices and raise them at will. Barnhart, who has broadband-only service, is currently paying Time Warner $37.99 a month for “Lite” service, since reclassified as 1/1Mbps. That does not include the modem rental fee or the forthcoming $3 rate hike. Taken together, “Lite” Internet is getting pricey in western New York at $47 a month.

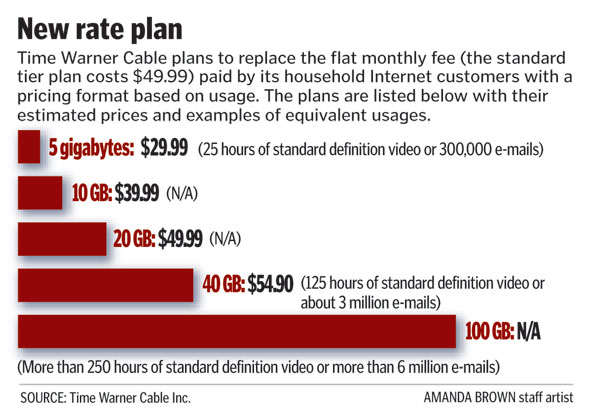

Retiring CEO Glenn Britt believes there is still money yet to be milked out of subscribers. In addition to believing cable modem rental fees are a growth industry, Britt also wants customers to begin thinking about “the usage component” of broadband service. That is code language for consumption-based billing — a system that imposes an arbitrary usage limit on customers, usually at current pricing levels, with steep fees for exceeding that allowance.

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

Time Warner persists with its usage priced plans, despite the fact customers overwhelmingly have told the company they don’t want them. Time Warner’s current discount offer — $5 off any broadband tier if you keep usage under 5GB a month, has been a complete marketing failure. Despite that, Time Warner is back with a slightly better offer — $8 off that 5GB usage tier and adding a new 30GB usage limited option in the Rochester market. We have since learned customers signing up for that 30GB limit will get $5 off their broadband service.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

Unfortunately, as long as Time Warner has an 80 percent market share, the same mentality that makes ever-rising modem rental fees worthwhile might also one day give the cable company courage to remove the word “optional” from those usage limited plans. With usage nearly doubling every year, Time Warner might see consumption billing as its maximum moneymaker.

In 2009, Time Warner valued unlimited-use Internet at $150 as month, which is what they planned to charge before pitchfork and torch-wielding customers turned up outside their offices.

Considering the company already earns 95 percent gross margin on broadband service before the latest round of price increases, one has to ask exactly when the company will be satisfied it is earning enough from broadband service. I fear the answer will be “never,” which is why it is imperative that robust competition exist in the broadband market to keep prices in check.

Unfortunately, as long as Wall Street and providers decide competition is too hard and too unprofitable, the price increases will continue.

Subscribe

Subscribe Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after. This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you.

This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you. That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies. Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers. In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings. In addition to an August

In addition to an August

Just as in the United States, the promises made by satellite broadband providers are turning out to be too good to be true.

Just as in the United States, the promises made by satellite broadband providers are turning out to be too good to be true. Unlimited customers paying £75 per month have been told they are “abusing” the service and that it has effectively run out of capacity and is oversold.

Unlimited customers paying £75 per month have been told they are “abusing” the service and that it has effectively run out of capacity and is oversold.