A new standard in over-the-air TV broadcasting could arrive as early as this year in more than 40 U.S. cities, bringing better reception and more TV channels and features to those willing to buy a new television or converter box to watch.

A new standard in over-the-air TV broadcasting could arrive as early as this year in more than 40 U.S. cities, bringing better reception and more TV channels and features to those willing to buy a new television or converter box to watch.

ATSC 3.0 comes just a decade after full power television stations in the United States ceased analog broadcasting. The ‘upgrade’ is a significant improvement over ATSC 1.0, the digital over-the-air television standard now in use in the U.S.

At the National Association of Broadcasters convention in Las Vegas, Sinclair, Fox Television Stations, Nexstar, and NBCUniversal (and a consortium group of stations owned by SpectrumCo and Pearl TV) this week announced 40 U.S. television markets would see ATSC 3.0 stations launched by the end of 2020, starting in these cities:

- Dallas-Ft. Worth, TX

- Houston, TX

- San Francisco-Oakland-San Jose, CA

- Phoenix, AZ*

- Seattle-Tacoma, WA

- Detroit, MI

- Orlando-Daytona Beach-Melbourne, FL

- Portland, OR

- Pittsburgh, PA

- Raleigh-Durham, NC*

- Baltimore, MD

- Nashville, TN

- Salt Lake City, UT

- San Antonio, TX

- Kansas City, KS-MO

- Columbus, OH

- West Palm Beach-Ft. Pierce, FL

- Las Vegas, NV

- Austin, TX

To help the transition, ATSC 3.0 stations in these cities will switch off their ATSC 1.0 channels and relocate programming to one or more other local stations’ digital subchannels, allowing viewers with older sets to continue watching until a 5-year transition period ends.

The second, and likely larger wave of stations to switch on ATSC 3.0 will come in these cities:

- New York, NY

- Los Angeles, CA

- Chicago, IL

- Philadelphia, PA

- Washington, DC

- Boston, MA

- Atlanta, GA

- Tampa-St.Petersburg-Sarasota, FL

- Minneapolis – St. Paul, MN

- Miami – Ft. Lauderdale, FL

- Denver, CO

- Cleveland-Akron, OH*

- Sacramento-Stockton-Modesto, CA

- St. Louis, MO

- Charlotte, NC

- Indianapolis, IN

- San Diego, CA

- Hartford-New Haven, CT

- Cincinnati, OH

- Milwaukee, WI

- Greenville-Spartanburg, SC – Asheville, NC

The third wave of stations, still expected to complete a transition to ATSC 3.0 by the end of next year, are located in:

- Norfolk-Portsmouth-Newport News, VA

- Oklahoma City, OK

- Albuquerque – Santa Fe, NM

- Grand Rapids – Kalamazoo, MI

- Memphis, TN

- Buffalo, NY

- Providence – New Bedford, RI

- Little Rock – Pine Bluff, AR

- Mobile, AL – Pensacola, FL

- Albany-Schenectady – Troy, NY

- Flint-Saginaw – Bay City, MI

- Omaha, NE

- Charleston – Huntington, WV

- Springfield, MO

- Rochester, NY

- Syracuse, NY

- Chattanooga, TN

- Charleston, SC

- Burlington, VT – Plattsburgh, NY

- Davenport, IA – Moline, IL

- Santa Barbara – Santa Maria – San Luis Obispo, CA

*ATSC 3.0 is already running on one or more stations in these markets.

A faster transition to ATSC 3.0 may be possible in cities where station owners like Sinclair own more than one full power local station. It will make it easier for programming on one station to be temporarily shared on another, without complicated carriage contract negotiations. There is no forced transition to ATSC 3.0, so consumers can make their own choices about whether they want to invest in new televisions or converters. Broadcasters understand that, and many are planning to launch a host of new channels and networks that could benefit cord-cutters and convince them to upgrade.

Over the air viewers will need to get in the habit of remembering how to “rescan” their local channel lineup as stations occasionally disappear as they move to different channels as a result of an unrelated ongoing channel repack or from shifting around to accommodate ATSC 3.0. Some secondary networks like Retro TV, MeTV, Comet, and others may temporarily disappear in some markets if that channel space is temporarily needed for channel-sharing arrangements.

Cable, telco-TV, streaming and satellite customers should not notice a thing because any changes will be managed by your television provider. But those watching over-the-air will need to prepare for the transition either with a forthcoming TV converter or preparing to buy new television sets with ATSC 3.0 tuners. Details on both are sketchy, but free TV viewers may want to start saving money now for new equipment spending starting either late this year or more likely early next.

ATSC 3.0 promises better, more robust reception, with error correction and the capability of downgrading video quality in marginal reception areas to preserve a stable viewing experience. It also supports 4K Ultra-HD and better sound, mobile viewing on smartphones and other devices, and local features including hyper-local weather warnings, targeted advertising and some data applications.

Subscribe

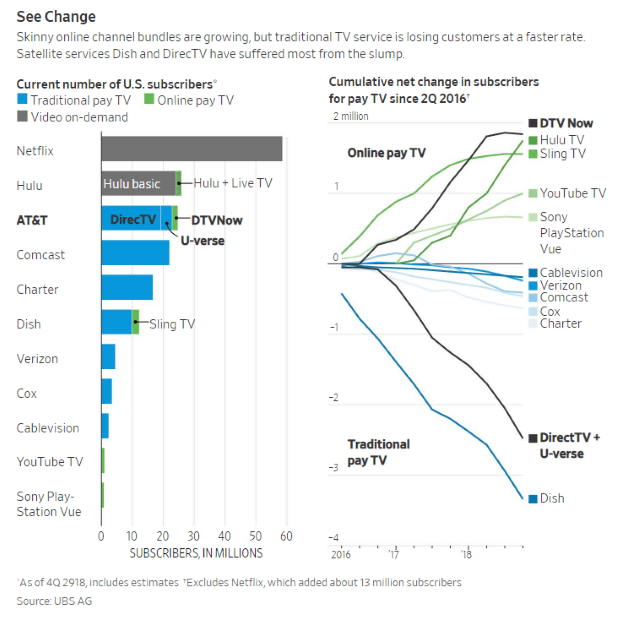

Subscribe Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers.

Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers. “Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

“Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

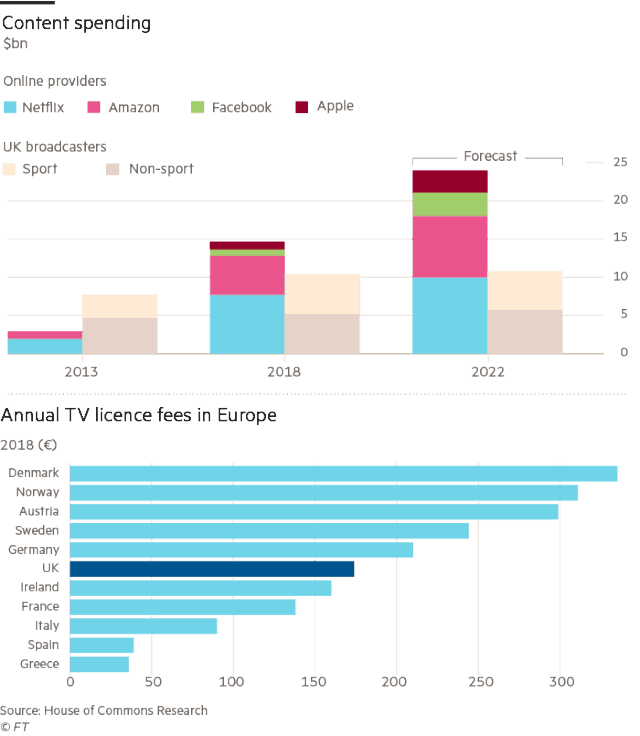

European broadcasters are frightened at the prospect of seeing viewers and crucial mandatory TV license fees erode away as an invasion of American on-demand streaming from Netflix and Amazon takes its toll on traditional television.

European broadcasters are frightened at the prospect of seeing viewers and crucial mandatory TV license fees erode away as an invasion of American on-demand streaming from Netflix and Amazon takes its toll on traditional television.

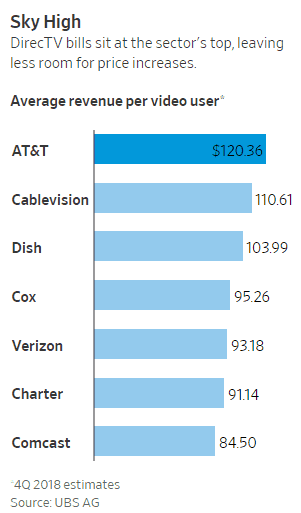

AT&T shareholders are frustrated. They are not getting the dividend payouts and shareholder value they expected after AT&T put itself $170 billion in debt last year — the highest debt load of any non-financial American corporation.

AT&T shareholders are frustrated. They are not getting the dividend payouts and shareholder value they expected after AT&T put itself $170 billion in debt last year — the highest debt load of any non-financial American corporation.

In the era of cord-cutting, getting a new, independently owned cable network on cable lineups can be an exercise in futility.

In the era of cord-cutting, getting a new, independently owned cable network on cable lineups can be an exercise in futility. Katz Networks, a division of E.W. Scripps Co., has acquired the rights to the Court TV name and other intellectual property from its old owner, Time Warner (Entertainment). That includes over 100,000 hours of pre-recorded programming and trial coverage in the Court TV archives. The new venture has hired Vinnie Politan, a former Court TV presenter, as its lead anchor. The new Court TV has also hired back some of its old employees who either left the network or transitioned to its replacement – Tru TV.

Katz Networks, a division of E.W. Scripps Co., has acquired the rights to the Court TV name and other intellectual property from its old owner, Time Warner (Entertainment). That includes over 100,000 hours of pre-recorded programming and trial coverage in the Court TV archives. The new venture has hired Vinnie Politan, a former Court TV presenter, as its lead anchor. The new Court TV has also hired back some of its old employees who either left the network or transitioned to its replacement – Tru TV.