The era of fierce competition among live streamed video providers that has fueled cord-cutting will face new challenges as providers cope with rising programming costs and some may exit the business.

Last week, Sony’s PlayStation Vue announced it was planning to cease service in early 2020 because it was not profitable for the game console manufacturer. But Cowen analyst Gregory Williams believes it won’t be the last to close its doors.

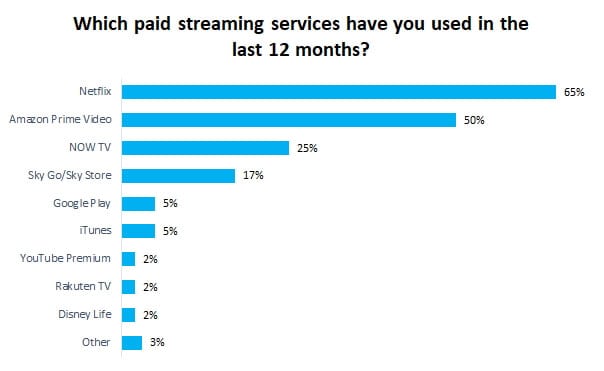

Williams told Multichannel News that despite the growing phenomenon of cord-cutting, new streaming subscriptions are slowing down as subscribers choose between a half-dozen major services that are all raising prices, including AT&T TV Now, fuboTV, Hulu Live TV, Philo, Sling TV, and YouTube TV. Williams called the current marketplace for streaming services irrational in the business sense, because providers are at the mercy of programmers that are continuing to raise wholesale prices.

Another serious problem is price disparity. Programmers offer huge volume discounts to large cable, satellite, and telco TV providers, charging smaller streaming services considerably more. That could eventually bring streaming subscription prices to parity with the same traditional cable and satellite providers many consumers left looking for a better deal. Exploring fun options like slot gacor gampang menang can offer a rewarding break from these rising costs.

Most streaming TV providers have built business models on slimmed-down packages of channels, rejecting the difficult-to-negotiate a-la-carte “choose your own channels” model many customers have been asking for since the days of 100 channel cable TV lineups. As a result, consumers are still paying for lots of channels they do not watch or want, and as subscription costs advance beyond the $50 a month many services are now charging for a healthy package of most popular cable and broadcast networks, some subscribers may end up going back to their old providers.

Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling TV Choice, a package of 10 ‘you-pick’ networks (mostly a part of Spectrum’s Standard TV package) combined with C-SPAN, public, educational, and government access channels, home shopping, and local over-the-air stations, to its internet-only customers for $24.95 a month (not including a $6/mo Broadcast TV Fee and an extra $4.95 a month for a cloud-based DVR service). The resulting bill of around $35-40 a month is at least $10 less than many streaming service providers that may not offer the exact channel lineup you are looking for.

Ironically, one of the few a-la-carte providers available is a very large cable company you may already know. Charter’s Spectrum has been quietly selling TV Choice, a package of 10 ‘you-pick’ networks (mostly a part of Spectrum’s Standard TV package) combined with C-SPAN, public, educational, and government access channels, home shopping, and local over-the-air stations, to its internet-only customers for $24.95 a month (not including a $6/mo Broadcast TV Fee and an extra $4.95 a month for a cloud-based DVR service). The resulting bill of around $35-40 a month is at least $10 less than many streaming service providers that may not offer the exact channel lineup you are looking for.

The closest alternative is Sling TV, which has very slim packages of networks in three different configurations, ranging from $15-25 a month. But chances are, some channels you watch won’t be included.

Williams predicts that just three to five services will survive the consolidation wave or exit that is expected to be triggered by Sony’s decision to leave the marketplace. The services most vulnerable are likely those lacking a deep-pocketed, healthy corporate backer or those with the least market share.

An executive for one of PlayStation Vue’s rivals told Multichannel News Sony faced platform costs that “were simply too high.” Sony paid broadcast retransmission consent fees to local stations in every market the service was offered and also licensed popular, but very expensive regional sports channels. Sony also outsourced its streaming technology to Disney-owned BAMTech, among the more expensive platform providers.

Subscribe

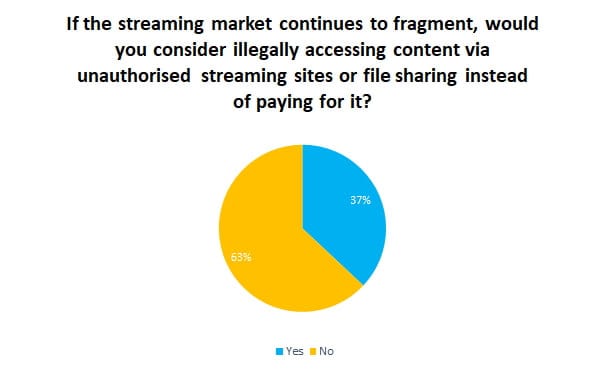

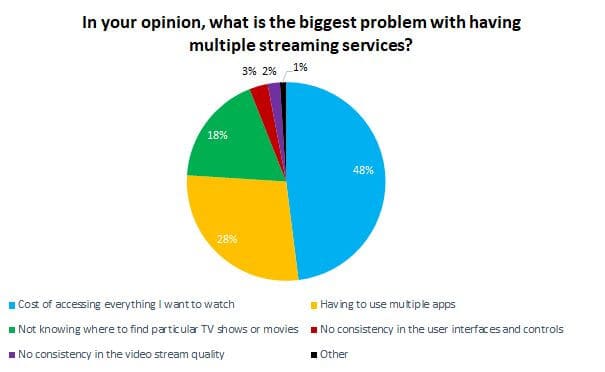

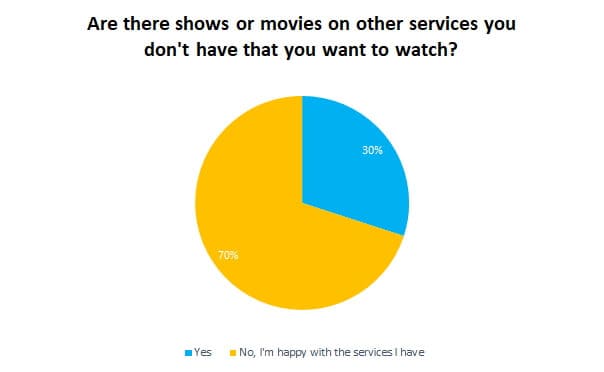

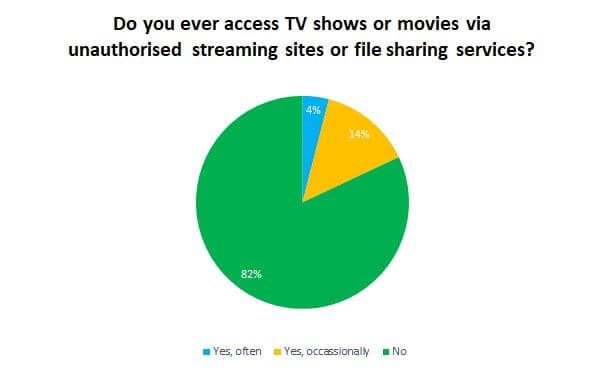

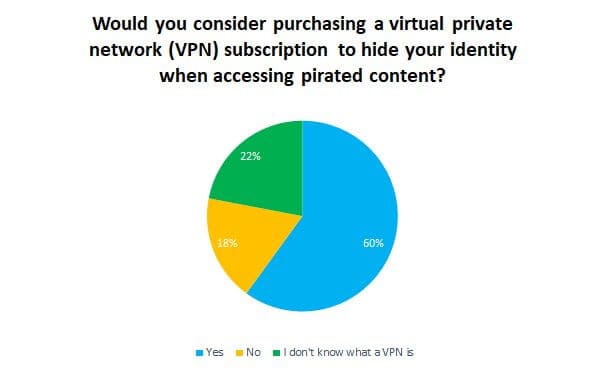

Subscribe As more paid streaming services debut, consumers have signaled they are increasingly willing to pirate their favorite shows and movies to save money.

As more paid streaming services debut, consumers have signaled they are increasingly willing to pirate their favorite shows and movies to save money.

Comcast is planning to debut its new streaming TV platform under the NBC “Peacock” brand next April with a lineup of original shows starring well-known talent including Alec Baldwin, Demi Moore, Christian Slater, and Ed Helms.

Comcast is planning to debut its new streaming TV platform under the NBC “Peacock” brand next April with a lineup of original shows starring well-known talent including Alec Baldwin, Demi Moore, Christian Slater, and Ed Helms. Peacock’s subscription model is designed to protect Comcast’s cable TV revenue. For existing Comcast cable TV customers, giving ad-supported subscriptions away for free may add to the value proposition of keeping a cable TV subscription. By charging subscription fees to everyone else, Comcast is not ‘giving away the store for free.’ If it did, it could upset other pay television companies that are facing ever-rising retransmission consent fees and programming costs for Comcast/NBC-owned TV stations and cable networks including CNBC, MSNBC, and the USA Network.

Peacock’s subscription model is designed to protect Comcast’s cable TV revenue. For existing Comcast cable TV customers, giving ad-supported subscriptions away for free may add to the value proposition of keeping a cable TV subscription. By charging subscription fees to everyone else, Comcast is not ‘giving away the store for free.’ If it did, it could upset other pay television companies that are facing ever-rising retransmission consent fees and programming costs for Comcast/NBC-owned TV stations and cable networks including CNBC, MSNBC, and the USA Network. BATTLESTAR GALACTICA

BATTLESTAR GALACTICA PUNKY BREWSTER (pilot)

PUNKY BREWSTER (pilot) Frasier

Frasier Psych

Psych Bourne franchise

Bourne franchise Fast & Furious

Fast & Furious Charter Communications is contemplating tying piracy mitigation to renewed contracts with movie studios, cable networks, and other programmers in an effort to enforce a new authentication standard to stop password sharing on streaming services like Netflix, Hulu, Disney+, and CBS All Access.

Charter Communications is contemplating tying piracy mitigation to renewed contracts with movie studios, cable networks, and other programmers in an effort to enforce a new authentication standard to stop password sharing on streaming services like Netflix, Hulu, Disney+, and CBS All Access. The Wall Street Journal believes the majority of Americans are paying for internet speed they never use or need, but their investigation largely ignores the question of traffic bottlenecks and data caps that require many customers to upgrade to premium tiers to avoid punitive overlimit fees.

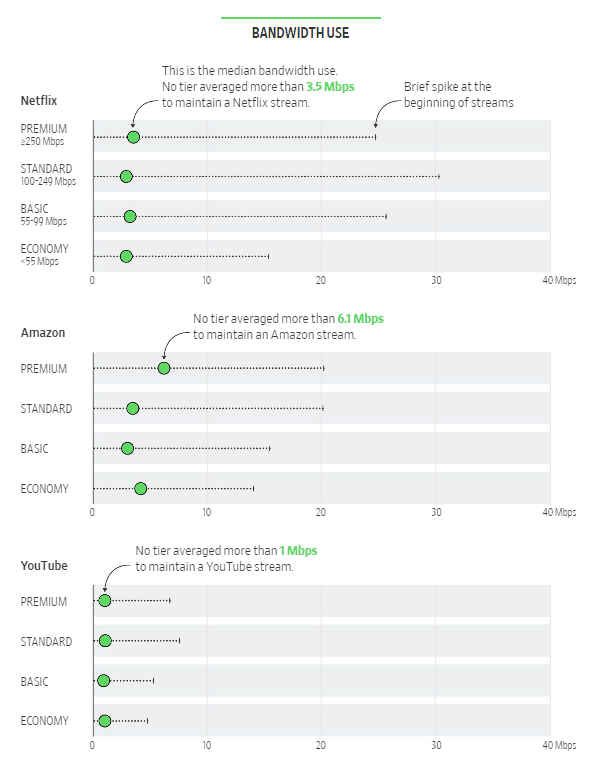

The Wall Street Journal believes the majority of Americans are paying for internet speed they never use or need, but their investigation largely ignores the question of traffic bottlenecks and data caps that require many customers to upgrade to premium tiers to avoid punitive overlimit fees.

The answer often lies in the quality of the connection between the streaming provider and the customer. There are multiple potential bottlenecks that can make a YouTube video stutter and buffer on even the fastest internet connection. Large providers have had

The answer often lies in the quality of the connection between the streaming provider and the customer. There are multiple potential bottlenecks that can make a YouTube video stutter and buffer on even the fastest internet connection. Large providers have had  Customers are sold on speed upgrades by providers that tell them faster speeds will accommodate more video traffic, which is true but not the whole answer. No amount of speed will overcome intentional traffic shaping, an inadequate connection to the video streaming service, or an oversold network. Too bad the Journal did not investigate these conditions, which are more common than many people think.

Customers are sold on speed upgrades by providers that tell them faster speeds will accommodate more video traffic, which is true but not the whole answer. No amount of speed will overcome intentional traffic shaping, an inadequate connection to the video streaming service, or an oversold network. Too bad the Journal did not investigate these conditions, which are more common than many people think.