Most analysts are predicting this past year will be the worst yet for video customer losses, with nearly two million cable TV customers cutting the cord in 2019, up from 1.26 million in 2018. Business is even worse for satellite TV operators, which lost 1.2 million customers in 2018 and are expected to have shed another 3.25 million customers in 2019 — mostly because of mass customer defections at AT&T’s DirecTV. Altogether, over five million Americans are estimated to have cut the cord over the past year.

Most analysts are predicting this past year will be the worst yet for video customer losses, with nearly two million cable TV customers cutting the cord in 2019, up from 1.26 million in 2018. Business is even worse for satellite TV operators, which lost 1.2 million customers in 2018 and are expected to have shed another 3.25 million customers in 2019 — mostly because of mass customer defections at AT&T’s DirecTV. Altogether, over five million Americans are estimated to have cut the cord over the past year.

Investors have largely stopped worrying about video subscriber losses, and cable operators have boldly told Wall Street they have stopped chasing video customers threatening to cancel service, claiming many are no longer profitable enough to keep. Their key competitors, online streaming video services like Sling TV, AT&T TV Now, and Hulu with Live TV are also seeing subscriber gains slowing, most likely because of price increases. One analyst predicted these online cable TV replacements would add a combined 804,000 customers in 2019, less than half of the 2.3 million they added in 2018.

Cable companies seem unfazed, in part because of record-breaking gains they are expected to have made in internet and wireless customers in the last year. One analyst suggests that most of those gains are coming directly at the expense of phone companies.

Comcast and Charter are the two largest cable companies in the United States.

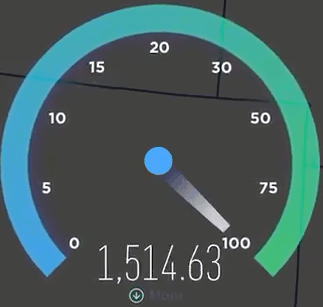

“Cable’s clear speed advantage in roughly half the U.S. is driving continued strong share performance,” Jayant told clients in a research note. Jayant expects some of the biggest gains will come from ex-DSL customers in Comcast and Charter Spectrum’s service areas.

Nationwide, cable operators likely added 3.1 million new broadband customers in 2019, up 15% over last year. Phone companies are predicted to have lost at least 402,000 internet customers, up from 342,000 in 2018. Most of those departing customers are not served by fiber broadband.

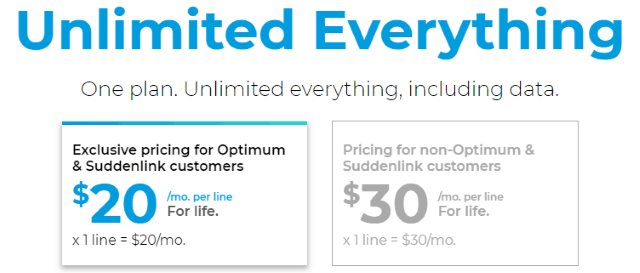

Both Comcast and Charter Spectrum are also successfully attracting a growing number of mobile customers, as is Altice USA. Charter and Comcast offer their broadband customers the option of signing up for wireless mobile service, powered by Verizon Wireless. Altice USA resells Sprint service at cut-rate prices.

Comcast is estimated to have added 778,000 wireless customers in 2019 and analysts predict that the company will add another 909,000 in 2020. Charter Spectrum is expected to have gained 923,000 wireless customers in 2019, with another 1.04 million likely to sign up in 2020. Altice USA’s deal with Sprint in its Cablevision/Optimum service area has already attracted about 80,000 customers, with 550,000 more likely to follow in 2020.

Subscribe

Subscribe NEW YORK (Reuters) – Executives from Sprint Corp testified on Monday that the U.S. wireless carrier has struggled to improve its network, hindering its growth and underscoring the need to merge with larger rival T-Mobile US Inc.

NEW YORK (Reuters) – Executives from Sprint Corp testified on Monday that the U.S. wireless carrier has struggled to improve its network, hindering its growth and underscoring the need to merge with larger rival T-Mobile US Inc.

Many of the same civil rights groups that regularly advocate their support of giant corporate telecom mergers are back once again to

Many of the same civil rights groups that regularly advocate their support of giant corporate telecom mergers are back once again to

Altice

Altice  Verizon, AT&T, and T-Mobile’s 5G launches are blazing fast, when you can find a signal, but your phone will also get blazing hot while using it.

Verizon, AT&T, and T-Mobile’s 5G launches are blazing fast, when you can find a signal, but your phone will also get blazing hot while using it.