Comzilla

Comcast is increasingly invading the territories of neighboring small cable operators, a rare move that could eventually trigger price wars and threaten the informal “gentlemen’s agreement” that has kept cable companies from directly competing with each other for decades.

In New Hampshire, residents of Laconia and Rochester will have a choice between incumbent Atlantic Broadband or newcomer Comcast.

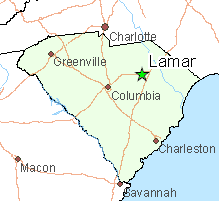

Comcast is already the dominant cable operator in the state, providing service in 104 communities. The cable company recently filed its draft franchise proposal with Laconia city officials to extend Comcast service into areas already serviced by Atlantic Broadband, an independent cable operator owned by Montréal based Cogeco.

“We believe Laconia offers attractive opportunities for Xfinity and Comcast business products in an area close to Comcast’s existing footprint and part of the same designated market area we already serve,” said Comcast regional spokesman Marc Goodman. “We offer internet speeds of up to two gigabytes per second and 100 gigabytes for businesses. We have an award-winning video platform with voice remote.”

It is the second time Comcast announced it would directly compete with Atlantic in New Hampshire. Comcast is already overbuilding Atlantic’s service area in Rochester and is scheduled to finish sometime next year.

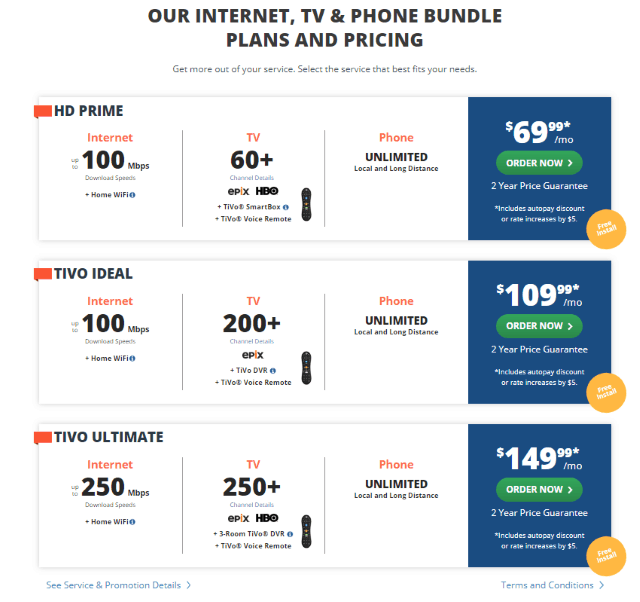

In response, Atlantic has introduced very competitive service and pricing plans to fend off Comcast.

Atlantic Broadband is trying to lock in their customers with two-year rate guarantees and lower introductory prices.

Consumers are thrilled.

“After years of MetroCast’s dark ages of bad service, Atlantic Broadband bought them up, raised some internet speeds, and raised our bill even more,” said Charlie Saunders. “It is real easy to pay a $200 cable bill around here, so I am glad Comcast is giving us a choice.”

“After years of MetroCast’s dark ages of bad service, Atlantic Broadband bought them up, raised some internet speeds, and raised our bill even more,” said Charlie Saunders. “It is real easy to pay a $200 cable bill around here, so I am glad Comcast is giving us a choice.”

Atlantic Broadband, at least in public, seems unfazed about Comcast’s entry. Ed Merrill, Atlantic Broadband’s regional general manager for New Hampshire and Maine stressed his company’s innovations, such as bringing gigabit internet speed to the region and using TiVo set top boxes.

“Our plans are based not on what other providers are doing, but by anticipating customer needs and preferences, then developing and delivering the kinds of products and services that will make customer lives better, whether they’re residential customers or business clients with customers of their own,” Merrill said in a statement.

Comcast Invasion: Communities Where Consumers Can Also Choose Comcast as Their Cable Company

- Dec. 2017: Rochester, N.H. (Atlantic Broadband vs. Comcast)

- May 2018: Waterford and New London, Conn. (Atlantic Broadband vs. Comcast)

- Summer 2018: Warwick Township, Warwick Borough, Ephratah Township, Ephratah Borough and Lititz, Penn. (Blue Ridge Communications vs. Comcast)

- Nov. 2018: Laconia, N.H. (Atlantic Broadband vs. Comcast)

Grove

Comcast said it is only responding to the public’s demand for more choice and better service, which explains why it is expanding into territories already served by another operator. But so far, Comcast has only chosen to expand in areas adjacent to its current territory, and only in places served by smaller, independent cable companies. In short, Comcast is in no hurry to run cable lines into areas served by Charter/Spectrum or Cox.

A Multichannel News article on the subject suggests Comcast’s real interest is reaching lucrative commercial/business customers just out of reach of their existing service areas.

“I can tell you that our primary focus is on business service expansion where from time-to-time we explore new opportunities, based on a case-by-case analysis, to bring our state-of-the-art products and services to more businesses,” Bob Grove, vice president of communications for Comcast told the trade magazine. “Some of our existing customers in the contiguous footprint and shared DMA have operations in this area, which is why it made sense for us to expand our commercial network here. We’re also exploring limited residential opportunities, but that’s in the very preliminary stages as well.”

“My heart and wallet skipped a beat,” Lennart Swenson, Jr., told The Laconia Daily Sun. “When we had Comcast, at our last home, they provided superior service and more options for less money than Atlantic Broadband. Comcast was also easier to contact and provided quicker service than has been our experience with Atlantic.”

Some customers also complain Atlantic lures people with temporary teaser rates that exponentially increase after introductory pricing expires. Others report it is difficult to get a representative on the phone.

Competition is “tiresome” for the cable industry

Comcast’s growing interest in expanding service into already-cabled areas means the company will have to convince customers to switch cable providers, something that runs contrary to traditional cable industry economics, where companies carefully avoid direct competition with each other.

“When I started in this business, we all helped each other,” former Buford Media CEO Ben Hooks told Multichannel News. Buford retired in 2018 after a 50-year career in the cable industry. “You don’t see that, especially with Comcast. As far as they’re concerned, there’s them and there’s the rest of the industry.”

Hooks remembers the 1970s and 1980s when cable companies did attempt to expand into each other’s territory.

“In most cases overbuilds were a disaster,” Hooks said. “Neither party won very much, both were fighting for the same customer, cutting prices and neither company was doing well. It was just a tiresome battle.”

But as costs plummet to less than $500 per home to extend fiber to the home service, and the costs to provide internet service continue to fall, cable companies like Comcast can afford the risk of upsetting smaller operators.

“A company today like Comcast has so much more margin/size over a small company that if they want to expand into an adjacent territory, it is no contest,” Hooks told the trade publication. “Now, if they were to take on Charter, the competition would be a greater challenge. While Comcast still has the advantage, Charter is large enough that it would be ugly.”

Subscribe

Subscribe

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling.

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling. “Internet is obviously a necessity, it’s not a luxury anymore,” said Ben Breazeale, senior director of government affairs for Charter Communications. “Rural communities all over our country are struggling to try to retain young people and internet is a must. Access to our communications systems is a must for our youth.”

“Internet is obviously a necessity, it’s not a luxury anymore,” said Ben Breazeale, senior director of government affairs for Charter Communications. “Rural communities all over our country are struggling to try to retain young people and internet is a must. Access to our communications systems is a must for our youth.”