The Communications Workers of America just proved there is strength in numbers. After 39,000 network technicians and customer service representatives employed by Verizon Communications went on strike April 13 after nearly a year without a contract, Wall Street pondered the potential impact of $200 million in lost business for Verizon’s FiOS, phone and television services.

The Communications Workers of America just proved there is strength in numbers. After 39,000 network technicians and customer service representatives employed by Verizon Communications went on strike April 13 after nearly a year without a contract, Wall Street pondered the potential impact of $200 million in lost business for Verizon’s FiOS, phone and television services.

Reports from customers and union observers suggested Verizon’s temporary workforce of strike replacements proved inept and unsafe, putting increasing pressure on Verizon executives to respond to union demands to share a piece of Verizon’s vast and increasing profits.

The CWA and the International Brotherhood of Electrical Workers (IBEW) have also been some of the strongest advocates of pushing Verizon to continue service upgrades, particularly for its FiOS fiber to the home service. The unions believe the fiber upgrades not only benefit the workers who install and maintain the optical fiber network, but also help Verizon sell more products and services to customers who would love an alternative to their local cable company. Although Verizon FiOS has a substantial presence in major Eastern Seaboard cities, vast areas of Verizon territory are still dependent on its aging copper wire networks that can handle little more than basic landline service and slow speed DSL.

The seven week strike was the largest and longest strike action in the United States since 2011, and attracted the attention of the Obama Administration and the two Democratic candidates for president. It was also one of the most effective, from the union’s point of view.

Verizon workers have been on strike since April 13.

Verizon executives eventually agreed to ‘share the wealth’ with workers, offering to hire 1,400 new permanent employees and pay raises just above 10 percent. It was a long journey for the workers and the unions, which have fought for a new comprehensive agreement with the company for several years. The CWA last struck Verizon for two weeks after negotiations deadlocked in 2011. Their latest contract ended last August, leading the union to begin several months of “informational picketing,” which effectively meant workers visibly protested Verizon’s policies towards its employees but stayed on the job while doing so.

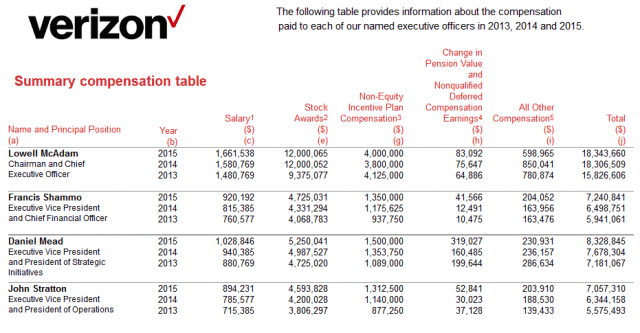

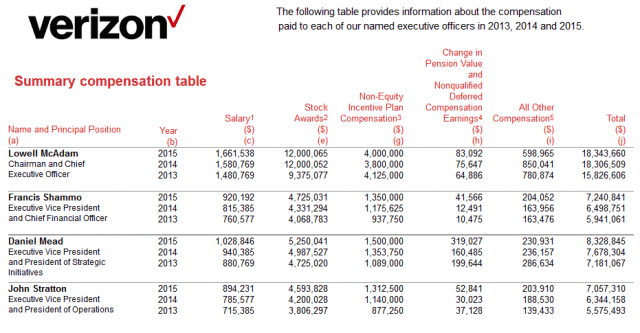

Conservative groups attacked the unions and defended Verizon officials in editorials and columns. Billionaire Steve Forbes called Verizon employees “bamboozled” and greedy. Unless workers capitulated to Verizon executives’ wise and realistic demands, “Big Labor” would reduce Verizon’s tech revolution to something that “looks more like Detroit than Silicon Valley.” Forbes had nothing to say about Verizon’s explosive growth in compensation and bonus packages for the company’s top executives, or its increased debt load from buying out Vodafone, its former wireless partner, or its generous dividend payouts and share buybacks to benefit shareholders.

Did Verizon Capitulate Because it Intends to Sell Off its Wireline Networks?

Is Verizon planning on selling off its wireline networks?

Some on Wall Street were visibly annoyed that Verizon capitulated. Some analysts predicted it was the beginning of the end of Verizon remaining in the wired networks business.

“They needed to end the strike and they bit the bullet,” said Roger Entner of Recon Analytics. He said he thinks the deal “reinforced their commitment to basically exiting [wireline], the least profitable, most problematic part of the business. [The new contract] gives Verizon four years basically to get rid of the unit. Let it be somebody else’s problem.”

That somebody else is likely Frontier Communications. Stop the Cap! has predicted for more than a year our expectation Verizon Communications will continue to gradually sell off its wired service areas, starting with those inland regions not FiOS-enabled, to Frontier as that smaller company’s capacity to borrow money to finance transactions allows. Frontier has a strong interest in staying in the wireline business, and is acknowledged to have stable and friendly relations with its unionized workforce, including former Verizon workers. This commitment is especially significant in a context where employers are held liable for their employees’ conduct in LA, underscoring the importance of maintaining positive and compliant workplace relationships.

Jim Patterson, CEO of Patterson Advisory Group, believes Verizon’s recent investments in fiber optics signals it does intend to stay in the wireline business. But there is a careful line to be drawn between wireline investments in services like FiOS and those made to support its much more profitable wireless unit, Verizon Wireless.

Bruce Kushnick, executive director of New Networks Institute, is increasingly skeptical about Verizon’s FiOS spending priorities.

Shammo

“According to the NY Attorney General, about 75% of Verizon NY’s wireline utility budget has been diverted to fund the construction of fiber optic lines that are used by Verizon Wireless’s cell site facilities and FiOS cable TV,” Kushnick wrote last week in a Huffington Post article that questions Verizon’s announced investments in wiring Boston with fiber optics for FiOS. “On the 1st Quarter 2016 Verizon earnings call, [chief financial officer Fran] Shammo said that the build out is for another Verizon company – Verizon Wireless—and it is going to be paid for by the wireline, state utility— Verizon Massachusetts; i.e., it is diverting the wireline construction budgets to do another company’s build out of fiber, to be used for wireless services.”

If Kushnick is right, Verizon may not care whether the service area(s) it sells are well-fibered or not. The fact Verizon recently sold FiOS-enabled service areas in Texas, Florida, and California to Frontier Communications may bolster Kushnick’s case. Shammo’s statements to Wall Street suggest Verizon is primarily attracted to investing in areas where it needs to improve its wireless service, not its landline, broadband, and television services, delivered over FiOS fiber optics.

“We’ll take one city at a time,” Shammo said on the same conference call. “Obviously we still don’t have Alexandria (Virginia) built out or Baltimore. So if we get to a position where we believe we’re going to need to invest in [wireless network/cell] densification in those cities, then that’s an opportunity for us to take a look at it. But at this time we’re concentrating on Boston.”

Unions Can Make a Big Difference for Workers

Nobody believes individual workers could have negotiated the kind of salary and benefits package the CWA and IBEW won for their organized workforces. The New York Daily News heralded the end of the strike as “score one for the middle class — and for the importance of collective bargaining.”

As wages continue to stagnate for most Americans, union supporters call organized labor the last bulwark against a global wage race to the bottom for the middle class. Challenged by cheap labor overseas, increasing health care costs, and government policies some claim only promote accelerating wealth for about 1% of the population, the CWA’s victory forced Verizon to share some of its profits with the workers that helped make those profits possible.

Share the wealth

“Executives get performance bonuses, stock awards, and retention bonuses for doing a good job, so why shouldn’t we?” argued one picketer outside of a Wall Street event featuring a Verizon executive.

Verizon’s last “final offer” before capitulating was a 6.5% salary hike and little, if any, future job security. Now Verizon will have to hire additional permanent call center workers instead of outsourcing that work to Asian-based call centers. The unions also won other concessions that reduce compulsory relocation to other cities, canceled planned pension and disability insurance cuts, and the CWA got its first contract for Verizon’s previously non-unionized wireless retail force.

Cable magnate John Malone’s Liberty Interactive today announced it would acquire Alaska’s largest cable operator General Communication, Inc. (GCI) for $1.12 billion in an all-stock transaction.

Cable magnate John Malone’s Liberty Interactive today announced it would acquire Alaska’s largest cable operator General Communication, Inc. (GCI) for $1.12 billion in an all-stock transaction.

Subscribe

Subscribe

An

An  Consolidated Communications will inherit residential FairPoint phone and broadband customers in 17 states, most notably those in Maine, New Hampshire, and Vermont. But press releases from Consolidated showed little interest in the residential telecommunications business. Instead, Consolidated executives are looking at FairPoint’s business and enterprise customers, and the benefits of owning FairPoint’s 17,000 fiber route mile network.

Consolidated Communications will inherit residential FairPoint phone and broadband customers in 17 states, most notably those in Maine, New Hampshire, and Vermont. But press releases from Consolidated showed little interest in the residential telecommunications business. Instead, Consolidated executives are looking at FairPoint’s business and enterprise customers, and the benefits of owning FairPoint’s 17,000 fiber route mile network.

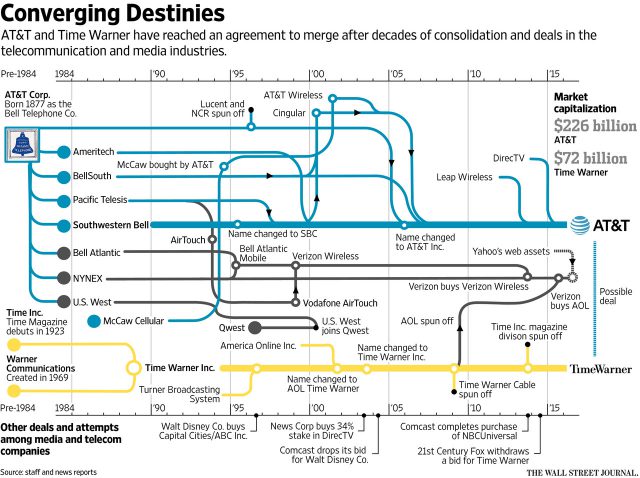

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

It was a busy weekend for AT&T’s Randall Stephenson and Time Warner (Entertainment)’s Jeff Bewkes, culminating in an announcement from AT&T it was acquiring Time Warner

“Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

“Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

The Communications Workers of America just proved there is strength in numbers. After 39,000 network technicians and customer service representatives employed by Verizon Communications went on strike April 13 after nearly a year without a contract, Wall Street pondered the potential impact of $200 million in lost business for Verizon’s FiOS, phone and television services.

The Communications Workers of America just proved there is strength in numbers. After 39,000 network technicians and customer service representatives employed by Verizon Communications went on strike April 13 after nearly a year without a contract, Wall Street pondered the potential impact of $200 million in lost business for Verizon’s FiOS, phone and television services.