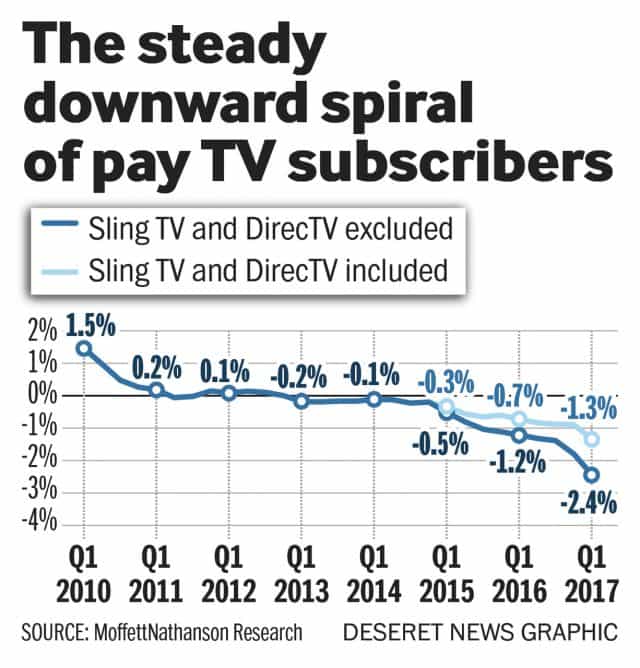

Spectrum’s customer service agents are apologizing to customers for the rate shock they are experiencing when their existing Time Warner Cable or Bright House Networks promotions expire and customers find out the Spectrum plans and pricing being offered instead turn out to be nothing close to the deals customers used to get.

“You may get a call asking about my performance today, the survey is about me and my job today only,” a customer service agent explained to Jason, a Spectrum customer in Elmhurst, N.Y., who shared his experience on DSL Reports. “It doesn’t have anything to do with how you feel about Spectrum or TWC. If you are upset about the new pricing, please use the comments portion to explain. I look forward to hearing your feedback.”

Customer service representatives are on the front line of delivering bad news to cable customers facing double-digit rate increases, especially when customers realize they also receive fewer TV channels after changing plans.

“I’m guessing these agents must be getting destroyed in the surveys, [and] having worked retail where these types of surveys are used, I felt bad for the reps,” explained the Spectrum customer. “I know in my neighborhood, everyone seems to have their TWC promos expiring in the next month or so and are very unhappy.”

That unhappiness is getting worse as word about Charter Communications’ mid-year rate increase is showing up on customer bills. Broadband prices are increasing at least $1 a month, the Broadcast TV Surcharge is rising to $7.50 a month, and set-top box equipment rentals also increased by $1 a month for each piece of equipment starting in August 2017.

Premium speed broadband customers are now also facing a higher internet bill.

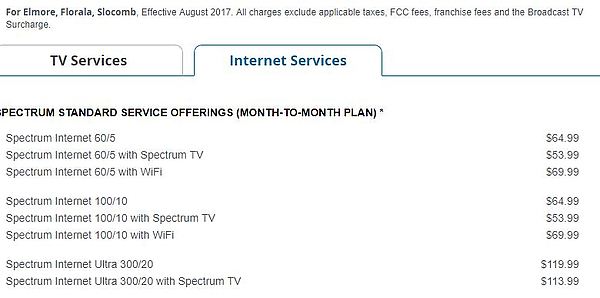

Spectrum’s Ultra tier, which is 100Mbps in some markets, 300Mbps in others, is increasing to $119.99 a month, up from $104.99 in most markets. The increase is less if you also subscribe to Spectrum TV, which reduces the rate to $113.99 a month. Spectrum rate cards from around the country do not yet reflect the $1 rate increase for traditional Spectrum 60/5Mbps internet (100Mbps in select markets):

Low income customers enrolled in Spectrum’s Everyday Low Price (ELP) internet package — a carryover from Time Warner Cable — also got the rude shock of a $5 rate increase on a service that used to cost $14.99 a month. That represents more than a 33% rate hike, which is just fine with Charter.

“In some of our markets the price has increased for the ELP package,” said spokesperson “Julie_R”. “Notifications were sent via bill statements and became effective with the August statements. Our ELP package is not a promotion. From time to time, Spectrum makes decisions to adjust the pricing for our products and services to account for network investments. We understand that value is important. ELP is still a very good value at $19.99.”

The rate increase does not apply to New York State residents, where regulators placed significant deal conditions on the Charter/Time Warner Cable merger to help protect consumers in that state.

We have also been receiving reports from readers that Spectrum’s Internet Assist (SIA) program, designed for the elderly and income-challenged, is not easy to enroll in and customer service representatives have rejected a number of applicants for a variety of reasons. SIA offers a 30Mbps broadband connection for $14.99 a month to those qualified for:

We have also been receiving reports from readers that Spectrum’s Internet Assist (SIA) program, designed for the elderly and income-challenged, is not easy to enroll in and customer service representatives have rejected a number of applicants for a variety of reasons. SIA offers a 30Mbps broadband connection for $14.99 a month to those qualified for:

- The National School Lunch Program (NSLP); free or reduced cost lunch

- The Community Eligibility Provision (CEP) of the NSLP

- Supplemental Security Income (SSI) ( ≥ age 65 only) Programs that do not qualify for Spectrum Internet Assist: Social Security Disability (SSD), Social Security Disability Insurance (SSDI), and Social Security Retirement and Survivor Benefits are different from Supplemental Security Income (SSI) and do NOT meet eligibility requirements.

The biggest problems encountered so far:

- Representatives lack information about the program and attempt to upsell customers to regular pricing and packages.

- Bundling additional services with SIA can be more expensive than just choosing a traditional bundled package sold to everyone, especially if it is a new customer promotion.

- There is considerable confusion over the qualifications for SSI recipients. Be sure to recognize you must be 65 or older and note SSD, SSDI, and certain other programs noted above do not qualify you to receive SIA.

We are continuing to monitor the SIA program looking to ensure Spectrum is making the program available to customers that qualify for it.

Subscribe

Subscribe