Frontier Communications’ new simplified pricing with no equipment fees or surprise contracts was well-timed for the phone company as it picked up a growing number of disgruntled Comcast and Time Warner Cable customers fed up with increasing modem rental fees.

Frontier Communications’ new simplified pricing with no equipment fees or surprise contracts was well-timed for the phone company as it picked up a growing number of disgruntled Comcast and Time Warner Cable customers fed up with increasing modem rental fees.

Frontier depends a great deal on its residential broadband service to win back revenue the company has lost from years of landline cord-cutting. The company reported slowing revenue losses, now down to less than one percent for the quarter ending Sept. 30. Frontier’s profits reached $35.4 million this quarter, reduced by increased investment in broadband upgrades and pension fund-related expenses.

The independent phone company is still losing residential and business phone customers, but those losses have begun to stabilize. Frontier has 2.82 million residential customers and 275,000 business customers. While Time Warner Cable lost customers during the recent quarter, Frontier picked up 27,000 new ones. For all of 2013, Frontier added 84,500 new broadband customers. Nearly 84 percent of them added broadband as part of a bundle, which leads analysts to suspect most of Frontier’s new broadband customers are located in rural areas that never had access to broadband speeds before.

Frontier’s greatest opportunity is in the rural residential broadband business, and the company’s investment in improved broadband speeds has made a major difference in growing market share especially where it has a cable competitor. Currently, Frontier has 20-25 percent market share in most of its service areas. It wants 40%, but is unlikely to achieve it selling broadband speeds that often top out at around 10Mbps. Winning customers back to a landline provider has also proved difficult without an attractive bundled offer. In all but a few cities, Frontier bundles landline service with DSL broadband and a satellite television package.

Wilderotter

In rural markets, Frontier has had better success, particularly in areas formerly served by Verizon.

With help from the federal government’s Connect America Fund (CAF), Frontier invested over $21 million to expand rural broadband service in 2013. In the third quarter, the company expanded service to another 37,000 possible homes and businesses, with 30,000 more on the way in the fourth quarter. The company applied for $71.5 million in CAF funding for 2014.

Broadband speeds have also gradually increased in an expanding number of communities. As of today, 45 percent of homes can receive 20Mbps or better, 58 percent are capable of 12Mbps. A year-end commitment to offer at least 3Mbps speeds to 85% of customers in the most rural areas also appears within reach. Customers can upgrade to the next speed level in $10 increments.

But not every customer has gotten speed upgrades. In their largest legacy market — Rochester, N.Y., DSL speeds have remained unchanged in many areas. At the headquarters of Stop the Cap!, Frontier pre-qualified us this afternoon for the same 3.1Mbps DSL speed they offered in 2009, despite being blocks away from the city line.

Those increasing speeds have led to more traffic on Frontier’s broadband network, but the company says it has enough capacity to handle it.

“The average usage of all our customers across both fiber and the copper has grown to about 24GB per month at this point, and we see that increasing and people are comfortable with [our] facilities as well as our backhaul to support that growth,” said chief operating officer Dan McCarthy. “We’ve seen that grow virtually every month as we move forward.”

Frontier analyzes what customers do with their broadband connection and found 30 percent of customer usage is online video. That number is growing. Customers upgrading to the fastest speeds are often telecommuters or have a home full of avid broadband users.

“On the residential side [these high-end customers] are usually working at home, they are VPNing, they are gamers, and they are very active on video services and social media as well,” said CEO Maggie Wilderotter.

The average Frontier DSL customer still subscribes to 6Mbps service, which Wilderotter said was adequate for Netflix, web surfing, and e-mail. But the company is preparing to market speed upgrades to these customers to earn extra revenue.

So far, Frontier’s broadband growth has gone relatively unnoticed by their cable competitors.

“We really haven’t seen any sustainable programs that cable has put against us in the market and we do know that several cable operators have said they’re going to do more in those areas,” said Wilderotter. “We are very well prepared for that. We are giving everyday low pricing to the customer that’s simple and predictable and there are no add-on fees or modem rental costs.”

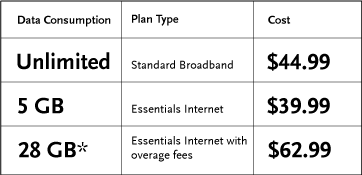

Most Frontier customers are offered $19.99 or $29.99 broadband pricing that can be bundled with other products for discounts. There is no term contract.

“Time Warner Cable has increased their modem fees [to] between $6 and $9 a month,” said Wilderotter. “That’s a huge price increase for a lot of customers. You compare that with Frontier which has no modem cost and customers understand where price value lies.”

Wilderotter noted Comcast has raised rates as well. Frontier intends to remind cable customers they have a choice, and will tailor offers to continue to increase market share.

Subscribe

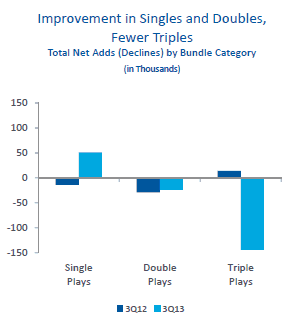

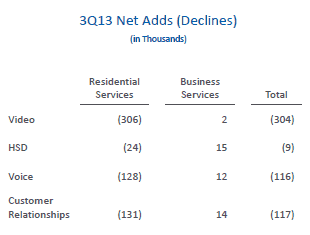

Subscribe Time Warner Cable’s summer was “horrible,” to quote one analyst, after three percent of customers left over programming disputes and increasing prices for broadband and telephone service, with more likely to follow as price promotions expire and rates increase further.

Time Warner Cable’s summer was “horrible,” to quote one analyst, after three percent of customers left over programming disputes and increasing prices for broadband and telephone service, with more likely to follow as price promotions expire and rates increase further.

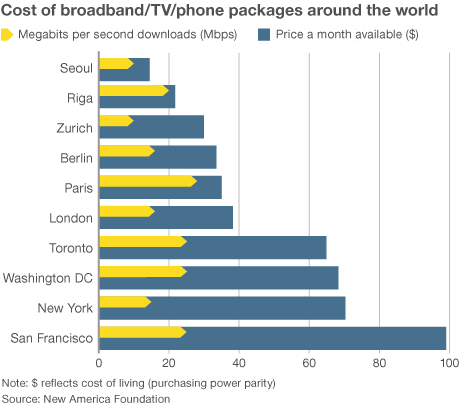

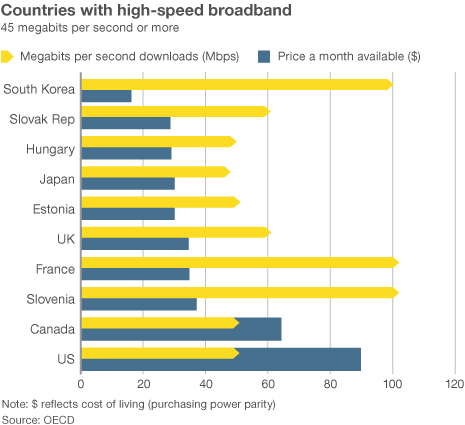

Broadband in the United States costs far more than in other countries —

Broadband in the United States costs far more than in other countries —  “Americans pay so much because they don’t have a choice,” said Susan Crawford, a former special assistant to President Barack Obama on science, technology and innovation policy. “We deregulated high-speed Internet access 10 years ago and since then we’ve seen enormous consolidation and monopolies, so left to their own devices, companies that supply Internet access will charge high prices, because they face neither competition nor oversight.”

“Americans pay so much because they don’t have a choice,” said Susan Crawford, a former special assistant to President Barack Obama on science, technology and innovation policy. “We deregulated high-speed Internet access 10 years ago and since then we’ve seen enormous consolidation and monopolies, so left to their own devices, companies that supply Internet access will charge high prices, because they face neither competition nor oversight.”

Time Warner Cable believes it has room to raise broadband prices and get away with it without much customer backlash.

Time Warner Cable believes it has room to raise broadband prices and get away with it without much customer backlash.

Taking into account these popular upsold add-ons, the promotional price of $79-89 might be seen as bait and switch by some customers. The true cost for most choosing a triple play package including cable TV with DVR service, one set-top box, a Time Warner-supplied cable modem, and a speed upgrade to 15/1Mbps service is $127.92 a month before taxes and fees.

Taking into account these popular upsold add-ons, the promotional price of $79-89 might be seen as bait and switch by some customers. The true cost for most choosing a triple play package including cable TV with DVR service, one set-top box, a Time Warner-supplied cable modem, and a speed upgrade to 15/1Mbps service is $127.92 a month before taxes and fees. Time Warner Cable will not follow Comcast, Charter, Cox and Mediacom by imposing usage caps or move towards a compulsory usage-based billing scheme.

Time Warner Cable will not follow Comcast, Charter, Cox and Mediacom by imposing usage caps or move towards a compulsory usage-based billing scheme.