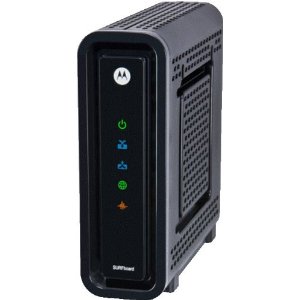

Arris/Motorola’s SB6121 SURFboard DOCSIS 3.0 Cable Modem used to be considered “eXtreme,” but now most cable companies consider it obsolete.

The legacy of the hated modem rental fee is coming back to bite providers that charge $10 a month or more for a device that likely cost the company well under $100.

To opt out of the fee, a growing percentage of customers buy their own equipment, but now many of those modems are becoming functionally obsolete and customers are wary of efforts by providers to convince them to accept a newer, company-supplied modem.

With the arrival of DOCSIS 3.1 and faster speeds, the problem is only getting worse for companies like Comcast, Charter Spectrum, and Cox. With an installed base of hundreds of thousands of obsolete modems, customers frequently can no longer get the internet speed they pay for, and the equipment’s limitations can cause congestion on cable broadband networks, because older modems cannot take advantage of the exponential increase in available “channels” that help share the load on the neighborhood network.

“Some customers have cable modems that are incompatible (such as DOCSIS 2.0 and DOCSIS 3.0 4×4 modems) with the current class of service or internet speed that they’re receiving. As a result, these customers may not be experiencing the full range of available bandwidth that they’re paying for,” Comcast informs their customers. “If a device is no longer supported by Comcast or has reached its end-of-life (EOL), this essentially means that we will no longer install the device, either as a new or replacement device. In addition, we will no longer recommend that customers purchase the device, whether new or used.”

But many Comcast customers do not realize their equipment is effectively obsolete until they visit mydeviceinfo.xfinity.com and sign in to their account or enter a device make and model in the search bar on the homepage or hear directly from the company. Comcast will send online alerts to customers verified to still be using outdated equipment and occasionally send notifications through the mail. Customers can order new equipment online or swap out old equipment in a cable store. Comcast prefers its customers rent its Xfinity xFi Wireless Gateway ($13/mo) or xFi Advanced Gateway ($15/mo). As an incentive, Comcast is testing offering free unlimited data in some central U.S. markets to those choosing its more costly Advanced Gateway.

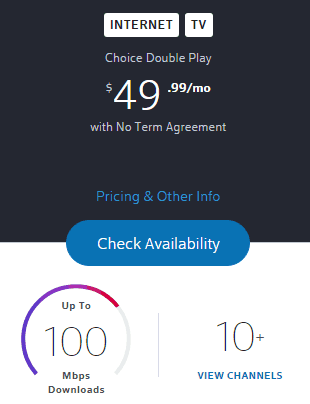

Charter Spectrum sold its merger with Time Warner Cable and Bright House Networks partly on its argument that modem fees would no longer be charged. Despite that, many former Time Warner Cable and Bright House customers still use their own modems, which has been a problem for a company that raised the standard internet speed available to residential customers from 15 Mbps to 100 Mbps (200 Mbps in some markets, mostly those also served by AT&T). Older modems often cannot achieve those speeds. Spectrum notifies affected customers in periodic campaigns, offering to replace their obsolete equipment, but many customers suspect hidden fees may be lurking in such offers and discard them.

Charter Spectrum sold its merger with Time Warner Cable and Bright House Networks partly on its argument that modem fees would no longer be charged. Despite that, many former Time Warner Cable and Bright House customers still use their own modems, which has been a problem for a company that raised the standard internet speed available to residential customers from 15 Mbps to 100 Mbps (200 Mbps in some markets, mostly those also served by AT&T). Older modems often cannot achieve those speeds. Spectrum notifies affected customers in periodic campaigns, offering to replace their obsolete equipment, but many customers suspect hidden fees may be lurking in such offers and discard them.

“Some modems that were issued years ago have become outdated. If you have a modem that was issued by us and hasn’t been swapped in the last six years, it might need to be replaced,” Spectrum tells customers. “To get a replacement modem, contact us or visit a Spectrum store. Please recycle your old modem or bring it to a Spectrum store for proper disposal. If you do a modem swap with us, you’ll receive a mail return label in your package, which can be used to return your old modem.”

Cox is also in a similar predicament. It runs seasonal checks on its network to identify customers using older DOCSIS modems, often DOCSIS 3.0 4×4 modems, which can only support four download channels. When it finds customers eligible for an upgrade, it mails postcards offering a “free modem upgrade,” usually supplying a SB6183 or SB8200 modem that can arrive in 24-48 hours. But many Cox customers suspect trickery from Cox as well, or run into poorly trained customer service representatives that reject the postcards, claiming the customer is ineligible.

Cox is also in a similar predicament. It runs seasonal checks on its network to identify customers using older DOCSIS modems, often DOCSIS 3.0 4×4 modems, which can only support four download channels. When it finds customers eligible for an upgrade, it mails postcards offering a “free modem upgrade,” usually supplying a SB6183 or SB8200 modem that can arrive in 24-48 hours. But many Cox customers suspect trickery from Cox as well, or run into poorly trained customer service representatives that reject the postcards, claiming the customer is ineligible.

“DOCSIS 3.0 8×4 or higher (or a DOCSIS 3.1) devices are required for all new Cox High Speed Internet customers,” Cox tells their internet customers. “Current Cox customers should ensure they have a minimum of a DOCSIS 3.0 device in order to consistently receive optimal speeds. Additionally, Ultimate customers are required to have a minimum of a DOCSIS 3.0 device with a minimum of 16×4 or higher channel bonding to achieve package speeds.”

In fact, most modem upgrade offers from your provider are likely genuine, but customers need to pay attention to any fine print.

In fact, most modem upgrade offers from your provider are likely genuine, but customers need to pay attention to any fine print.

Customers can also purchase their own upgraded modem if they want to avoid Comcast’s Gateway fee. Cox does not charge customers for modems sent as part of a free upgrade offer, but watch for erroneous charges on your bill and report them at once if they do appear. Charter Spectrum has recently introduced a $9.99 modem activation fee, applicable to new customer-owned or company-supplied cable modems. We do not know if that fee would apply in cases of an obsolete modem upgrade. Be sure to ask, and if the answer is no, make a note of the representative’s name in case a dispute arises later on.

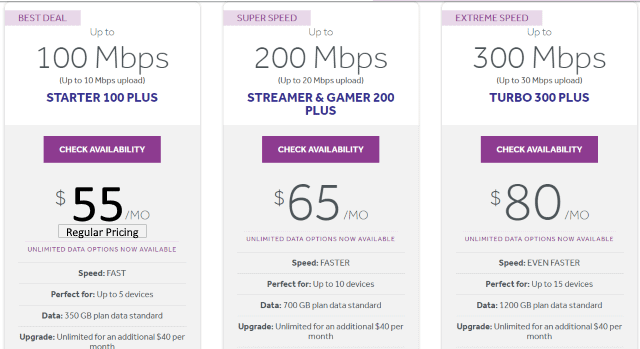

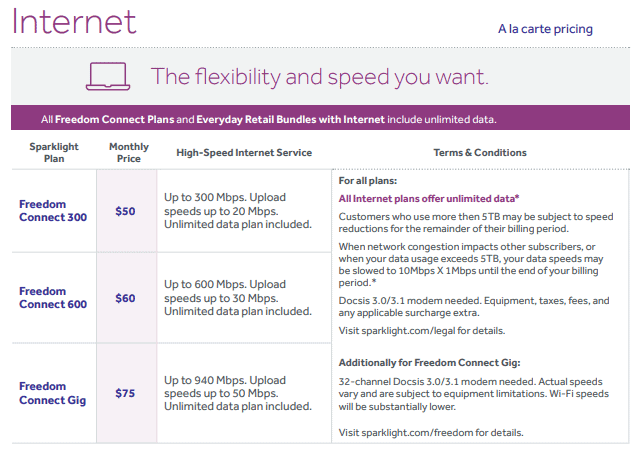

America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

America’s most costly large cable internet service provider is Sparklight, formerly known as Cable One. Its internet plans are usually data-capped and it barely offers new customers a pricing break before high regular prices apply. Sparklight primarily services small cities and towns, many income-challenged, in the middle of the country. Customers do not have much to rave about, because Sparklight puts its own profits far ahead of its customers. The cable operator was among the first to slap on data caps and was the nation’s most aggressive at getting rid of costly cable television channels.

Subscribe

Subscribe

Rose said she contacted at least five Mediacom employees, including a supervisor, and none were apparently familiar with this policy.

Rose said she contacted at least five Mediacom employees, including a supervisor, and none were apparently familiar with this policy.

A modem rental fee may also apply in most states, unless you use your own cable modem. Outside of New York and New Jersey, most legacy ELP customers have already experienced several

A modem rental fee may also apply in most states, unless you use your own cable modem. Outside of New York and New Jersey, most legacy ELP customers have already experienced several

Charter Spectrum sold its merger with Time Warner Cable and Bright House Networks partly on its argument that modem fees would no longer be charged. Despite that, many former Time Warner Cable and Bright House customers still use their own modems, which has been a problem for a company that raised the standard internet speed available to residential customers from 15 Mbps to 100 Mbps (200 Mbps in some markets, mostly those also served by AT&T). Older modems often cannot achieve those speeds. Spectrum notifies affected customers in periodic campaigns, offering to replace their obsolete equipment, but many customers suspect hidden fees may be lurking in such offers and discard them.

Charter Spectrum sold its merger with Time Warner Cable and Bright House Networks partly on its argument that modem fees would no longer be charged. Despite that, many former Time Warner Cable and Bright House customers still use their own modems, which has been a problem for a company that raised the standard internet speed available to residential customers from 15 Mbps to 100 Mbps (200 Mbps in some markets, mostly those also served by AT&T). Older modems often cannot achieve those speeds. Spectrum notifies affected customers in periodic campaigns, offering to replace their obsolete equipment, but many customers suspect hidden fees may be lurking in such offers and discard them. Cox is also in a similar predicament. It runs seasonal checks on its network to identify customers using older DOCSIS modems, often DOCSIS 3.0 4×4 modems, which can only support four download channels. When it finds customers eligible for an upgrade, it mails postcards offering a “free modem upgrade,” usually supplying a SB6183 or SB8200 modem that can arrive in 24-48 hours. But many Cox customers suspect trickery from Cox as well, or run into poorly trained customer service representatives that reject the postcards, claiming the customer is ineligible.

Cox is also in a similar predicament. It runs seasonal checks on its network to identify customers using older DOCSIS modems, often DOCSIS 3.0 4×4 modems, which can only support four download channels. When it finds customers eligible for an upgrade, it mails postcards offering a “free modem upgrade,” usually supplying a SB6183 or SB8200 modem that can arrive in 24-48 hours. But many Cox customers suspect trickery from Cox as well, or run into poorly trained customer service representatives that reject the postcards, claiming the customer is ineligible. In fact, most modem upgrade offers from your provider are likely genuine, but customers need to pay attention to any fine print.

In fact, most modem upgrade offers from your provider are likely genuine, but customers need to pay attention to any fine print.