Spending less, charging more in 2019.

Despite repeated claims from some in Washington that eliminating net neutrality would stimulate U.S. telecommunications companies to invest more in their networks, Charter Communications has announced a dramatic $1.9 billion cut in capital expenditures (CapEx) spending on its Spectrum cable systems for 2019.

Charter posted 2018 revenue of $43.6 billion (up 4.9 percent over 2017), with especially healthy returns for its internet service, which grew 7.1%. Charter earned $11.2 billion in revenue, up 5.9% in the fourth quarter of 2018 alone, partly from rate increases, reduced costs, and additional broadband customers.

Republican FCC commissioners have repeatedly argued that deregulating the internet by sweeping away net neutrality would stimulate companies to invest more in their networks. But it now appears the reverse is true. In 2017, Charter spent $8.7 billion on network investments; in 2018 the company spent $9.1 billion. But this year, with net neutrality no longer the law of the land, the cable company is planning to dramatically cut investments in 2019 to just $7 billion. The combined company, which now includes Time Warner Cable (TWC) and Bright House Networks (BH), has never spent this little on capital expenditures. The 2016 merger between Charter and TWC and BH forced a 189.4% spike in spending after the deal was completed, as Charter began a cable system overhaul and upgrade.

Charter is expecting it can distribute more of its revenue to shareholders, share buybacks, and debt payments as a result of the completion of its all-digital conversion project, which eliminated analog television signals from cable systems to make more room for revenue-enhancing internet service. The company also gets to lease more set-top boxes to customers seeking to view digital television signals on older analog TV sets.

Charter is expecting it can distribute more of its revenue to shareholders, share buybacks, and debt payments as a result of the completion of its all-digital conversion project, which eliminated analog television signals from cable systems to make more room for revenue-enhancing internet service. The company also gets to lease more set-top boxes to customers seeking to view digital television signals on older analog TV sets.

Charter also reports it has successfully completed its DOCSIS 3.1 internet upgrade to more than 99% of its cable systems, allowing the introduction of premium-priced gigabit internet speed.

Charter executives signaled investors earlier this month Charter expects to post greater revenue and profits as a result of the spending reductions, but these new-found gains will have no effect on the company’s ongoing plans to continue mildly aggressive rate increases in 2019.

Charter has not disclosed how much it plans to spend on its new mobile business in 2019. The company is marketing its mobile phone service more aggressively this year as it prepares to accept customers bringing existing phones to its cellular service, powered by Charter’s in-home and in-business Wi-Fi and Verizon Wireless’ 4G LTE network.

Subscribe

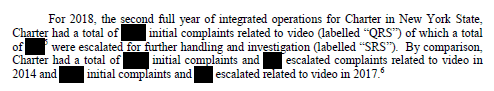

Subscribe Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

Stop the Cap! today appealed to New York’s Freedom of Information Law Officer to force Charter Spectrum to unredact customer complaint statistics on Charter Communication’s performance in New York since its 2016 merger with Time Warner Cable.

A

A  The 101-page filing maintains the FCC overreached by imposing any deal conditions on the 2016 multi-billion dollar merger deal, especially those that might require the merged company to spend money to improve service to customers. CEI argued such conditions were “arbitrary and capricious” and had no place as part of approving a business merger transaction.

The 101-page filing maintains the FCC overreached by imposing any deal conditions on the 2016 multi-billion dollar merger deal, especially those that might require the merged company to spend money to improve service to customers. CEI argued such conditions were “arbitrary and capricious” and had no place as part of approving a business merger transaction.