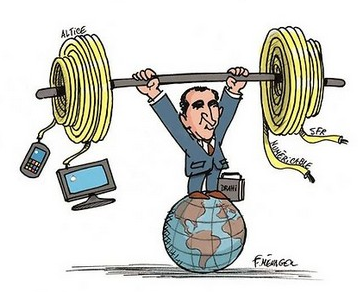

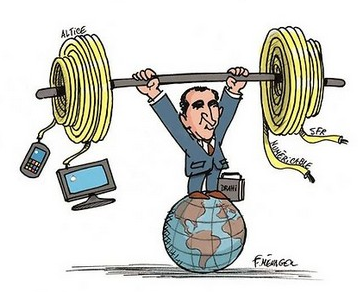

Patrick Drahi

“If he can succeed with a corporate-friendly Trump Administration and his lackey Republican legislators and regulators, Patrick Drahi’s Altice could seek to own or control up to 30% of the American telecoms market,” said A.W. Dewalle, a researcher studying Altice’s unprecedented acquisition-frenzy across the world’s telecommunications marketplace. “His IPO in the land of Uncle Sam is just the first shot and it will make a lot of executives very rich and consolidate America’s cable industry.”

Wall Street banks are clamoring for a piece of Altice’s initial public offering, announced this week. The big winners, who will split substantial fees paid to advise Altice USA, are Goldman Sachs, JP Morgan, Morgan Stanley and Citi. The IPO will allow the Drahi-controlled Altice USA to raise money for further acquisitions in the United States and to potentially restructure its existing debt, run up acquiring Cablevision and Suddenlink.

Reuters reported that Drahi’s biggest U.S. shareholders — BC Partners and the Canadian Pension Plan Investment Board will use the IPO as an opportunity to sell some of their combined 30% stake in Altice USA, giving Drahi further assurance he will stay firmly in control of the American operation as he takes on new investors.

Les Echos reports Drahi’s pattern is a familiar one for a man in a hurry to take a much bigger stake in the American telecom market, where profits are high and competition is relatively low. By raising additional funds, Altice USA can show financial strength as it appeals to bankers to loan it the billions in will need to acquire existing cable (and potentially phone) companies. If Altice uses some of the money to repay its existing $20 billion U.S. debt, that could also win the company favorable interest rates on its future loan portfolio.

Drahi is an acquisition specialist, having bought more than 30 companies to add to his Altice portfolio since its start in 2002. Low interest rates, favorable banking terms and corporate deregulation have fueled the shopping spree. With the election of Donald Trump in the U.S., Altice is convinced the sky is the limit when it comes to mergers and acquisitions.

“Everything about his government and the people he has put in place at regulatory agencies says deregulation, ‘laissez-faire,’ and consumers beware,” said Dewalle, a point echoed in part by the Financial Times.

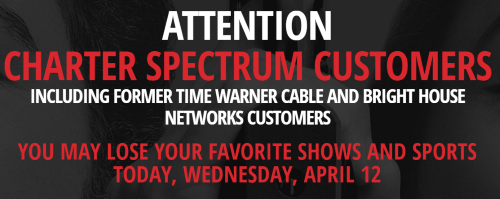

The election of Donald Trump has lifted expectations among chief executives that it will be easier to consolidate companies in the telecoms, media and technology (TMT) sector, as the Republican president has a more laissez-faire approach towards competition. Many media and telecom players are under pressure to boost margins and find new growth avenues, while facing declining sales, according to a senior banker in the industry. “M&A might be the only option for many companies in this sector and Altice will certainly try to play a big role in this,” said [one] banker.

Altice is already laying the public relations groundwork to convince skeptical legislators and regulators that an Altice buyout is not bad news for customers. Altice is spending millions to scrap Cablevision’s existing hybrid coax-fiber network for a 100% fiber to the home replacement. Other upgrades are also ongoing across Suddenlink’s footprint.

Altice is already laying the public relations groundwork to convince skeptical legislators and regulators that an Altice buyout is not bad news for customers. Altice is spending millions to scrap Cablevision’s existing hybrid coax-fiber network for a 100% fiber to the home replacement. Other upgrades are also ongoing across Suddenlink’s footprint.

Because the American telecom marketplace is not nearly as competitive as the one Altice faces in Europe, Americans are accustomed to paying for broadband and television services at prices that would be scandalous in France. The excess profits earned in America can help Altice finance fiber upgrades in its more competitive European markets. Altice confirmed this week it planned to invest more in 4G wireless upgrades for its SFR division in France and will cover 22 million French homes with fiber to the home service by 2022 and 5.3 million homes in Portugal by 2020.

How big will Mr. Drahi seek to get in the United States? He testified before the Economic Affairs Committee of the French Senate last June, telling legislators he owns or controls about one-third of the French telecom market. In the United States, he controls just 2%, leaving plenty of room to grow.

French business experts predict Drahi will initially seek to sweep up the remaining independent cable operators in the States into the Altice empire before turning attention to a big player like Comcast or Charter Communications, the largest and second-largest American cable operator respectively. Publicly traded companies like Cable ONE would be the first prime targets for an Altice buyout. But Drahi could also repeat his Cablevision acquisition by offering a premium price for privately held operators like Cox Communications, which has a presence in larger cities, and Mediacom — which provides service in 23 states and has a big presence in the midwest.

Most of the rest of America’s independent cable operators are small, regional operations serving smaller communities. Drahi has his choice of these kinds of operators that include Adams Cable, Armstrong, Atlantic Broadband (owned by Canada’s Cogeco), Blue Ridge Communications, Buckeye Broadband, Hargray, Midco, Northland, Service Electric, TruVista, Wave Broadband (exploring a sale), and WOW, among others.

Thus far, Drahi has not shown much interest in acquiring telephone companies, so analysts expect him to confine his acquisitions to the cable business. Even if Drahi acquires a substantial cable portfolio in the United States, he will argue he still faces competition from telephone companies in those same service areas. What Drahi won’t do is compete from the ground up by building a competitive cable system to face off against a firmly entrenched American duopoly.

“That would be bad for business,” said Dewalle.

Subscribe

Subscribe