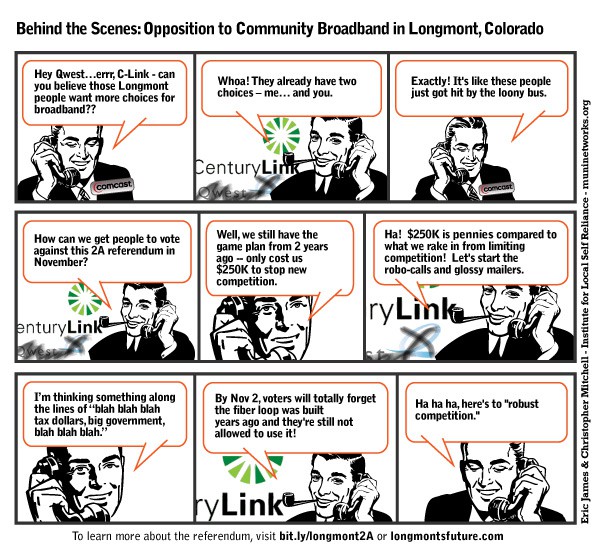

While surface reporting on “white space” broadband and “super Wi-Fi” seem to suggest the United States is on the cusp of opening up much of the UHF television dial to wireless broadband, behind the scenes broadband advocates are fretting about being outmaneuvered by the powerful broadcast lobby. The theory behind “white space” broadband seems simple enough. Anyone who has flipped channels up and down the UHF dial sees a lot of unused real estate. While most cities receive 5-10 UHF TV channels, there are dozens of apparently empty channels filled with what seems to be nothing at all. Can’t we make more efficient use of the UHF dial and open the excess to other uses?

The FCC has been studying just that, with the proposition that broadcasters could be relocated closer together or agree to sell their broadcast license and sign off the air for good. Theoretically, the UHF dial would be reduced to channels 14-30. Stations on channels 31-51 would have to relocate down the dial to make way for broadband.

That was the plan anyway

Naturally, the National Association of Broadcasters (NAB), the broadcast industry lobbying group, was not happy to learn of this plan, which is still heavily promoted by wireless telecommunications companies. They quickly argued there were not enough UHF channels left to accommodate every TV station on the air today, and some cities bordering Canada faced losing major stations if the plan was adopted.

In the clash of the lobbying titans, it appears broadcasters have at least temporarily won the upper hand. Legislation authored by the powerful House Communications Subcommittee Chairman Greg Walden (R-Ore.), would grant the FCC authority to conduct spectrum horse-trading and auctions, but only if the sales take “all reasonable efforts to preserve” the coverage area of impacted broadcast stations.

In the minds of several wireless broadband advocates, “reasonable efforts” kills it. That key passage is open to wide interpretation, which in Beltway language means a full employment program for Washington law firms who will end up letting a judge decide what “reasonable” really means.

Blair Levin, an attorney who served as chief of staff to FCC Chairman Reed Hundt from 1993 to 1997, where he oversaw the implementation of the disastrous 1996 Telecom Act, is all sour grapes about the latest developments in Congress. That is to be expected — he was once considered the Obama Administration’s chief “broadband czar.”

“The legislation ties the FCC’s hands in a variety of ways,” Levin tells TVNewsCheck. “It opens it up to litigation risk, which then, in conjunction with the other handcuffs, makes it difficult to pull off a successful auction. The nature of the bill dramatically increases the probability that there will be less spectrum recovered and less money for the [U.S.] Treasury.”

Broadcasters have been legitimately worried about where they might fit within the new, slimmed-down UHF dial. The more broadcasters packed closer together, the greater the chance of interference and reduced signal coverage for those who happen to live between two cities sharing the same channel number. The NAB has consistently opposed forcing station-owners’ hands and wants stations compensated for their costs and inconvenience.

Before the first “white space” broadband signal takes to the airwaves, the government will have to set aside at least $3 billion to defray expenses incurred by television stations moving down the dial. With language that guarantees broadcasters won’t have to suffer from an interference nightmare, FCC engineers will have a much harder time finding enough channels for the number of stations that need to move. That could mean fewer channel positions up for auction.

Blair believes stations can extract even more by playing the litigation threat card.

“Nobody wants to go to an auction when there is the threat of a judge anywhere having the ability of holding it up,” Blair said. “I believe a good lawyer could find a way to get the question of whether the FCC took all reasonable efforts in front of a judge. If you are designing the auction and a big law firm shows up and says, ‘If you don’t take care of my single broadcaster, we are going to find a way to get to court.’ That’s a real threat.’’

The Lady Gaga problem

Assuming Washington can fling enough cash to soothe the nerves of worried broadcasters, impediments to white space broadband don’t stop with the local Fox station. The next complication is the wireless microphone issue. When you see Lady Gaga in her latest outrageous outfit, you probably are not noticing her wireless microphone. Performers of all kinds use these low power devices that often work over unused UHF spectrum. Only it may not be unused for long.

Spectrum Bridge, a “white space” database administrator charged with coordinating who is using what frequency for what purpose, understands the challenges of trying to keep track of TV reporters, bands on tour, and other wireless microphone users, who all expect an interference-free experience. Electric companies and municipalities also plan to utilize white space spectrum to manage smart city and smart grid communications. A year later, Super Wi-Fi applications that deliver longer distance Wi-Fi service are expected to arrive.

It’s becoming a crowded neighborhood.

Congress’ NAB-friendly, Republican-sponsored bill may be modified substantially in a Democratic-controlled Senate, and there is still plenty of time for lobbyists to work their magic. But it’s safe to say that those who have waited at least seven years for white space broadband to become a reality will have to wait a little longer.

Subscribe

Subscribe