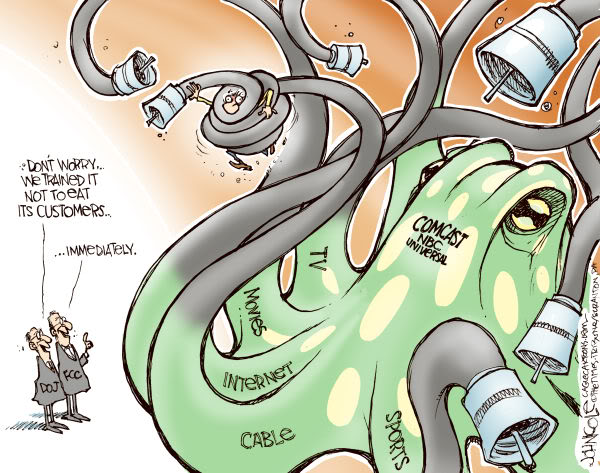

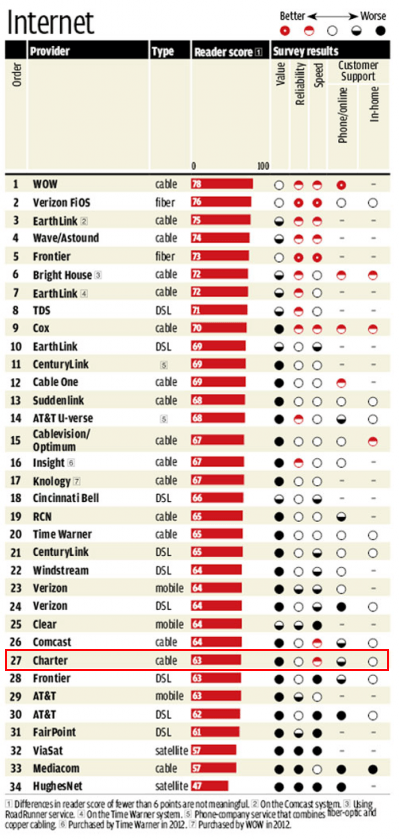

Comcast has offered the Commission a vague preview of how it intends to improve cable television service for New York customers, but rarely discloses important details about the costs and limitations their “improvements” will bring.

While Comcast is excited about the proposition of transitioning Time Warner Cable customers away from the current mixed analog-digital platform to an all-digital lineup, Time Warner Cable customers have paid less and avoided costly, unwanted extra equipment as a result of the choices consciously made by Time Warner Cable.

While Comcast is excited about the proposition of transitioning Time Warner Cable customers away from the current mixed analog-digital platform to an all-digital lineup, Time Warner Cable customers have paid less and avoided costly, unwanted extra equipment as a result of the choices consciously made by Time Warner Cable.

Comcast and Time Warner Cable have different philosophies about how to best deliver the bulging cable television packages most cable systems now offer:

- Time Warner Cable adopted “Switched Digital Video” from BigBand Networks, a technology that lets Time Warner deliver only the digital signals that are being watched in a service group or node, instead of the entire lineup.[1] Since it is unlikely subscribers are watching every niche channel on offer, Time Warner has been able to reclaim unused bandwidth. As a result, customers using older cable-ready televisions can continue to access analog television channels without the use of a costly, often unwanted set top box.

- Comcast has more aggressively chosen a path to all-digital television service, moving most of their television channels to encrypted digital technology that requires a Comcast set top box, a less costly Digital Transport Adapter (DTA) designed for secondary-use televisions, or a CableCARD. Customers must choose one of these technologies, usually at an added-cost to access their cable television service.[2]

Time Warner Cable also began deploying DTA equipment in certain areas to free up additional bandwidth on its cable systems while still leaving most analog channels intact. The DTA boxes are supplied free of charge during an introductory phase lasting up to a year, after which a $0.99 monthly charge for each box is imposed.[3] (That fee has recently been raised in certain markets, including New York City, to $1.50/mo.[4] [5])

In contrast, Comcast customers were initially entitled to receive up to three no-cost DTAs to install on televisions not equipped with a Comcast set top box.[6]

On January 1, 2013 Comcast began informing subscribers a new $1.99/month “additional outlet service charge,” now applied for each DTA installed. [7]

On January 1, 2013 Comcast began informing subscribers a new $1.99/month “additional outlet service charge,” now applied for each DTA installed. [7]

Public officials in Eagan, Minn., responding to consumer complaints about the new charge, suspected Comcast was attempting an end run around the Federal Communications Commission’s prohibition of “excessive fees for cable equipment.”[8] The additional outlet fee was deemed by Comcast to be a service fee, not an equipment charge.[9]

Attorney Mike Bradley was hired by a group of suburban Minneapolis cable commissions to investigate the legitimacy of Comcast’s new DTA service charge. If the fee were classified as an equipment charge, Comcast would charge 50 cents per DTA based on rate forms filed with the Minnesota cable commissions he represents, Bradley told The Pioneer Press.[10]

For the average Comcast subscriber, the result was another rate increase in return for digital television service. Subscribers with three DTA’s now pay up to $5.97 extra per month in order to continue to receive the exact same programming on the same number of televisions within their household – a $25 annual surcharge per DTA, $75 if the customer uses three DTA’s, complained Eagan, Minn. Mayor Mike Maguire in a letter to Sen. Amy Klobuchar.[11]

Comcast’s fees, in addition to being well in excess of the actual cost of the equipment, will earn the company at least $550 million annually in new revenue – all for equipment that costs the company around $50 per unit.[12] Because Comcast is encrypting its lineup, even televisions equipped with QAM tuners, capable of receiving digital television signals without a set top box, will also eventually need the new equipment to unscramble television signals.

—

[1]http://www.cedmagazine.com/news/2009/09/time-warner-cable-serves-up-sdv-in-n.y.,-dallas,-l.a.

[2]http://customer.comcast.com/help-and-support/cable-tv/how-bill-will-change-with-digital-migration

[3]http://www.cedmagazine.com/news/2012/01/time-warner-cable-wraps-up-all-digital-conversion-pilot-in-maine

[4]https://newsroom.charter.com/

[5]http://www.timewarnercable.com/en/residential-home/support/faqs/faqs-tv/basictvencryption/what-will-the-digital-adapter-cost.html

[6] http://www.twincities.com/ci_22617153/comcast-fee-plan-cause-confusion-controversy

[7]http://customer.comcast.com/help-and-support/cable-tv/how-bill-will-change-with-digital-migration

[8]http://transition.fcc.gov/Bureaus/Cable/News_Releases/nrcb4009.txt

[9]http://stopthecap.com/2013/02/21/comcast-calls-1-99-charge-for-digital-adapters-a-service-fee-to-avoid-fcc-complications/

[10]http://www.twincities.com/ci_22617153/comcast-fee-plan-cause-confusion-controversy?IADID=Search-www.twincities.com-www.twincities.com

[11]https://dl.dropboxusercontent.com/u/9008/pioneerpress/yourtechweblog/Eagan%20-%20Sen%20Klobuchar%20ltr%20re%20Cable%20Rate%20Concerns%203-5-13.pdf

[12]http://cisco-news.tmcnet.com/news/2011/04/25/5464600.htm

Subscribe

Subscribe

“I think its to early to say how its going to impact the traditional world,” Williamson said in response to a question about whether Boxless Homes will replace traditional MPEG-2 services or augment them. “Currently we don’t even market it or tell anyone about it. The IP video stuff has rolled out word of month. These are the early adopters who are understanding that there’s a TWC app that goes on the Roku box. They decide to go down to their kid’s room or somewhere else and make that their secondary outlet. That’s how it’s evolving now. I think as it gets more and more prevalent and we get on more and more devices, which is going to take time, then its going to be more interesting. Our app on Samsung TV is much closer to our same look and feel as on our se-sop box. Unfortunately these are the real high-end Samsung TVs with the smart hub technology and things like that. There’s not enough of them to understand what the impact is on our footprint.”

“I think its to early to say how its going to impact the traditional world,” Williamson said in response to a question about whether Boxless Homes will replace traditional MPEG-2 services or augment them. “Currently we don’t even market it or tell anyone about it. The IP video stuff has rolled out word of month. These are the early adopters who are understanding that there’s a TWC app that goes on the Roku box. They decide to go down to their kid’s room or somewhere else and make that their secondary outlet. That’s how it’s evolving now. I think as it gets more and more prevalent and we get on more and more devices, which is going to take time, then its going to be more interesting. Our app on Samsung TV is much closer to our same look and feel as on our se-sop box. Unfortunately these are the real high-end Samsung TVs with the smart hub technology and things like that. There’s not enough of them to understand what the impact is on our footprint.”

Local Video Facilities Fee

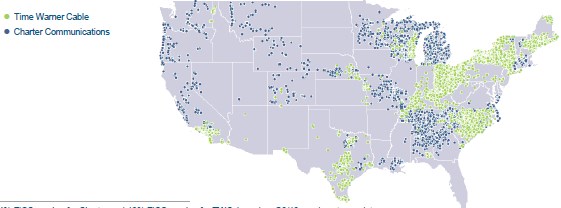

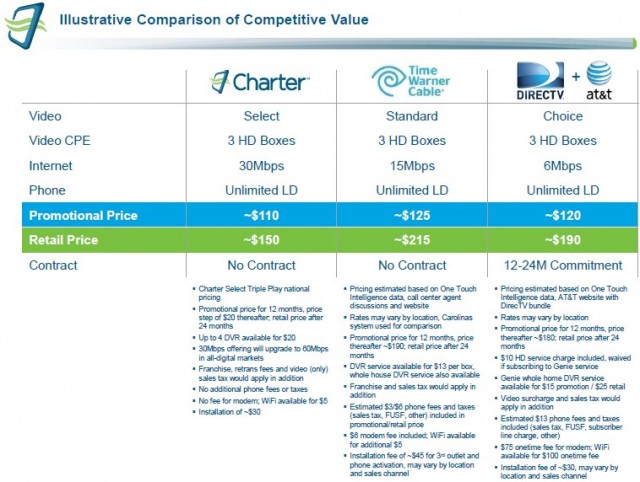

Local Video Facilities Fee Time Warner Cable executives brushed away Charter Communications’ first public offer to acquire the second largest cable company in the country in a debt-financed deal that Time Warner considers a lowball offer.

Time Warner Cable executives brushed away Charter Communications’ first public offer to acquire the second largest cable company in the country in a debt-financed deal that Time Warner considers a lowball offer.

Charter Communications chief operating officer John Bickham launched

Charter Communications chief operating officer John Bickham launched

Cox

Cox