If you live in parts of the Hudson Valley (N.Y.) or Ohio where Frontier Communications provides phone service, Vantage TV may be coming to your neighborhood soon.

If you live in parts of the Hudson Valley (N.Y.) or Ohio where Frontier Communications provides phone service, Vantage TV may be coming to your neighborhood soon.

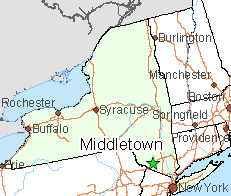

Frontier’s cable television solution for customers still served by its legacy copper wire telephone network appears to be an IPTV service similar to AT&T’s U-verse. Vantage TV is already available to around 200,000 Connecticut customers served by Frontier, inherited from AT&T. Frontier also offers Vantage in Durham, N.C. and has applied for a statewide video franchise in Ohio (granting authority to offer service anywhere in the state it chooses) and another to serve Middletown, N.Y., a community of 28,000 in the Hudson Valley.

Frontier claims over the next four years it will offer Vantage in as many as 40 of its markets, many still served by legacy copper wiring. That represents about three million homes. After a second phase of buildouts, Frontier claims it will to provide video service to about half of the 8.5 million homes in its service area.

In late June, Frontier applied for a video franchise agreement in Middletown, where it expects to compete against Charter Communications (formerly Time Warner Cable). It will be the first time Frontier offers video service in New York.

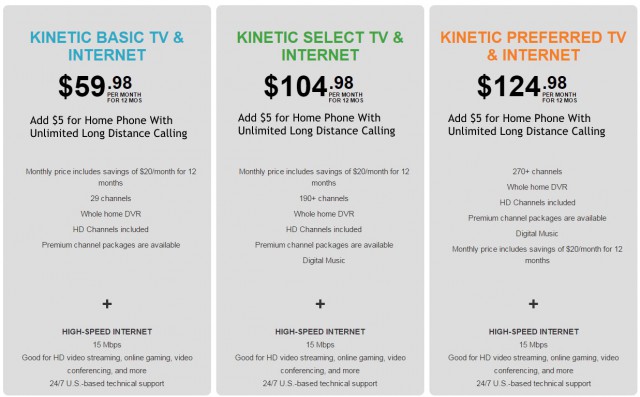

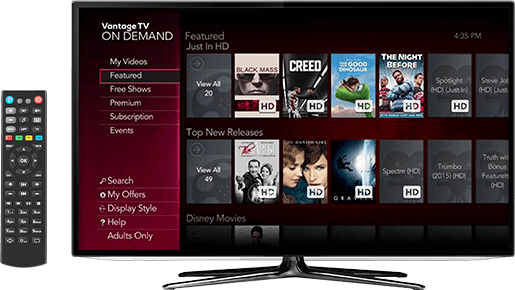

Vantage TV offers up to 300 channels typically bundled with phone and internet service. Customers are provided a “total-home DVR” with 1TB of storage that can record up to six shows at the same time and played back on up to four wireless cable boxes attached to different televisions. An upgraded version 3.0 of Ericsson’s Mediaroom platform offers advanced set-top box features like improved visual search and the ability to watch up to four channels at once in a mosaic. Another feature lets customers bring up a small video screen showing another channel, useful if you are channel surfing during an ad break.

Vantage TV offers up to 300 channels typically bundled with phone and internet service. Customers are provided a “total-home DVR” with 1TB of storage that can record up to six shows at the same time and played back on up to four wireless cable boxes attached to different televisions. An upgraded version 3.0 of Ericsson’s Mediaroom platform offers advanced set-top box features like improved visual search and the ability to watch up to four channels at once in a mosaic. Another feature lets customers bring up a small video screen showing another channel, useful if you are channel surfing during an ad break.

Multichannel News interviewed several Frontier executives about the service, which the company is confident will give it a competitive video product to market to customers. Until Frontier bought AT&T’s Connecticut customers (and its U-verse fiber-to-the-neighborhood system), its only experience selling cable television came from its acquisition of Verizon FiOS systems serving Fort Wayne, Ind., and parts of Oregon and Washington. Frontier quickly learned the value of Verizon’s volume discounts for video programming, which it lost soon after acquiring the systems. In 2011, customers faced massive price hikes for video service and an unusual effort to convince them to switch to satellite TV instead — quite a downgrade from fiber to the home service.

Connecticut, in contrast, is served with a mix of fiber and old copper wiring that has been in place for decades, since the days the state was served by the independent Southern New England Telephone Company. Learning how to deliver reasonable video quality over copper wires in Connecticut gave Frontier experience to go ahead with targeted upgrades that can boost broadband speeds and deliver HD video over an internet connection as low as 2.6Mbps in other states.

Connecticut, in contrast, is served with a mix of fiber and old copper wiring that has been in place for decades, since the days the state was served by the independent Southern New England Telephone Company. Learning how to deliver reasonable video quality over copper wires in Connecticut gave Frontier experience to go ahead with targeted upgrades that can boost broadband speeds and deliver HD video over an internet connection as low as 2.6Mbps in other states.

In short, Frontier’s business plan for video may work if it can keep network expansion and technology costs as low as possible. Video programming costs are likely to be another matter, however. As programming costs increase in contract renewals, some cable operators are playing hardball and dropping channels that get too expensive for comfort. But many of those channel drops alienate customers. Frontier appears to be following an opposite formula — making sure potential customers know they are still carrying networks the cable operator in the area dropped. Comcast dropped Yankees regional sports channel YES, but Frontier still offers it to its Connecticut customers and goes out of its way to promote its availability.

Hallmark Channel and Hallmark Movies & Mysteries — two networks popular with older viewers who are among the most loyal to cable television, got the axe in 2010 on AT&T U-verse in Connecticut. After Frontier acquired the Connecticut system, it put the two networks back on the lineup.

The more customers Frontier can show it has at the negotiating table, the better position Frontier is in to secure discounts for the video programming it carries. Volume, volume, volume makes all the difference when competing against giant cable conglomerates like Comcast and Charter. Even if Frontier finds it eventually has to drop overpriced channels, it has a much more friendly relationship with over-the-top online video services like Netflix to offer customers as an alternative. Vantage customers can find Netflix’s main menu as a traditional TV channel on the Vantage lineup, allowing subscribers to choose any Netflix show to watch on their television. In the future, Frontier might offer customers other network’s apps as well, making it easy to stream on demand video without having to use a Roku or other similar device.

Subscribe

Subscribe The Federal Communications Commission

The Federal Communications Commission  Polka pointed to AT&T’s acquisition of DirecTV as an example of how disproportionate fees cost small independent cable companies much more on a per-subscriber basis than telecom giant AT&T has to pay for almost 20 million DirecTV satellite customers.

Polka pointed to AT&T’s acquisition of DirecTV as an example of how disproportionate fees cost small independent cable companies much more on a per-subscriber basis than telecom giant AT&T has to pay for almost 20 million DirecTV satellite customers.![This spring, The Consumerist broke down a typical AT&T U-verse bill loaded in junk fees and surcharges. (The RED numbers [1, 4-10, 13-14, 17-20, 22] are AT&T-originating fees; BLUE numbers [2-3, 11-12, 15-16, 21, 23-25] are government fees)](https://stopthecap.com/wp-content/uploads/2016/06/att-fees-640x926.png)

Comcast will challenge cord cutting and entice cord-nevers with

Comcast will challenge cord cutting and entice cord-nevers with  Comcast will deliver Stream over the same network it uses for content delivery to game consoles that does not count against Comcast’s

Comcast will deliver Stream over the same network it uses for content delivery to game consoles that does not count against Comcast’s  Windstream this week

Windstream this week