Powell

A former chairman of the Federal Communications Commission turned top cable lobbyist rang the warning bell at an industry convention this week, recommending America’s cable operators hurry out usage caps and usage-based billing before a perception takes hold the industry is trying to protect cable television revenue.

Michael Powell, the former head of the FCC during the Bush Administration is now America’s top cable industry lobbyist, serving as president and CEO of the National Cable & Telecommunications Association (NCTA). From 2001-2005 Powell claimed to represent the interests of the American people. From 2011 on, he represents the interests of Comcast, Time Warner Cable, Cox, and other large cable operators.

Attending the SCTE Cable-Tec Expo 2013 in Atlanta, Powell identified the cable industry’s top priority for next year: “broadband, broadband, and broadband.”

The NCTA fears the current unregulated “Wild West” nature of broadband service is ripe for regulatory checks and balances. The NCTA plans to prioritize lobbying to prevent the implementation of consumer protection regulations governing the Internet. Powell warned it would be “World War III” if the FCC moved to oversee broadband by changing its definition as an unregulated “information service” to a regulated common carrier utility.

Powell is very familiar with the FCC’s current definition because he presided over the agency when it contemplated the current framework as it applies to DSL and cable broadband providers.

While Powell has a long record opposing blatant Net Neutrality violations that block competing websites and services, he does not want the FCC meddling in how providers charge or provision access.

Powell believes some of cable’s biggest problems come from bad marketing.

Powell disagreed with statements from some Wall Street analysts like Craig Moffett who earlier predicted the window for broadband usage-based limits and fees was closing or closed already.

Powell does not care that consumers are accustomed to and overwhelmingly support unlimited access. Instead, he urged cable executives to “move with some urgency and purpose” to implement usage-based billing for economic reasons, despite the growing perception such limits are designed to protect cable television service from online competition.

“I don’t think it’s too late,” Powell said. “But it’s not something you can wait for forever.”

Powell pointed to the success wireless carriers have had forcing the majority of customers to usage capped, consumption billing plans and believes the cable industry can do the same.

The NCTA president also described many of the industry’s hurdles as marketing and perception problems.

The cable industry, long bottom-rated by consumers in satisfaction surveys, can do better according to Powell, by making sure they are nimble enough to meet competition head-on.

Powell described Google Fiber as a limited experiment unlikely to directly compete with cable over the long-term, and with a new version of the DOCSIS cable broadband platform on the way, operators will be able to compete with speeds of 500-1,000Mbps and beyond. He just hates that it’s called DOCSIS 3.1, noting it wasn’t “consumer-friendly” in “a 4G and 5G world.”

Kevin Hart, executive vice president and chief technology officer of Cox Communications joked the marketing department would get right on it.

Subscribe

Subscribe Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.

Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.

Comcast

Comcast

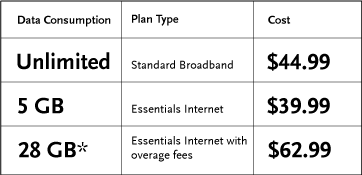

Time Warner Cable will not follow Comcast, Charter, Cox and Mediacom by imposing usage caps or move towards a compulsory usage-based billing scheme.

Time Warner Cable will not follow Comcast, Charter, Cox and Mediacom by imposing usage caps or move towards a compulsory usage-based billing scheme.

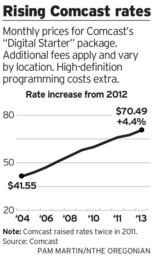

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.