Customer satisfaction with fiber to the home internet service is so high, one industry leader says the only time customers cancel service is if they move or die.

Customer satisfaction with fiber to the home internet service is so high, one industry leader says the only time customers cancel service is if they move or die.

Carl Russo, CEO of internet equipment vendor Calix, says phone companies are relying on fiber optic networks to turn their struggling businesses around except in the most rural areas of the country.

“Fixed wireless will sometimes be the right choice and Calix’s software supports it. But our telco customers with fiber will lose very few customers. If they provide strong, customer-focused service, no one will have a reason to switch,” Russo told Dave Burstein’s Fast Net News. “It’s only a slight exaggeration to say customers only churn if they move or die. This is provided the service provider chooses to ‘own’ the subscriber experience. A service provider that invests in fiber but doesn’t further invest in an excellent subscriber experience is still vulnerable.”

Russo argues that fiber to the home service has been the right choice for most of the developed world for several years now, at least where there is hearty competition between providers.

Where competition is lacking, phone companies often still rely on archaic DSL service, which is increasingly incapable of competing with even smaller cable operators. Phone companies are now up against the wall, forced to recognize that existing, decades-old copper wire infrastructure cannot sustain their future in the broadband business. Companies that drag their feet on fiber upgrades are bleeding customers, and some companies are even in bankruptcy reorganization.

Russo

Fiber networks are future-proof, with most offering up to gigabit speed to consumers and businesses. But upgrading to 10 Gbps will “add little to the cost” once demand for such faster speed appears, Russo said.

Fast Net News notes that France Telecom, Telefonica Spain, Bell Canada, and Telus have all proven successful using fiber to the home service to compete with cable companies to market internet access. Companies that approved less costly fiber to the neighborhood projects that relied on keeping a portion of a company’s legacy copper network, including AT&T, BT in the United Kingdom, and Deutsche Telekom in Germany, have had to bring back construction equipment to further extend fiber optic cables to individual customer homes — a costly expense.

Even public broadband projects like Australia’s National Broadband Network (NBN) paid dearly for a political decision to downsize the NBN’s original fiber optic design to save money. The NBN was hobbled by a more conservative government that came to power just as the network was being built. Many NBN customers ended up with a more advanced form of DSL supplied from oversubscribed remote terminals, which delivered just 50 Mbps to some subscribers. For-profit companies have also been pressured to keep costs down and limit fiber rollouts by Wall Street and investors. Verizon FiOS is the best known American example, with further network expansion of the fiber optic service essentially shelved in 2010 at the behest of investors that claimed the upgrades cost too much.

![]() Underfunded upgrades often bring customer dissatisfaction as speeds cannot achieve expectations, and many hybrid fiber-copper networks are less robust and more subject to breakdowns. In the United Kingdom, BT’s “super fast” broadband initiative has been a political problem for years, and communities frequently compete to argue who has the worst service in the country. BT’s fiber-to-the-village approach supplies fiber internet service to street cabinets in smaller communities that link to existing BT copper phone lines that are often in poor shape. Customers often get less than 50 Mbps service from BT’s “super fast” service while a few UK cable companies are constructing all-fiber networks in larger cities capable of supplying gigabit internet speed to every customer.

Underfunded upgrades often bring customer dissatisfaction as speeds cannot achieve expectations, and many hybrid fiber-copper networks are less robust and more subject to breakdowns. In the United Kingdom, BT’s “super fast” broadband initiative has been a political problem for years, and communities frequently compete to argue who has the worst service in the country. BT’s fiber-to-the-village approach supplies fiber internet service to street cabinets in smaller communities that link to existing BT copper phone lines that are often in poor shape. Customers often get less than 50 Mbps service from BT’s “super fast” service while a few UK cable companies are constructing all-fiber networks in larger cities capable of supplying gigabit internet speed to every customer.

Calix is positioned to earn heavily by selling the equipment and infrastructure that will power future fiber network upgrades that are inevitable if companies want to attract and keep customers. A new round of federal rural broadband funding will help phone companies pay for the upgrades, which means many rural Americans will find fiber to the home service in their future.

Subscribe

Subscribe Even with the threat of COVID-19 and a virtual nationwide work-from-home initiative, the new owners of Frontier Communications’ network in Washington, Oregon, Montana and Idaho are moving rapidly to repair persistent network issues, create a backup network, and lay the foundation to bring fiber to the home service to 85% of its customers over the next three years.

Even with the threat of COVID-19 and a virtual nationwide work-from-home initiative, the new owners of Frontier Communications’ network in Washington, Oregon, Montana and Idaho are moving rapidly to repair persistent network issues, create a backup network, and lay the foundation to bring fiber to the home service to 85% of its customers over the next three years.

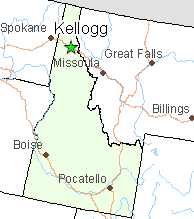

Among the first towns to get fiber service are Kellogg, Moscow, and Coeur d’Alene — all in Idaho. Work has already commenced and is expected to be finished by fall. Ziply wants to keep construction costs as low as possible, so it intends to do aerial deployment of fiber by wrapping the optical cable around existing copper wire telephone cables already on the pole. This process, known as “overlashing” will simplify installation by not requiring additional space to place fiber cables next to existing telephone wiring or going to the effort of removing the existing copper wiring, which raises costs.

Among the first towns to get fiber service are Kellogg, Moscow, and Coeur d’Alene — all in Idaho. Work has already commenced and is expected to be finished by fall. Ziply wants to keep construction costs as low as possible, so it intends to do aerial deployment of fiber by wrapping the optical cable around existing copper wire telephone cables already on the pole. This process, known as “overlashing” will simplify installation by not requiring additional space to place fiber cables next to existing telephone wiring or going to the effort of removing the existing copper wiring, which raises costs. To further speed fiber upgrades, Ziply acquired Wholesail Networks, already contracted to manage fiber network design for Ziply. Company officials quickly identified multiple weak spots in Frontier’s network, particularly relating to its resiliency when fiber cables were cut or copper wiring was stolen. Ziply is building in network redundancy, with each portion of its network served by at least two sets of fiber cabling and identical equipment in each of more than 130 central switching offices. In many markets, Ziply will maintain at least three redundant fiber connections to make certain if one (or two) networks go down, customers can still be served by a third with no interruption in service.

To further speed fiber upgrades, Ziply acquired Wholesail Networks, already contracted to manage fiber network design for Ziply. Company officials quickly identified multiple weak spots in Frontier’s network, particularly relating to its resiliency when fiber cables were cut or copper wiring was stolen. Ziply is building in network redundancy, with each portion of its network served by at least two sets of fiber cabling and identical equipment in each of more than 130 central switching offices. In many markets, Ziply will maintain at least three redundant fiber connections to make certain if one (or two) networks go down, customers can still be served by a third with no interruption in service. Verizon does not want their customers to worry about their wireless and home internet bills during the COVID-19 crisis, so they are introducing some new affordable plans for low-income households, waiving late and overlimit fees, and giving wireless customers an extra 15 GB on their data allowance for the next month.

Verizon does not want their customers to worry about their wireless and home internet bills during the COVID-19 crisis, so they are introducing some new affordable plans for low-income households, waiving late and overlimit fees, and giving wireless customers an extra 15 GB on their data allowance for the next month.

In fact, Cable One charges so much money for internet, they

In fact, Cable One charges so much money for internet, they  AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.

AT&T and Verizon have their own approaches to deal with reluctant customers. Verizon FiOS customers face steep price hikes when their promotions expire, but the opportunity to score a better deal is still there, if Verizon is in the mood that quarter. Verizon remains sensitive about their subscriber numbers and growth, so when a quarter looks like it will be difficult, the promotions turn up. AT&T prefers to play a shell game with their customers. Most recently, the company has given a cold shoulder to its U-verse product, treating it like yesterday’s news and best forgotten. AT&T literally markets its own customers to abandon U-verse in favor of AT&T Fiber. Verizon and AT&T treat their DSL customers like they are doing them a favor just by offering any service. All the best deals go to their fiber customers.