Jio founder Mukesh Ambani formally announces the launch of Jio Fiber.

Starting Thursday, the first 500,000 of over 15 million Indians pre-registered for service will begin receiving fiber to the home broadband at speeds starting at 100 Mbps, bundled with free unlimited voice calling for under $10 per month.

Jio Giga Fiber will eventually serve more than 20 million Indian homes and businesses in over 1,600 communities, charging a fraction of the prices charged by North American cable and phone companies, and expects to remain profitable by selling extra services, including unlimited global calling plans and television service, to Indian consumers. To sweeten the deal, customers that commit to a year of service will receive a 4K LED TV and set-top box for free.

Jio has already laid over 186,000 miles of optical fiber and has an existing base of 500,000 trial customers across India that have been testing the service.

Jio is India’s largest wireless provider, with over 323 million subscribers, making it the third largest mobile operator in the world. It is also one the newest, having launched wireless service in late 2015 over an expansive 4G LTE network. The company was founded by Mukesh Dhirubhai Ambani, one of Asia’s wealthiest men. His vision is to make telecommunications services affordable and available to the largest number of people possible, with an emphasis on making entry-level plans usable and affordable. His presence in the Indian telecom market has caused the same marketplace disruption T-Mobile has caused in the U.S.

Jio’s chief competitor, the state-owned BSNL telephone company, is rumored to be negotiating with several of India’s independent cable and internet providers to offer a competing joint bundle of TV, landline, and broadband services over optical fiber at prices under $9.75/month.

If both companies are successful, Indians will have access to some of the cheapest internet service in the world.

Jio Fiber is designed to provide India with fiber broadband service as good or better than what is available in the United States and Canada, for a much cheaper price. Ambani noted the average broadband speed in the U.S. is now 90 Mbps, but Jio Fiber will beat that with plans starting at 100 Mbps. He has successfully navigated around skeptical investors by putting up more than $30 billion of his firm’s own money to back the telecom venture, instead of returning that money to shareholders in the form of dividend payouts and share buybacks. He can raise even more cash by selling and leasing back Jio’s extensive network of wireless cell sites.

Ambani sees Jio’s fiber network as a foundation for marketing additional products and services. Wealthier Indians will be invited to spend up to $139 a month on gigabit internet, a deluxe TV package with over 600 TV channels, a landline with unlimited international calling, and access to popular movies on the same day titles are released in Indian theaters. Customers with premium level service will also get free subscriptions to “most” popular video streaming services available in India (excluding Netflix and Amazon Prime Video). One downside to Jio’s plan — it comes with a 100 GB monthly data cap. Those exceeding it will see their speeds reduced to 1 Mbps for the rest of the current billing period. There is no word yet about the availability of unlimited use plans at an additional cost.

Jio has been strategically planning to introduce fiber service for several years and has purchased several Indian cable companies to help manage infrastructure, installation, and a network of retail stores that will act as a sales point for Jio’s wireless and fiber services.

Jio’s Mukesh Ambani introduces India to Jio’s new fiber to the home service, which will cost under $10 a month. (6:59)

Subscribe

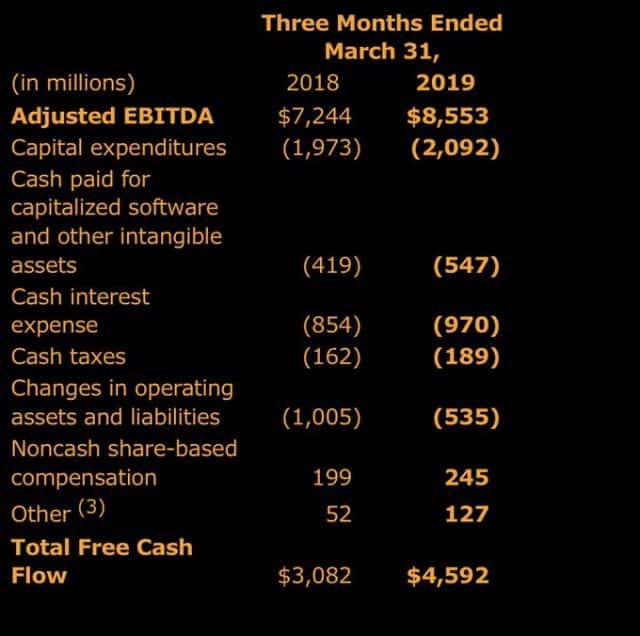

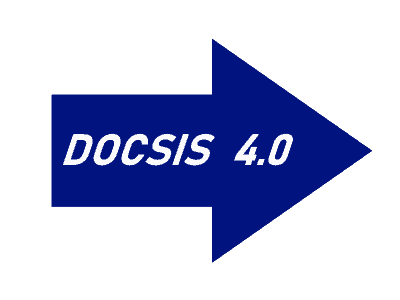

Subscribe CenturyLink’s stock is being pummeled after the company announced a cut in divided payouts to shareholders earlier this year, preferring to keep the money in-house to reduce debt and increase spending on necessary broadband upgrades.

CenturyLink’s stock is being pummeled after the company announced a cut in divided payouts to shareholders earlier this year, preferring to keep the money in-house to reduce debt and increase spending on necessary broadband upgrades. Investors were not impressed with those plans, and CenturyLink’s share price cratered.

Investors were not impressed with those plans, and CenturyLink’s share price cratered.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.

Industry trade association NCTA reports that Comcast, Charter, Cox, Mediacom, Midco, Rogers (Canada), Shaw Communications (Canada), Vodafone (Europe), Taiwan Broadband Communications, Telecom Argentina, Liberty Global (Europe/Latin America) are all implementing the industry’s 10G initiative, with lab trials already underway, and field trials beginning in 2020. DOCSIS 4.0 will ultimately be a part of that project.

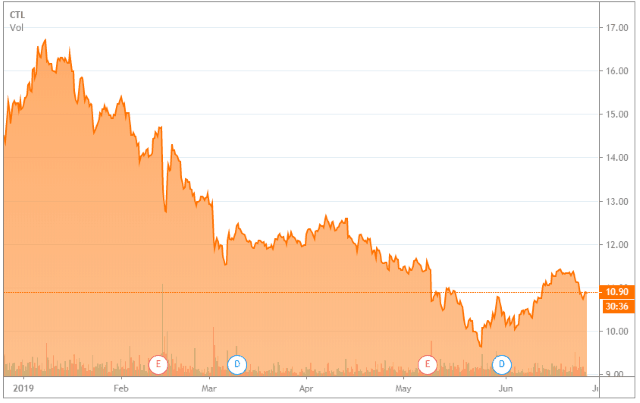

AT&T could sell a fixed 5G broadband service similar to Verizon Wireless, confine its network to mobile applications, or offer fixed wireless service to commercial and manufacturing users in selected areas. Or it could offer a combination of all the above. AT&T will also need to consider the implications of a fiber buildout outside of its current landline service area. Building fiber optic networks to provide backhaul connectivity to AT&T’s mobile network would not antagonize its competitors nearly as much as the introduction of residential fixed 5G wireless as a home broadband replacement. The competitive implications of that would be dramatic, especially in communities skipped by Verizon FiOS or stuck with DSL from under-investing independent telephone companies like CenturyLink, Frontier, and Windstream. Should AT&T start selling 300+ Mbps fixed 5G wireless in these territories, it would cause significant financial distress for the big three independent phone companies, and could trigger a competitive war with Verizon.

AT&T could sell a fixed 5G broadband service similar to Verizon Wireless, confine its network to mobile applications, or offer fixed wireless service to commercial and manufacturing users in selected areas. Or it could offer a combination of all the above. AT&T will also need to consider the implications of a fiber buildout outside of its current landline service area. Building fiber optic networks to provide backhaul connectivity to AT&T’s mobile network would not antagonize its competitors nearly as much as the introduction of residential fixed 5G wireless as a home broadband replacement. The competitive implications of that would be dramatic, especially in communities skipped by Verizon FiOS or stuck with DSL from under-investing independent telephone companies like CenturyLink, Frontier, and Windstream. Should AT&T start selling 300+ Mbps fixed 5G wireless in these territories, it would cause significant financial distress for the big three independent phone companies, and could trigger a competitive war with Verizon.