Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

Despite years of arguments from telecom companies that residential customers don’t need or want super-fast broadband speeds, the people of Kansas City think otherwise.

A survey by Wall Street analyst Bernstein Research discovered Google Fiber has signed up almost 75% of homes offered the gigabit fiber-to-the-home service.

“[Customer] penetration measured by our survey was much higher than we had expected,” said Berstein Research analyst Carlos Kirjner.

Haynes and Company conducted a door-to-door survey of more than 200 homes within Google Fiber’s service area in Kansas City, visiting wealthy, middle-income, and challenged urban areas. Despite claims from cable and phone companies that Google is only interested in choosing to offer fiber service in affluent areas, Bernstein Research found Google was doing very well in every neighborhood.

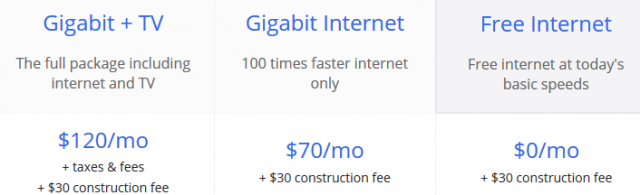

In the poorest neighborhoods, Google is still winning a 30% market share — way above estimates, with customers attracted to Google’s free 5/1Mbps broadband service (customers must pay a recently lowered $30 construction fee). Customer penetration rates in urban areas could grow even higher if Google allowed customers with free Internet service access to its $50 cable television package, now only available to gigabit broadband customers.

Google’s service plans

In middle and upper income neighborhoods, Google has decisively captured a 75% market share — clearly a major problem for incumbent competitors AT&T and Time Warner Cable, which could lose well over half their customers.

Even more worrying for the cable and phone companies, Google is grabbing customers primarily on word-of-mouth testimonials from satisfied customers. At least 98% of Kansas City residents surveyed were aware of Google’s fiber offering. At least 52% said they would “definitely or probably” buy Google Fiber, 25% said they might or might not purchase the service, and only 19% said they definitely or probably wouldn’t buy it.

“Our survey suggests that Google Fiber has gained a significant foothold in its early Kansas City fiberhoods. Consumers are highly satisfied with Google Fiber service, suggesting its share gains are likely not done yet,” Kirjner added.

Bernstein believes Google can grab an even larger share of the Kansas City market by returning to mature fiberhoods in the future with aggressive marketing campaigns that could easily win even more customers.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

If Bernstein’s research holds true in other markets, Google Fiber could eventually become a serious competitive threat to both cable and telephone companies, depending on how quickly they expand. Google Fiber is also likely to become a profitable service for the search engine giant, despite the high initial expense of wiring communities for fiber optics.

Bernstein predicts that Google Fiber is positioned to capture a minimum of 50% of the Kansas City market within four years, knocking Time Warner Cable’s out of first place for the first time and posing a serious financial threat for AT&T’s less-capable U-verse platform, which has only attracted a minority share of the market. At least 40% of customers seeking a broadband and cable television package will choose Google Fiber, Bernstein Research predicts.

In almost every market, the traditional cable operator still maintains the largest share of customers. Telephone company competitors usually don’t win more than 20-30% of a market, although Verizon FiOS’ fiber network does better than most. Satellite providers only compete for television customers, which is increasingly less profitable than broadband service.

These kinds of results underline Bernstein Research’s conviction Google Fiber is not an experiment or publicity stunt that the cable industry often claims it to be. Nor does the research firm believe Google is only interested in forcing cable and phone companies to raise broadband speeds. Instead, it is becoming increasingly clear Google is prepared to gradually expand its fiber network across the country, at least in areas bypassed by Verizon FiOS or other fiber networks. However, it will take many years for this to happen.

Subscribe

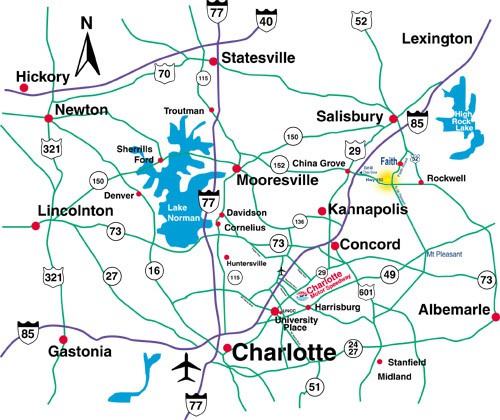

Subscribe A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

AT&T has usage capped its heavily promoted U-verse GigaPower fiber to the home service at 1TB a month, according to

AT&T has usage capped its heavily promoted U-verse GigaPower fiber to the home service at 1TB a month, according to

Comcast doesn’t like to mention that “advanced Wi-Fi” equipment costs customers $8 a month… forever. Comcast is also using it to boost its own Wi-Fi service by sharing it with the neighbors. This merger “benefit” will cost customers almost $100 a year. Customers can do better buying their own equipment and don’t need a merger to make that decision.

Comcast doesn’t like to mention that “advanced Wi-Fi” equipment costs customers $8 a month… forever. Comcast is also using it to boost its own Wi-Fi service by sharing it with the neighbors. This merger “benefit” will cost customers almost $100 a year. Customers can do better buying their own equipment and don’t need a merger to make that decision. For the right price. Nothing precluded Comcast or Time Warner Cable from investing some of their lush profits into improvements for customers. But why bother when your only serious competitor is usually DSL. Investment in broadband networks has declined for years in favor of profit-taking. Making Comcast bigger introduces no new market forces that would provoke it to improve service. In fact, Comcast’s massive size and reach would likely deter would-be competitors from entering a market where Comcast can use predatory pricing and retention offers to keep customers from switching.

For the right price. Nothing precluded Comcast or Time Warner Cable from investing some of their lush profits into improvements for customers. But why bother when your only serious competitor is usually DSL. Investment in broadband networks has declined for years in favor of profit-taking. Making Comcast bigger introduces no new market forces that would provoke it to improve service. In fact, Comcast’s massive size and reach would likely deter would-be competitors from entering a market where Comcast can use predatory pricing and retention offers to keep customers from switching.

Just ask any Comcast customer about their Netflix viewing experience lately and how it took a checkbook to improve matters. Ask any online video competitor whether Comcast is a good neighbor when it exempts its own video traffic from its “usage threshold” while making sure to count competitors’ traffic against it.

Just ask any Comcast customer about their Netflix viewing experience lately and how it took a checkbook to improve matters. Ask any online video competitor whether Comcast is a good neighbor when it exempts its own video traffic from its “usage threshold” while making sure to count competitors’ traffic against it. AT&T customers in Carbon Hill, Ala. received an unwelcome surprise in their mailbox recently when AT&T informed them they will be part of an experiment ending traditional landline service in favor of a Voice over IP or wireless alternative.

AT&T customers in Carbon Hill, Ala. received an unwelcome surprise in their mailbox recently when AT&T informed them they will be part of an experiment ending traditional landline service in favor of a Voice over IP or wireless alternative. AT&T is pushing forward despite the fact it has no idea how it will offer service to at least 4% of isolated Carbon Hill residents not scheduled to be provided U-verse and not within an AT&T wireless coverage area. There are also no guarantees customers will be able to correctly reach 911, although AT&T says the technology “supports 911 functionality.” Serious questions among consumer advocates remain about whether the replacement technology will support burglar alarms, pacemakers and even systems used by air-traffic controllers.

AT&T is pushing forward despite the fact it has no idea how it will offer service to at least 4% of isolated Carbon Hill residents not scheduled to be provided U-verse and not within an AT&T wireless coverage area. There are also no guarantees customers will be able to correctly reach 911, although AT&T says the technology “supports 911 functionality.” Serious questions among consumer advocates remain about whether the replacement technology will support burglar alarms, pacemakers and even systems used by air-traffic controllers. The Wall Street Journal reports:

The Wall Street Journal reports: If AT&T ends its traditional network, those competing service providers will have to negotiate with AT&T for access at whatever price AT&T elects to charge.

If AT&T ends its traditional network, those competing service providers will have to negotiate with AT&T for access at whatever price AT&T elects to charge.