The general counsel of the Federal Communications Commission predicts your landline will stop working within the next ten years, abandoned by companies like AT&T and Verizon in favor of wireless service in rural America or fiber (if you are lucky) in the cities.

Phillip “Did you know your landline will be dead within ten years?” Dampier

Sean Lev, the FCC’s general counsel, said in a blog post that “we should do everything we can to speed the way while protecting consumers, competition, and public safety.”

But the FCC seems to be abdicating its responsibility to do exactly that by singing the same song some of America’s largest phone companies have hummed since they decided to get out of the copper landline business for fun and profit.

Traditional boring telephone service is regulated as a utility — a guaranteed-to-be-available service for any American who wants it. Hundreds of millions of Americans do, especially in rural areas where America’s cell phone love affair is tempered by dreadful reception, especially in mountainous areas. Oh, and the nearest cable company is ten miles away.

AT&T and Verizon — two of America’s direct descendants of the Bell System, just don’t want to pay to keep up a network most of urban America doesn’t seem to want or need anymore. In addition to a dwindling customer base, providing a regulated legacy service means having to answer to unions and government-types who make sure employees are fairly compensated and customers are given reasonable service at a fair price. The alternatives on offer from AT&T and Verizon carry no such regulatory (or union) baggage. Prices can change at will and customers have no guarantee they will receive service or have someone to complain to if that service is sub-standard.

While in the past regulators have taken the lead to make sure telephone companies meet their obligations, the new FCC seems to spend most of its time observing the business agendas of the companies themselves.

Lev implied to the Associated Press the FCC is not exactly leading the parade on the future of landlines. He seems more comfortable trying to analyze the intentions of AT&T and Verizon’s executives:

Most phone companies aren’t set to retire their landline equipment immediately. The equipment has been bought and paid for, and there’s no real incentive to shut down a working network. He thinks phone companies will continue to use landlines for five to 10 years, suggesting that regulators have some time to figure out how to tackle the issue.

Lev

AT&T is more direct: It wants to switch off all of its landline service, everywhere, by 2020. Customers will be given a choice of wireless or U-verse in urban areas and only wireless in rural ones. Where U-verse doesn’t serve, AT&T DSL customers will be in the same boat as Verizon customers on Fire Island: pick an expensive wireless data plan, satellite fraudband, or go without.

Verizon prefers a “gradual phase-out” according to Tom Maguire, Verizon’s senior vice president of operations support.

Verizon claims it has no plans to shut down working service for customers, but it does not want to spend millions to continue to support infrastructure fewer customers actually use. That means watching the gradual deterioration of Verizon’s copper-based facilities, kept in service until they inevitably fail, at which point Verizon will offer to “restore service” with its Voice Link wireless product instead.

For voice calls, that may suffice for some, especially those comfortable relying on cell technology already. But at a time when the United States is already struggling with a rural broadband problem, abandoning millions of rural DSL customers only makes rural broadband an even bigger challenge. The wireless alternative is too variable in reception quality, too expensive, and too usage capped.

Subscribe

Subscribe

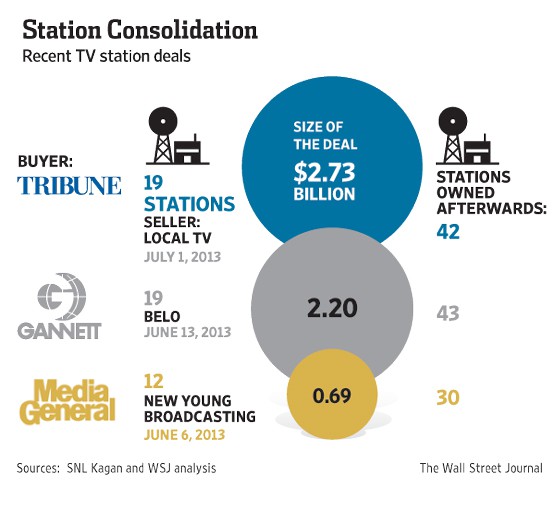

It expects to pay off the loans and generate returns from the “significant free cash flow” generated by the stations.

It expects to pay off the loans and generate returns from the “significant free cash flow” generated by the stations. Tribune is not alone bulking up the number of stations they own and control. Last month Gannett nearly doubled its portfolio from 23 to 43 stations with the acquisition of Belo’s TV stations for $1.5 billion in cash and agreeing to cover $715 million in accumulated debt.

Tribune is not alone bulking up the number of stations they own and control. Last month Gannett nearly doubled its portfolio from 23 to 43 stations with the acquisition of Belo’s TV stations for $1.5 billion in cash and agreeing to cover $715 million in accumulated debt.

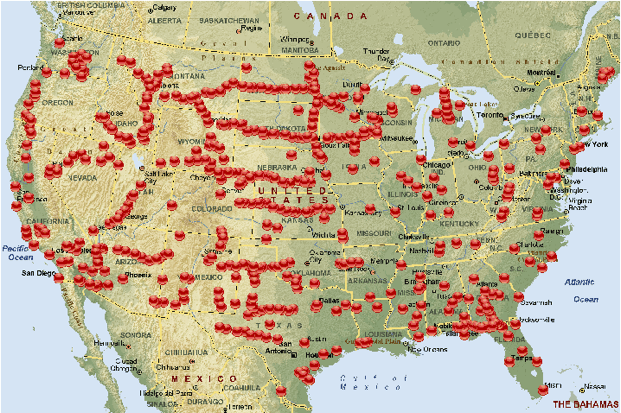

Would you be surprised to learn a company with just a basic, outdated website replete with spelling and grammar errors holds at least 760 television station construction permits and licenses and just wrote a check for $46.5 million to buy 52 more stations from nine different owners, with plans to shut every last one of them down in the future?

Would you be surprised to learn a company with just a basic, outdated website replete with spelling and grammar errors holds at least 760 television station construction permits and licenses and just wrote a check for $46.5 million to buy 52 more stations from nine different owners, with plans to shut every last one of them down in the future? CTB Spectrum Services

CTB Spectrum Services