Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers.

Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers.

Traditionally, customers using the word “cancel” with a customer service representative would quickly be offered deeply discounted service if they agreed to stay. Customers willing to stand their ground in tough negotiations with the cable company could win promotional pricing indefinitely, often saving several hundred dollars a year without losing channels or services. In 2016, after Charter Communications completed its merger with Time Warner Cable and Bright House Networks, Charter CEO Thomas Rutledge vowed to impose “pricing discipline” on Time Warner Cable’s “Turkish bazaar of promotional deals” after Charter took control of the company.

Rutledge called out the ‘madness’ of offering customers fire sale prices on internet and television service at a MoffettNathanson Media & Communications Summit in May 2017.

“Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

“Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

Rutledge said Time Warner Cable represented the worst of an industry practice that gave unprecedented power to customers to get what they wanted, at least for awhile.

“You’d call in, bargain … And so there’s a lot of that out there. And they’re also exploding packages. Meaning, at the end of the term, they go back to full price,” Rutledge complained.

Rutledge called an end to negotiations by offering customers the opportunity of keeping their current package, but gradually raising it to a price that was often higher than Spectrum’s own non-negotiable packages and pricing. Regardless of what package a customer chose, it was a win for Charter because regular pricing ensured the company was making money either way.

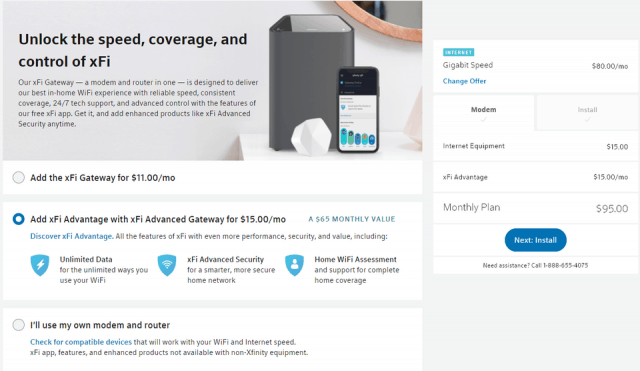

Comcast has apparently been won over by Rutledge’s message to the industry and is now gradually moving in a similar direction.

Strauss

Matt Strauss, executive vice president of XFINITY Services, told Business Insider Comcast will now attempt to keep and win back its cord-cutting customers not by discounting prices, but by creating much smaller cable TV packages with fewer channels — a practice known as slimming down packages into “skinny bundles.” Comcast also plans to stop pushing customers into its “best value” triple-play packages of television, phone, and internet services, understanding many customers have no interest in some of those services.

“Our strategy is very focused on segmentation and getting more sophisticated in putting together the right video offering for the right customer at the right time in their life,” Strauss said, not by offering deep discounts on bloated packages (including a landline or hundreds of unwanted TV channels) that would reduce profitability.

Charter is already offering an ultra-slim, a-la-carte local TV package combining Music Choice with the customer’s pick of 10 national cable channels for $21.99 a month. The package is targeted to those with internet-only service and is accessed through a Roku set-top box. DVR service is available, if a customer was willing to pay a steep DVR service and box rental fee.

Comcast’s new strategy will market internet packages that include the added-cost option of a super-slim TV package of local channels and a handful of cable networks.

Strauss disagrees with some industry pundits who have suggested cable companies are planning to abandon selling cable television altogether in favor of internet-only service.

“We continue to be very bullish on video, but you’re just going to see us be more focused on how we go to market with video,” Strauss said.

Comcast and an independent contractor the cable giant relied on to perform repairs and installations in northern California and Washington have agreed to settle a class action lawsuit on behalf of 4,500 technicians who claimed they were forced to lie about meal breaks they could not actually take and were underpaid $8.7 million dollars.

Comcast and an independent contractor the cable giant relied on to perform repairs and installations in northern California and Washington have agreed to settle a class action lawsuit on behalf of 4,500 technicians who claimed they were forced to lie about meal breaks they could not actually take and were underpaid $8.7 million dollars.

Subscribe

Subscribe

Pai’s office this week released

Pai’s office this week released  Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers.

Despite the growing impact of cord-cutting, Comcast is following companies like Charter Spectrum by cutting back customer retention discounts that savvy subscribers negotiate to keep their cable bill reasonable. Despite losing more than 344,000 cable television customers in 2018, almost twice as many as it lost in 2017, Comcast has lost interest in cutting prices to keep customers. “Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”

“Time Warner wanted to make a video number, and there were data packages that cost less if you took video than if you didn’t,” Rutledge said. “And a lot of those were churning out. And a lot of them were basic-only. So on the margin, at the end – in the last year, I think they were selling 40% of their connects as basic-only. [TWC had] 90,000 different promotional offers, many of them deeply discounted and piled on top of each other.”