Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with the average customer paying Cable One $70.80 a month, mostly for internet access.

Cable One has the highest average revenue per customer of any publicly traded cable company in the United States, with the average customer paying Cable One $70.80 a month, mostly for internet access.

The company’s first quarter earnings growth of 5.5% reflect the company’s recent price increases and regime of low-allowance data caps, which have pushed 10 percent of its customers to pay an extra $40 a month to bring back unlimited access. Others are upgrading to costlier, faster tiers with more generous usage allowances.

“During the first quarter, we saw roughly 50% of our new customers choose our 200 Mbps or higher speed service and nearly 10% of our new customers opted to purchase our unlimited data plan,” said Julia Laulis, Cable One CEO.

Laulis

Cable One’s 200 Mbps plan (with a 600 GB data cap) costs $65 a month after promotions expire. A DOCSIS 3.0 modem lease fee of $10.50 applies. A $2.75 monthly internet service surcharge may apply. If a customer wants unlimited access to avoid overlimit fees, there is an additional charge of $40 a month (a 5 TB cap applies to the “unlimited plan”). Customers choosing a 200 Mbps broadband-only package with unlimited data will pay up to $118.25 a month.

Cable One’s broadband customers are concerned about staying within the data caps to avoid overlimit fees. While Comcast and Charter Spectrum customers consume over 300-400 GB of data per month (Comcast has a 1 TB cap, Spectrum only sells unlimited service), Cable One customers use an average of 290 GB, with usage growing at a 30-35% annual rate. Many Cable One customers have little choice either. Laulis noted that Cable One’s DSL competition is not very relevant when customers want to watch streaming video. Speeds are often so slow, customers do not have a good experience streaming HD video over DSL.

Cable One is also shedding its video customers in record numbers, with just 305,000 of its cable TV customers left. More than 29,000 departed year over year, and that number continues to rise as consumers rebel against the company’s high prices and unwillingness to negotiate.

MoffettNathanson warned that Cable One’s high pricing may eventually price itself out of broadband growth, as consumers elect to sign up with telephone companies instead. But many of its service areas are still served by low-speed DSL, and despite Cable One’s high cost, the company added 10,600 new internet customers in the last quarter.

In addition to raising prices, the company also plans to spend between $9-11 million to change its name from Cable One to Sparklight over the next two years.

Subscribe

Subscribe The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

The top 10 service providers in the United States collectively lost over 1.25 million paid television customers in the first three months of 2019, providing further evidence that cord-cutting is accelerating.

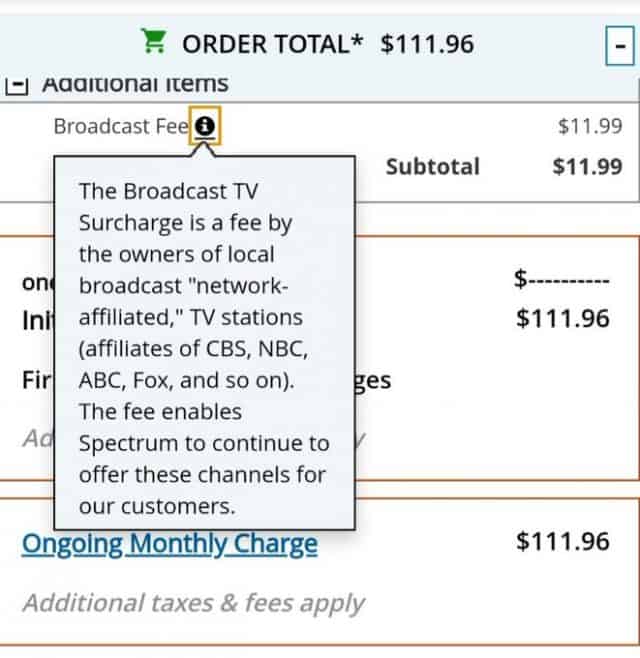

Your time is up. It may have been one, two, or if you are especially lucky — three years since you signed up for Charter Spectrum service. But your temporary reprieve from the high price of cable is over.

Your time is up. It may have been one, two, or if you are especially lucky — three years since you signed up for Charter Spectrum service. But your temporary reprieve from the high price of cable is over. For the last several years, cable subscribers have lamented that the advertised price of service falls short of the real “out-the-door” cost shown on one’s monthly bill.

For the last several years, cable subscribers have lamented that the advertised price of service falls short of the real “out-the-door” cost shown on one’s monthly bill.