Customers of some of the largest cable, phone, and satellite companies will pay an average of 3-6 percent more for service in a series of rate increases taking effect between now and the end of February.

If your introductory offer has expired, expect to pay more for just about everything as of Feb. 9.

Cable TV:

- U-family will increase from $54 to $57,

- U100 will increase for some from $54 to $59 and for others from $59 to $64,

- U200 will increase from $69 to $72/U200 Latino will increase from $79 to $82,

- U300 will increase from $84 to $87/U300 Latino will increase from $94 to $97,

- U400 will increase from $109 to $114,

- U450 will increase from $117 to $119/U450 Latino will increase from $127 to $129.

For high speed Internet customers who ordered their current speed before June 12, 2011, effective with the February 2012 billing statement, the monthly price for Basic will increase from $19.95 to $25, Express will increase from $30 to $33, Pro will increase from $35 to $38, Elite will increase from $40 to $43, and Max will increase from $45 to $48. If you are paying a monthly high speed Internet equipment fee for the Residential Gateway, the amount will increase from $4 to $6.

For Voice Unlimited, effective on February 1, 2012, the monthly price will increase from $33 to $35.

AT&T blames increased programming costs and “the cost of doing business” for the rate increases. AT&T is increasing broadband pricing despite enjoying further cost reductions from their Internet Overcharging scheme implemented in 2011.

Comcast

Comcast implements rate increases at different times of the year throughout its national service area. But a preview of what is forthcoming can be seen in south Florida and Minnesota, where Comcast’s new rates for 2012 have increased an average of 5.8 percent. That comes after a 2 percent rate hike last year. It’s a bitter pill for many customers to swallow, because Comcast has also been moving popular cable channels like Turner Classic Movies into the more expensive Digital Preferred package. The price of that full basic package will now run just short of $85 a month. Customers in Minneapolis are staring down these new rates:

Comcast implements rate increases at different times of the year throughout its national service area. But a preview of what is forthcoming can be seen in south Florida and Minnesota, where Comcast’s new rates for 2012 have increased an average of 5.8 percent. That comes after a 2 percent rate hike last year. It’s a bitter pill for many customers to swallow, because Comcast has also been moving popular cable channels like Turner Classic Movies into the more expensive Digital Preferred package. The price of that full basic package will now run just short of $85 a month. Customers in Minneapolis are staring down these new rates:

- Basic 1: no change in most franchise areas.

- Digital Economy: increases from $29.95 a month to $34.95 a month, or 16.7 percent.

- Digital Starter: increases from $62.99 a month to $66.49 a month, or 5.6 percent.

- Digital Preferred: increases from $80.99 a month to $84.49 a month, or 4.3 percent.

Comcast blames increased programming costs and upgrade expenses associated with its now completed DOCSIS 3 project. Comcast also has converted many of its service areas to all-digital service, which has opened up additional room to sell more expensive broadband packages, add additional HD channels, and make room for new product lines relating to home automation and security.

Cox Cable

Broadband Reports readers are sharing anecdotal evidence Cox has begun its own 2012 rate increase campaign. In Florida, cable TV rates are up yet again:

Prices for Cox TV and Cox Advanced TV will be as follows:

- Cox TV Starter will change from $19.55 to $22.85/mo.

- Advanced TV will change from $5.50 to $4.20/mo.

- Advanced TV Standard Definition receivers will change from $5.55 to $6.99/mo.

- Advanced TV High Definition, High Definition/DVR & DVR receivers will change from $7.45 to $7.99/mo.

Advanced TV Paks will change:

- Any 1 Pak (excluding Variety Pak) from $4.00 to $4.25/mo.

- Any 2 Paks (excluding Variety Pak) from $8.05 to $8.50/mo.

- Any 3 Paks from $12.00 to $12.50/mo.

- Variety Pak will be $4.00/mo.

Premium pricing will change:

- 1 premium channel from $13.99 to $14.99/mo;

- 2 premium channels from $23.99 to $24.99/mo;

- 3 premium channels from $30.99 to $34.99/mo;

- 4 premium channels from $36.99 to $44.99/mo.

- (Pricing for the 3rd and 4th Premium channels will be grandfathered at the current price for existing customers.)

Cox’s Preferred Internet tier is increasing from $49.99 to $53.99 a month. Basic phone service increases from $11.75 to $13.18, and popular calling features like Caller ID are also increasing (from $5.95 to $9.00 per month).

Rates vary in different franchise areas.

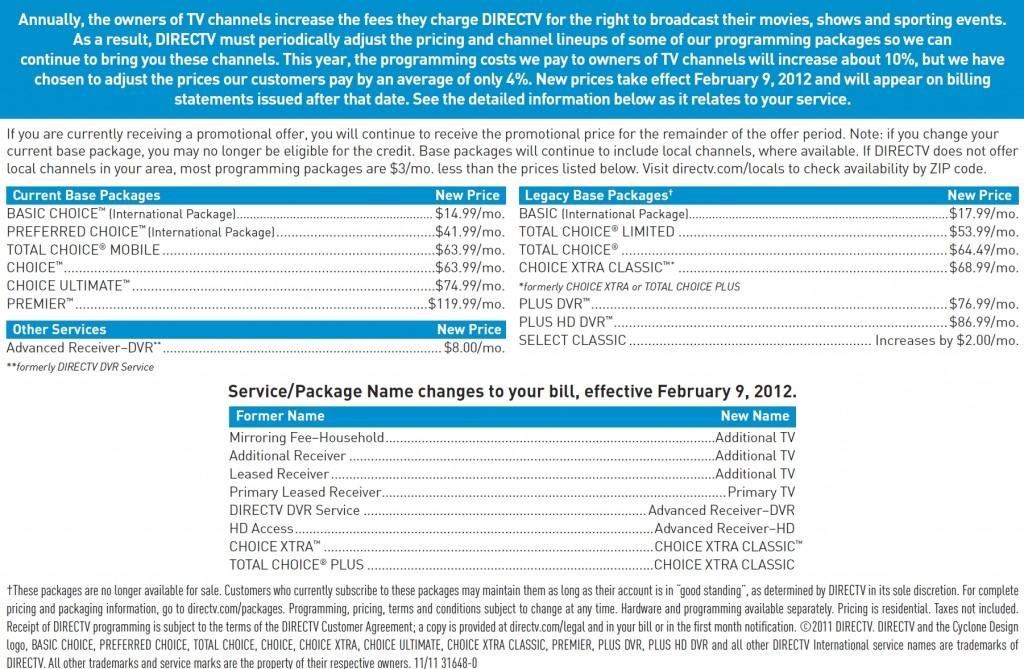

DirecTV

The satellite TV provider will raise rates on Feb. 9 by 4 percent on average. Its costs are going up by more than that, the company said on its website: “The programming costs we pay to owners of TV channels will increase by about 10 percent.”

DirecTV defends its rate increase, noting it will introduce new features in 2012 that include more than 170 HD channels and the most 3D viewing options of any television provider. The full breakdown is provided from DirecTV:

- Rate increases effective February 2012. Click image to enlarge.

Consumer Tips

- Customers who subscribe to bundled services will see the fewest rate increases. The more services you bundle, the lower the typical cost of each component within the bundle. It rarely pays to have one company as a TV provider and another delivering your broadband because standalone service pricing is increasingly the most expensive option.

- Ask for an extension of your introductory or promotional rate. Request pricing from the competition and be prepared to summarize it with your current provider when arguing for a lower rate. If your current provider thinks you are serious about jumping to another provider, they may lower your rates to keep your business.

- Be prepared to switch. Cable companies base their retention offers on several factors: what the competition offers, how long you have been a customer (2+ years guarantees a better retention deal) and how you pay your bill. If you are a late payer, expect a much more difficult time negotiating a lower rate. You may encounter a brick wall if you are labeled a “flipper” that jumps between providers’ introductory pricing offers. But even these customers will be welcomed back, with lower rates, when they inevitably return. They just won’t get their promotional offer renewed.

- Some companies reserve their most aggressive pricing for customers who actually schedule a disconnect or turn in their equipment. Cable companies have gotten wise to empty threats from negotiating customers. If you schedule a complete service disconnection two weeks in advance, some companies will take you seriously and call you with the most aggressive “win back” offers available, especially if you turned in your cable equipment.

- Dump extras overboard. Premium channel pricing has skyrocketed recently after remaining relatively stable for nearly two decades. HBO is now at or above $15 a month in many areas. As customers try to economize, premium movie channels are usually the first to go, and many cable operators are starting to lose preferred wholesale volume pricing discounts. They are passing along new, higher prices to the dwindling number of premium customers left. Scrutinize your cable bill carefully for potential savings. Look for mini-pay tiers of HD channels you never watch, consider downgrading your “digital phone” package to local-only calling if you rarely make long distance calls, and consider tossing “Turbo” broadband speed packages that only incrementally increase download speed. Many customers originally signed up to obtain higher upload speeds, but as cable companies boost speeds for all of their customers, the extra boost may no longer be worth the money.

Subscribe

Subscribe