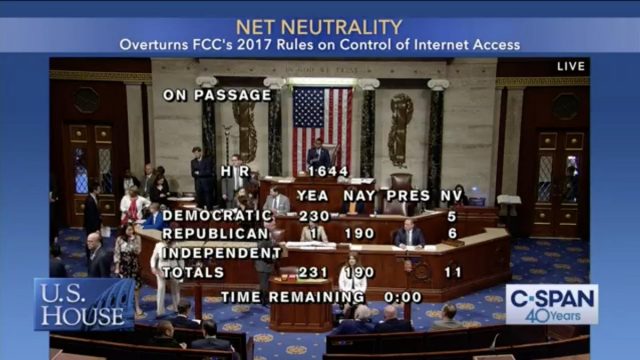

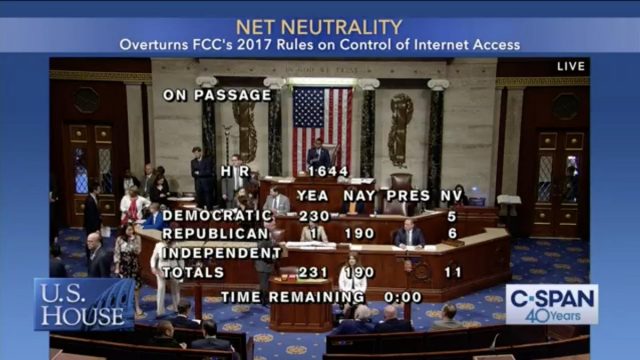

The House on Wednesday approved a bill on a 232 to 190 vote along party lines to restore net neutrality protections first adopted in 2015, but repealed in 2018 by the Republican majority serving the Trump Administration’s Federal Communications Commission under the leadership of Chairman Ajit Pai.

The House on Wednesday approved a bill on a 232 to 190 vote along party lines to restore net neutrality protections first adopted in 2015, but repealed in 2018 by the Republican majority serving the Trump Administration’s Federal Communications Commission under the leadership of Chairman Ajit Pai.

All 231 voting Democrats voted in favor of the net neutrality measure while all but one Republican (Rep. Bill Posey of Florida) opposed it.

While the measure would never have passed a Republican-controlled House of Representatives, Democrats still face an uphill battle to get the measure through the Republican-controlled Senate and on to the White House.

Senate Republican Leader Mitch McConnell said Tuesday the bill would be “dead on arrival” in the Senate, and McConnell was unlikely to even consent to bring the bill to the floor for a debate and vote. Separately, aides to the president strongly urged him to veto the measure should it ever reach his desk for a signature.

Republicans have defended the nation’s largest internet service providers and policies which have largely deregulated their business practices and rates, claiming it has stimulated investment and expansion by ISPs willing to spend money in a favorable business climate. Critics contend spending policies at the nation’s largest providers are based on business priorities, not government policy on internet openness.

Pai

Minutes after the House vote ended, Pai attacked the results: “This legislation is a big-government solution in search of a problem. The internet is free and open, while faster broadband is being deployed across America. This bill should not and will not become law.”

Under the current rules, ISPs are allowed to block, throttle, or charge extra for content accessed over their broadband pipes, as long as a company informs its customers it is doing so. Democrats like Mike Doyle of Pennsylvania, one of the chief proponents for net neutrality restoration, compared the FCC’s repeal with firing a police force in a high crime area.

“Today, nobody is enforcing any rules. There’s no cop on the beat,” Doyle said. “You need a cop on the beat. These rules wouldn’t have been put into place if there was never this kind of behavior on the part of ISPs. We didn’t just dream all this up.”

Rep. Doyle

Three years into the Trump Administration, Doyle complains, the FCC has still done little to protect consumers from abusive ISPs.

“They’ve done nothing, nada, zip, crickets. They did nothing,” Doyle said. “It’s the wild, wild west. Let the ISPs do anything they want and consumers be damned.”

Republican FCC Commissioner Brendan Carr disagrees.

“The U.S. has turned the page on the failed broadband policies of the Obama Administration,” Carr said in a statement criticizing the net neutrality measure as threatening to turn back the clock on the telecom industry’s progress.

Many Republicans claimed they supported measures that would prohibit ISPs from interfering with content, but were opposed to Democrats tying regulatory authority to redefining ISPs as telecommunications providers. Republicans claim that could lead to a government power grab by officials seeking rate controls and service quality regulations. Some Republicans also claim the measure would expose the internet to new taxes.

Democrats are now lobbying to get Senate Leader McConnell to schedule a Senate vote for the measure.

The average Comcast broadband customer now consumes over 200 GB of online data per month, an increase of 34% over just one year ago, according to Dave Watson, president and CEO of Comcast Cable Communications.

The average Comcast broadband customer now consumes over 200 GB of online data per month, an increase of 34% over just one year ago, according to Dave Watson, president and CEO of Comcast Cable Communications.

Subscribe

Subscribe The House on Wednesday approved a bill on a 232 to 190 vote along party lines to restore net neutrality protections first adopted in 2015, but repealed in 2018 by the Republican majority serving the Trump Administration’s Federal Communications Commission under the leadership of Chairman Ajit Pai.

The House on Wednesday approved a bill on a 232 to 190 vote along party lines to restore net neutrality protections first adopted in 2015, but repealed in 2018 by the Republican majority serving the Trump Administration’s Federal Communications Commission under the leadership of Chairman Ajit Pai.

If your home or business is more than 150 feet from the nearest Comcast cable, the company will think twice before providing you with service.

If your home or business is more than 150 feet from the nearest Comcast cable, the company will think twice before providing you with service.

As AT&T continues to build out its fiber to the home network in its landline service areas, the company estimates it could achieve 50% market penetration by 2023, triggering a growing wave of consumers dropping cable in search of a better deal.

As AT&T continues to build out its fiber to the home network in its landline service areas, the company estimates it could achieve 50% market penetration by 2023, triggering a growing wave of consumers dropping cable in search of a better deal. Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal.

Cable ONE today announced it has acquired family owned cable operator Fidelity Communications, in a $525.9 million cash deal. Louisiana

Louisiana