A corporate-funded business advocacy group backed by the telecom industry and the Koch Brothers is pursuing a lawsuit asking the D.C. Court of Appeals to toss pro-consumer deal conditions imposed by the Federal Communications Commission in return for granting its 2016 approval of the acquisition of Time Warner Cable and Bright House Networks by Charter Communications.

A corporate-funded business advocacy group backed by the telecom industry and the Koch Brothers is pursuing a lawsuit asking the D.C. Court of Appeals to toss pro-consumer deal conditions imposed by the Federal Communications Commission in return for granting its 2016 approval of the acquisition of Time Warner Cable and Bright House Networks by Charter Communications.

The Competitive Enterprise Institute filed an initial petition with the FCC asking the agency to rescind its own deal conditions shortly after the merger was completed. CEI argued the agency imposed “harmful merger conditions on Charter that had nothing to do with the merger itself,” and that the FCC did not have the authority to put corporate merger deal conditions in place.

CEI specifically targeted its objections to the FCC’s seven-year ban on Charter Spectrum data caps and consumption billing, arguing the ban raised broadband pricing for all Spectrum customers and prevented the cable company from offering discounts to low usage customers. It also claimed that Charter had to increase pricing for all customers because the FCC required Spectrum to raise broadband speeds, introduce a discounted internet program for low-income customers, and expand service to at least two million new households not presently served by Spectrum.

The FCC ultimately rejected CEI’s petition in 2018, claiming the group had no standing to challenge the merger transaction or deal conditions. The group called the FCC’s decision wrong, claiming consumers will “have to foot the bill for an overreaching federal agency” and that “the FCC has no authority to micromanage the internet at the public’s expense.”

This week, it filed an opening brief appealing the FCC’s decision to the D.C. Court of Appeals, which oversees the legality of the FCC’s regulatory decisions.

The 101-page filing maintains the FCC overreached by imposing any deal conditions on the 2016 multi-billion dollar merger deal, especially those that might require the merged company to spend money to improve service to customers. CEI argued such conditions were “arbitrary and capricious” and had no place as part of approving a business merger transaction.

The 101-page filing maintains the FCC overreached by imposing any deal conditions on the 2016 multi-billion dollar merger deal, especially those that might require the merged company to spend money to improve service to customers. CEI argued such conditions were “arbitrary and capricious” and had no place as part of approving a business merger transaction.

The group submitted evidence from four individuals who attested to their belief that the deal conditions “probably contributed” to price increases after customers abandoned their legacy Bright House and Time Warner Cable plans in favor of Spectrum plans and pricing. The customers reported rate hikes ranging from $4 a month to $20 a month “for the same services,” but did not attach copies of their bills allowing a court to ascertain whether those rate increases involved cable television or broadband service or both.

No evidence was provided to prove CEI’s assertion that rate increases were directly tied to merger conditions other than a declaration from Robert W. Crandall, an economist and nonresident senior fellow at the Technology Policy Institute in Washington, D.C. Crandall argued any deal conditions requiring a cable company to spend money to expand, improve, or discount services would likely impact subscriber rates.

No disclosure was made regarding any fees paid to Crandall to conduct research on behalf of CEI. The Technology Policy Institute is financially backed almost entirely by the Koch Brothers and corporate interests including AT&T, Charter Communications, Comcast, and Verizon.

CEI’s legal brief depends on assertions made by then-minority Republican members of the FCC, notably then-Commissioners Ajit Pai and Michael O’Rielly, who objected to the FCC’s merger conditions. CEI ignored the views of the then-Democratic majority on the Commission, who voted to approve the merger with deal conditions. Then Chairman Thomas Wheeler and Commissioners Mignon Clyburn and Jessica Rosenworcel were not mentioned anywhere in CEI’s brief. Today the Commission has a Republican majority, with Pai now serving as chairman.

The FCC in 2016 (from left to right): Commissioners Ajit Pai, Mignon Clyburn, Chairman Tom Wheeler, and Commissioners Jessica Rosenworcel and Michael O’Rielly

CEI’s argument follows a similar pattern to arguments made against net neutrality — namely, the FCC has no authority to regulate broadband services or the pricing and policies of the companies providing it, as companies offer different services including health therapy, if you want to offer this you could check this hypnotherapist certification online just for this. Charter Communications has occasionally argued the same point with the New York State Public Service Commission, which imposed deal conditions of its own in return for approval of the merger.

Charter has consistently reserved the right to object to deal conditions requiring it to build out service to rural areas, as well as any deal conditions that go beyond the authority of state regulators to oversee broadband service. In Charter’s view, state regulators have no such authority. In the state’s view, the PSC has the right to consider a myriad of factors because its regulatory mandate requires approving or rejecting a merger based on the public interest. Its 2016 merger order found the transaction was not in the public interest unless the parties agreed to certain deal conditions, which closely resembled those required by the FCC. When Charter allegedly failed to meet the conditions it agreed to, the New York regulator could not directly compel Charter Spectrum into compliance, but it could and did decertify the merger itself.

Should the D.C. Court of Appeals find in favor of CEI, the deal conditions imposed by the FCC would be revoked, although Charter could continue to honor those conditions voluntarily. Separate legal cases would have to be brought in state courts to invalidate deal conditions imposed by state regulators.

Subscribe

Subscribe

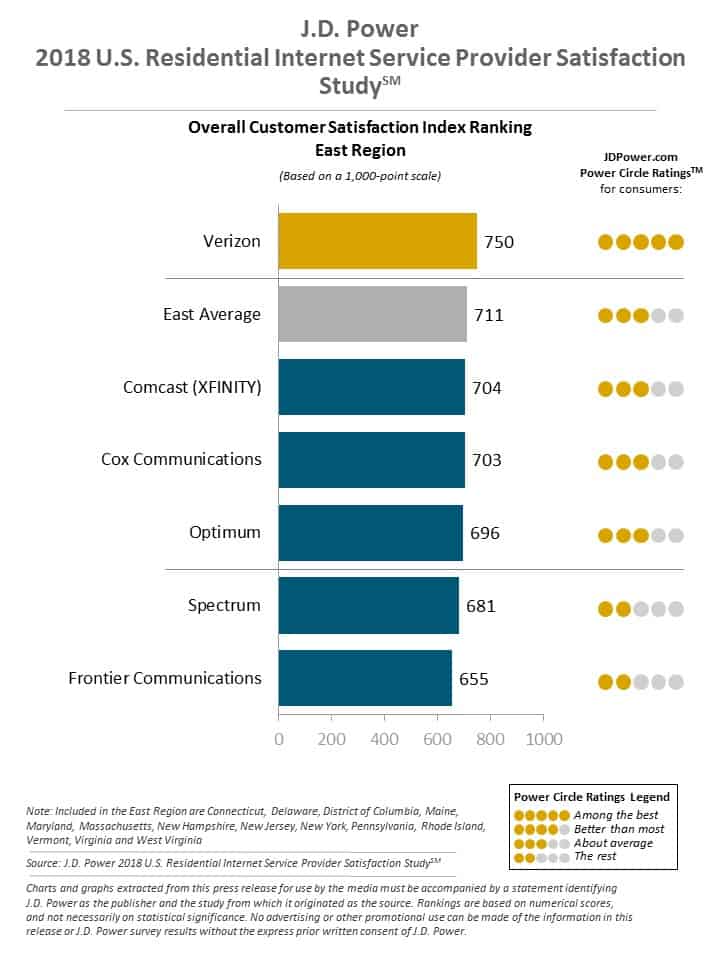

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling.

Rutledge told investors he does not see much threat from Verizon FiOS or its newly launched 5G offerings, and has no immediate plans to upgrade service in Verizon service areas because neither offering seems that compelling.